- South Korea

- /

- Electrical

- /

- KOSDAQ:A340930

Youil Energy Technology CO.,LTD's (KOSDAQ:340930) Business Is Trailing The Industry But Its Shares Aren't

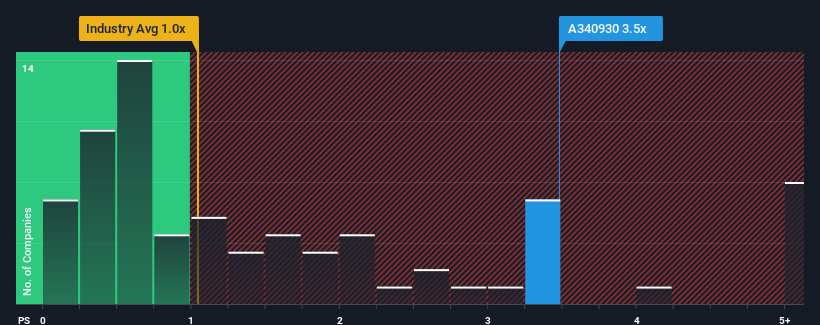

When close to half the companies in the Electrical industry in Korea have price-to-sales ratios (or "P/S") below 1x, you may consider Youil Energy Technology CO.,LTD (KOSDAQ:340930) as a stock to avoid entirely with its 3.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Youil Energy TechnologyLTD

How Youil Energy TechnologyLTD Has Been Performing

For instance, Youil Energy TechnologyLTD's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Youil Energy TechnologyLTD's earnings, revenue and cash flow.How Is Youil Energy TechnologyLTD's Revenue Growth Trending?

In order to justify its P/S ratio, Youil Energy TechnologyLTD would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 31%. This means it has also seen a slide in revenue over the longer-term as revenue is down 41% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 1.9% shows it's an unpleasant look.

With this information, we find it concerning that Youil Energy TechnologyLTD is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Youil Energy TechnologyLTD's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Youil Energy TechnologyLTD revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Having said that, be aware Youil Energy TechnologyLTD is showing 3 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A340930

Youil Energy TechLtd

Youil Energy Technology Co.,Ltd manufactures secondary batteries and fuel cells in South Korea.

Slight and overvalued.

Market Insights

Community Narratives