- Philippines

- /

- Food and Staples Retail

- /

- PSE:RRHI

3 Reliable Dividend Stocks Yielding Up To 5.5%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating interest rates, AI competition fears, and political tariff uncertainties, investors are seeking stability amid volatility. While U.S. stocks faced a turbulent week with mixed earnings results and geopolitical tensions, the European markets found some relief in rate cuts by the ECB, highlighting the importance of strategic investment choices in such dynamic environments. In this context, dividend stocks stand out as attractive options for those looking to balance risk and reward; they offer consistent income streams which can be particularly appealing during periods of market uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.48% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.18% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

Click here to see the full list of 1954 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

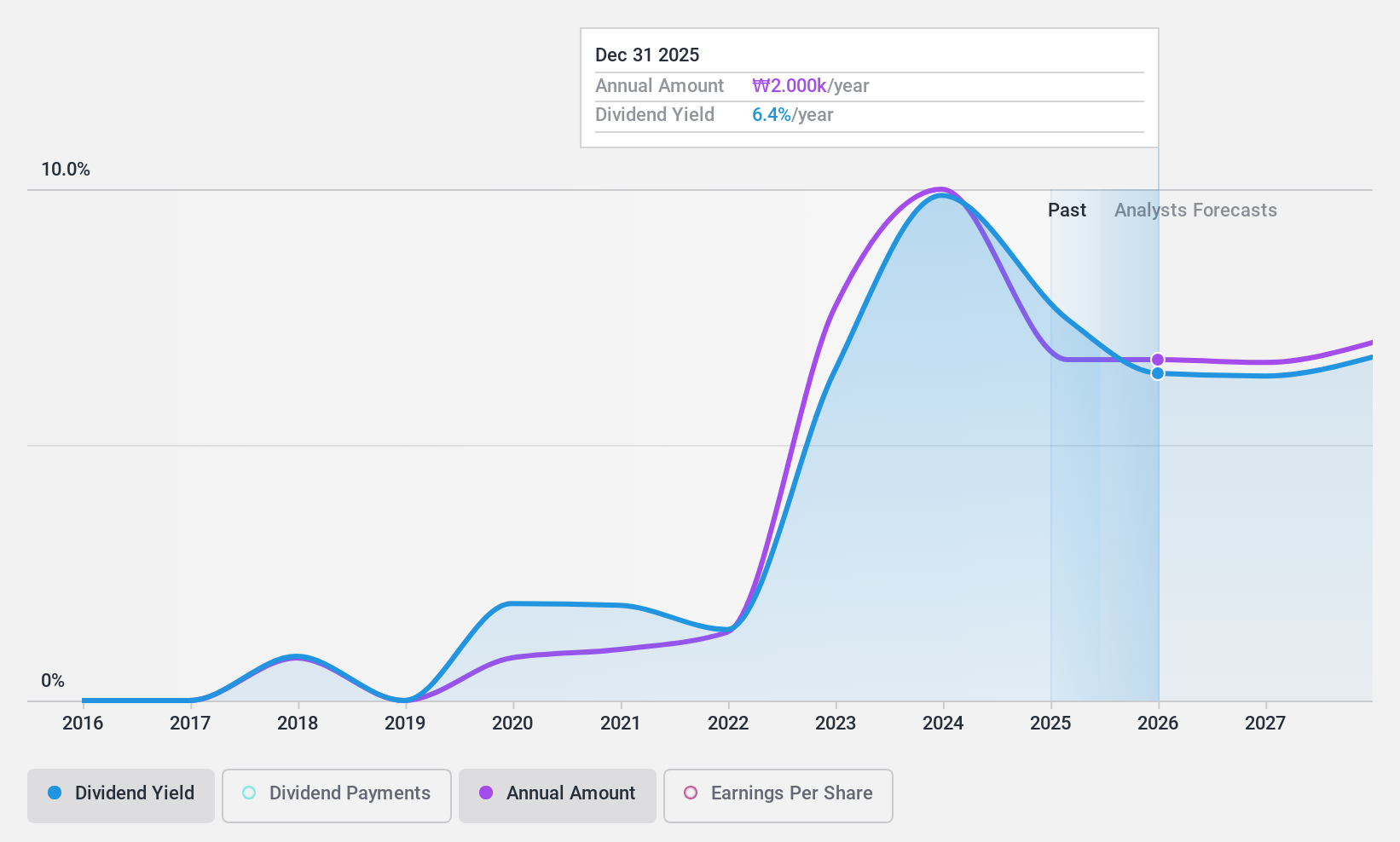

LX International (KOSE:A001120)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LX International Corp. operates in the trading business both domestically in Korea and internationally, with a market capitalization of approximately ₩895.60 billion.

Operations: LX International Corp.'s revenue is derived from three main segments: Resource Sector (₩1.12 billion), Trading/New Business (₩7.50 billion), and Logistics Division (₩7.50 billion).

Dividend Yield: 4.6%

LX International's dividend payments have been volatile over the past 8 years, despite being in the top 25% of dividend payers in South Korea. The dividends are well-covered by both earnings and cash flows, with a payout ratio of 25.6% and a cash payout ratio of 11.7%. Although trading at a significant discount to its estimated fair value, investors should note the unstable dividend track record when considering it for income portfolios.

- Dive into the specifics of LX International here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that LX International is trading behind its estimated value.

Robinsons Retail Holdings (PSE:RRHI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Robinsons Retail Holdings, Inc. is a multi-format retail company operating in the Philippines with a market capitalization of ₱49.28 billion.

Operations: Robinsons Retail Holdings, Inc. generates revenue through various segments, including Department Store (₱16.31 billion), Specialty Stores (₱14.71 billion), Drug Store Division (₱35.56 billion), and Do It Yourself (DIY) (₱11.84 billion).

Dividend Yield: 5.6%

Robinsons Retail Holdings offers a stable dividend history over the past decade, with payments growing consistently. The dividend yield of 5.59% is well-covered by both earnings and cash flows, with payout ratios of 31.2% and 28.5%, respectively. While trading at a significant discount to its estimated fair value, the forecasted decline in earnings by an average of 11.2% annually over the next three years could impact future dividend growth potential compared to top-tier payers in the Philippines market.

- Get an in-depth perspective on Robinsons Retail Holdings' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Robinsons Retail Holdings is priced lower than what may be justified by its financials.

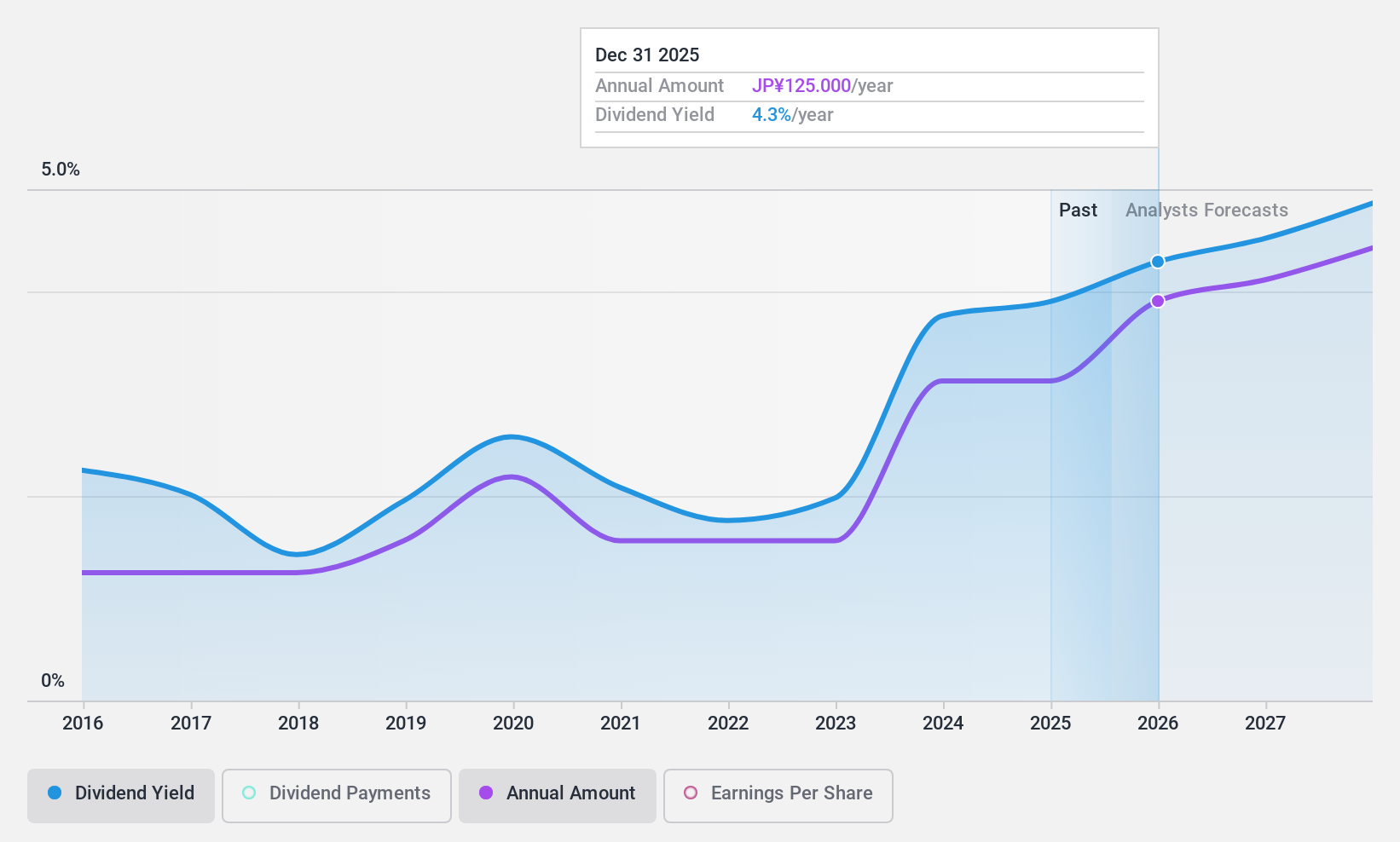

Nippon Ceramic (TSE:6929)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Ceramic Co., Ltd. develops, manufactures, and sells ceramic sensors and modules both in Japan and internationally, with a market cap of ¥54.68 billion.

Operations: Nippon Ceramic Co., Ltd. generates revenue of ¥24.47 billion from its manufacturing and sales of electronic components and related products segment.

Dividend Yield: 3.8%

Nippon Ceramic's dividend yield of 3.84% ranks in the top 25% in Japan, supported by a payout ratio of 66% and a cash payout ratio of 36.5%, ensuring coverage by earnings and cash flows. Despite past volatility in dividend payments, recent earnings growth of 15.5% suggests potential stability improvements. The stock trades at a significant discount to its fair value, while recent share buybacks totaling ¥999.81 million may enhance shareholder value further.

- Click to explore a detailed breakdown of our findings in Nippon Ceramic's dividend report.

- Our expertly prepared valuation report Nippon Ceramic implies its share price may be too high.

Seize The Opportunity

- Click this link to deep-dive into the 1954 companies within our Top Dividend Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:RRHI

Robinsons Retail Holdings

Operates as a multi-format retail company in the Philippines.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives