- South Korea

- /

- Machinery

- /

- KOSE:A009540

Even though HD Korea Shipbuilding & Offshore Engineering (KRX:009540) has lost ₩453b market cap in last 7 days, shareholders are still up 80% over 3 years

By buying an index fund, you can roughly match the market return with ease. But if you pick the right individual stocks, you could make more than that. For example, the HD Korea Shipbuilding & Offshore Engineering Co., Ltd. (KRX:009540) share price is up 80% in the last three years, clearly besting the market decline of around 14% (not including dividends).

Although HD Korea Shipbuilding & Offshore Engineering has shed ₩453b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for HD Korea Shipbuilding & Offshore Engineering

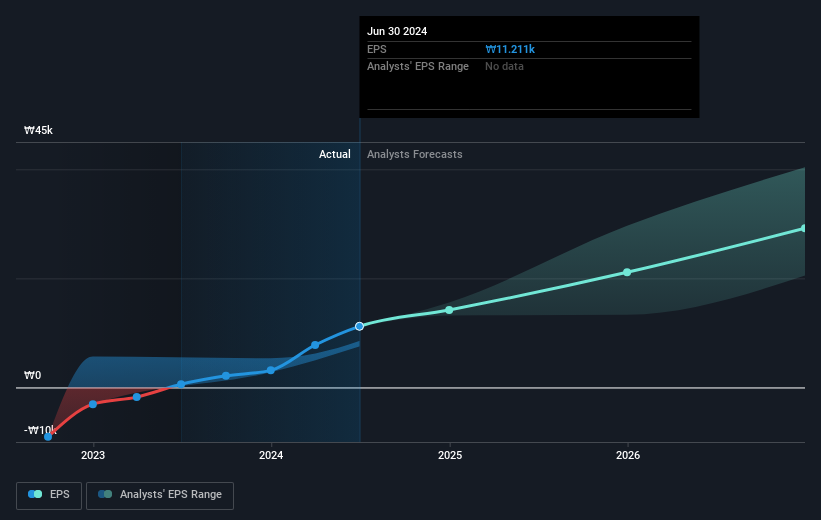

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, HD Korea Shipbuilding & Offshore Engineering moved from a loss to profitability. So we would expect a higher share price over the period.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how HD Korea Shipbuilding & Offshore Engineering has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling HD Korea Shipbuilding & Offshore Engineering stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that HD Korea Shipbuilding & Offshore Engineering has rewarded shareholders with a total shareholder return of 79% in the last twelve months. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before forming an opinion on HD Korea Shipbuilding & Offshore Engineering you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

If you're looking to trade HD Korea Shipbuilding & Offshore Engineering, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HD Korea Shipbuilding & Offshore Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A009540

HD Korea Shipbuilding & Offshore Engineering

HD Korea Shipbuilding & Offshore Engineering Co., Ltd.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives