- South Korea

- /

- Electrical

- /

- KOSE:A006260

LS Corp.'s (KRX:006260) Shares Bounce 26% But Its Business Still Trails The Market

The LS Corp. (KRX:006260) share price has done very well over the last month, posting an excellent gain of 26%. The last 30 days bring the annual gain to a very sharp 41%.

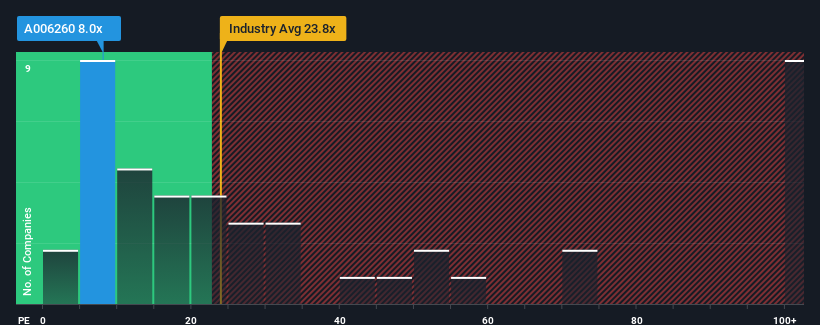

In spite of the firm bounce in price, given about half the companies in Korea have price-to-earnings ratios (or "P/E's") above 14x, you may still consider LS as an attractive investment with its 8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times haven't been advantageous for LS as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for LS

Does Growth Match The Low P/E?

LS' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 44%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 251% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 2.6% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 20% each year, which is noticeably more attractive.

With this information, we can see why LS is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

The latest share price surge wasn't enough to lift LS' P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of LS' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 4 warning signs for LS (1 can't be ignored!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than LS. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A006260

LS

Engages in electric power, automation, machinery, materials, and energy businesses in South Korea and internationally.

Good value with moderate growth potential.

Market Insights

Community Narratives