- South Korea

- /

- Insurance

- /

- KOSE:A000370

Top Dividend Stocks On The KRX In June 2024

Reviewed by Simply Wall St

The South Korean market has shown robust growth, climbing 2.0% in the last week and achieving a 6.7% increase over the past year, with earnings expected to grow by 29% annually. In this dynamic environment, dividend stocks that offer consistent payouts can be particularly appealing for investors looking for both stability and potential income growth.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.29% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 6.35% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.26% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.48% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 4.41% | ★★★★★☆ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.41% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.79% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 4.77% | ★★★★★☆ |

| Tong Yang Life Insurance (KOSE:A082640) | 6.36% | ★★★★☆☆ |

| Hansae Yes24 Holdings (KOSE:A016450) | 5.21% | ★★★★☆☆ |

Click here to see the full list of 69 stocks from our Top KRX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Hanwha General Insurance (KOSE:A000370)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanwha General Insurance Co., Ltd. operates as an insurance service provider in South Korea, with a market capitalization of approximately ₩571.16 billion.

Operations: Hanwha General Insurance Co., Ltd. offers insurance services in South Korea.

Dividend Yield: 4%

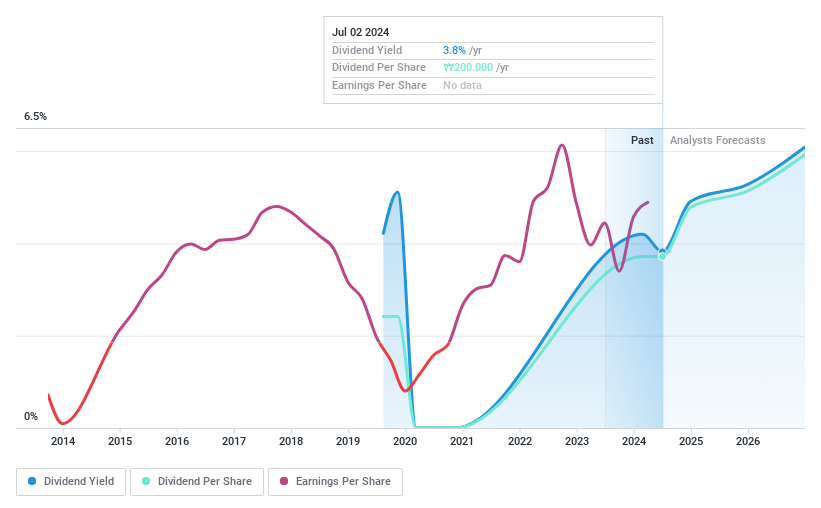

Hanwha General Insurance's dividend yield of 4.05% ranks in the top 25% in South Korea, supported by a robust coverage with a cash payout ratio of 1.4%, ensuring dividends are well-covered by free cash flows. Despite its attractive yield and recent share buyback completion for KRW 4.94 billion enhancing shareholder value, the dividend history is less stable, marked by volatility and a relatively short track record of five years. While earnings have grown significantly last year at 63.6%, future projections show an annual growth rate of approximately 11.31%, suggesting potential for continued financial improvement albeit with past dividend inconsistencies.

- Navigate through the intricacies of Hanwha General Insurance with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Hanwha General Insurance's current price could be quite moderate.

Hyundai G.F. Holdings (KOSE:A005440)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai G.F. Holdings Co., Ltd. operates primarily in the rental and investment sectors with a market capitalization of approximately ₩696.89 billion.

Operations: Hyundai G.F. Holdings Co., Ltd. generates its revenue primarily through activities in the rental and investment sectors.

Dividend Yield: 4.5%

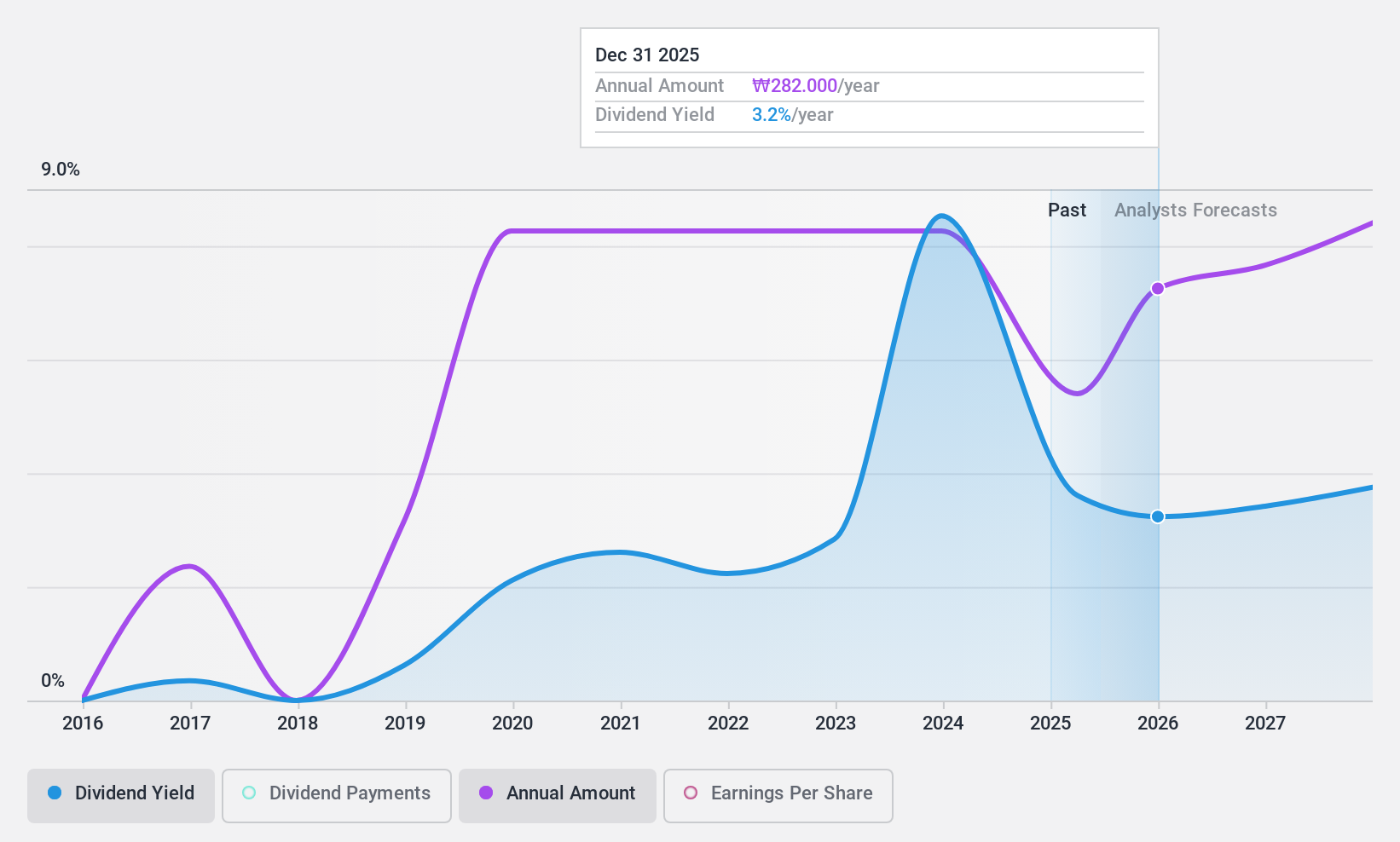

Hyundai G.F. Holdings offers a dividend yield of 4.47%, placing it in the top 25% of Korean dividend payers. Despite its attractive yield, the company's dividend history is marked by instability, having paid dividends for only eight years with fluctuating payments. However, dividends are well-supported financially, with a low payout ratio of 2.1% and a cash payout ratio of 57.3%, indicating strong coverage by both earnings and cash flows. Recent forecasts predict significant revenue growth at 27.92% annually, but shareholder dilution has occurred over the past year.

- Click here to discover the nuances of Hyundai G.F. Holdings with our detailed analytical dividend report.

- Our valuation report unveils the possibility Hyundai G.F. Holdings' shares may be trading at a discount.

JB Financial Group (KOSE:A175330)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Financial Group Co., Ltd. operates as a financial institution offering banking products and services both domestically in South Korea and internationally, with a market capitalization of approximately ₩2.73 billion.

Operations: JB Financial Group Co., Ltd. generates its revenue primarily from providing banking products and services across South Korea and various international markets.

Dividend Yield: 6%

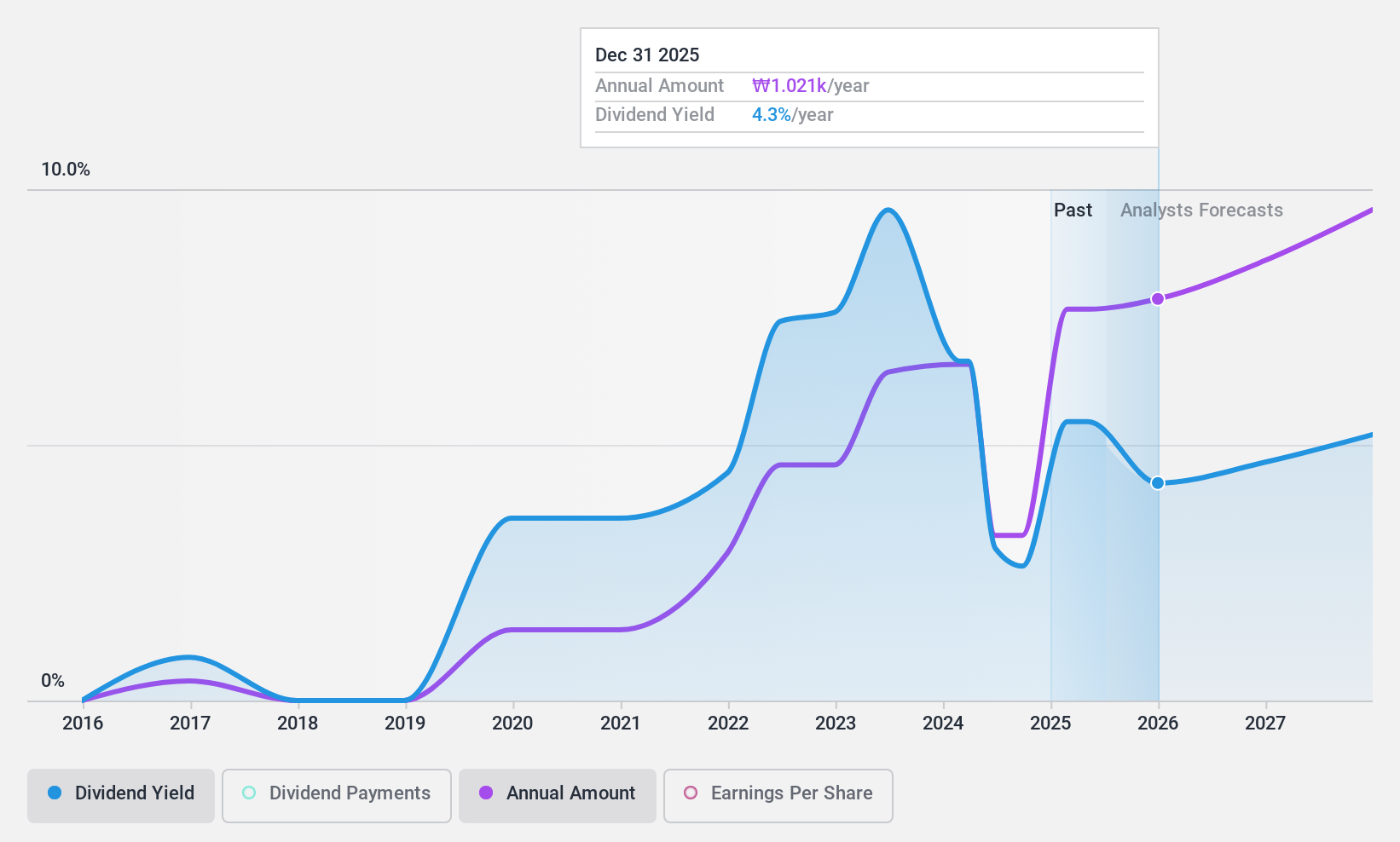

JB Financial Group maintains a dividend yield of 6.01%, ranking it among the top 25% in the South Korean market. While its dividend history spans less than a decade, payments have shown stability and growth. The dividends are financially sustainable with a current payout ratio of 28.8% and projected to remain robust at 29.3% over three years, underpinned by an expected annual earnings growth of 5.43%. Recent trading suggests the stock is undervalued, priced at 70% below estimated fair value as of April 2024.

- Unlock comprehensive insights into our analysis of JB Financial Group stock in this dividend report.

- Our valuation report here indicates JB Financial Group may be undervalued.

Key Takeaways

- Navigate through the entire inventory of 69 Top KRX Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hanwha General Insurance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hanwha General Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000370

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives