- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A131290

South Korea's Hidden Gems Three Promising Small Caps

Reviewed by Simply Wall St

As the South Korean stock market experiences fluctuations with the KOSPI index rallying recently, yet facing potential downward pressure amid global economic concerns, investors are keenly observing small-cap stocks for opportunities. In this environment of rising treasury yields and interest rate uncertainties, identifying promising small-cap companies can be pivotal for those seeking growth potential beyond the major indices.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| PaperCorea | 53.09% | 1.31% | 77.27% | ★★★★★☆ |

| Itcen | 64.57% | 14.33% | -24.39% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

TSE (KOSDAQ:A131290)

Simply Wall St Value Rating: ★★★★★☆

Overview: TSE Co., Ltd specializes in providing semiconductor test solutions both in South Korea and internationally, with a market capitalization of ₩584.44 billion.

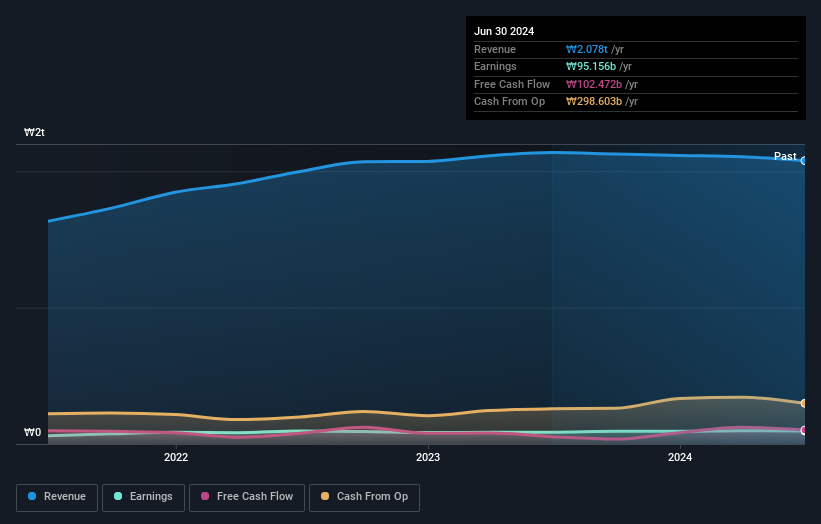

Operations: TSE Co., Ltd generates revenue primarily from semiconductor light inspection equipment, contributing ₩160.25 billion, and electronic product inspection at ₩112.77 billion. The semiconductor, etc., inspection service adds ₩13.67 billion to the revenue stream, while the semiconductors production line contributes ₩21.04 billion.

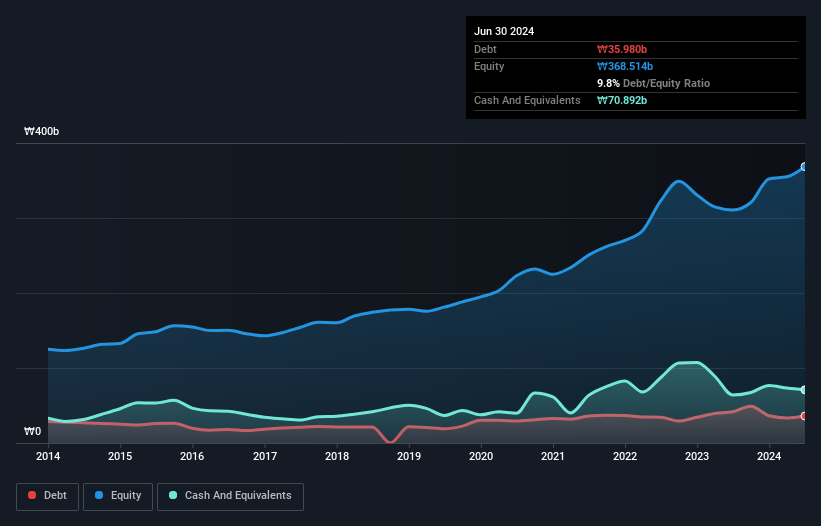

TSE, a smaller player in the semiconductor space, has shown impressive earnings growth of 231.1% over the past year, outpacing its industry peers who saw a -10% change. The company seems to be trading at 45% below its estimated fair value, suggesting potential undervaluation. Despite recent volatility in share price and negative free cash flow figures like A$-29 million as of June 2024, TSE's debt-to-equity ratio has improved from 10.4 to 9.8 over five years. With high-quality earnings and sufficient interest coverage, TSE appears poised for continued growth with forecasted annual earnings increase of nearly 48%.

HYUNDAI MOVEX (KOSDAQ:A319400)

Simply Wall St Value Rating: ★★★★★★

Overview: HYUNDAI MOVEX Co., Ltd. is engaged in the IT and logistics system sectors both domestically in South Korea and internationally, with a market capitalization of approximately ₩376.18 billion.

Operations: HYUNDAI MOVEX generates revenue primarily from its logistics automation segment, contributing ₩286.90 billion, and its IT service segment, which adds ₩26.29 billion.

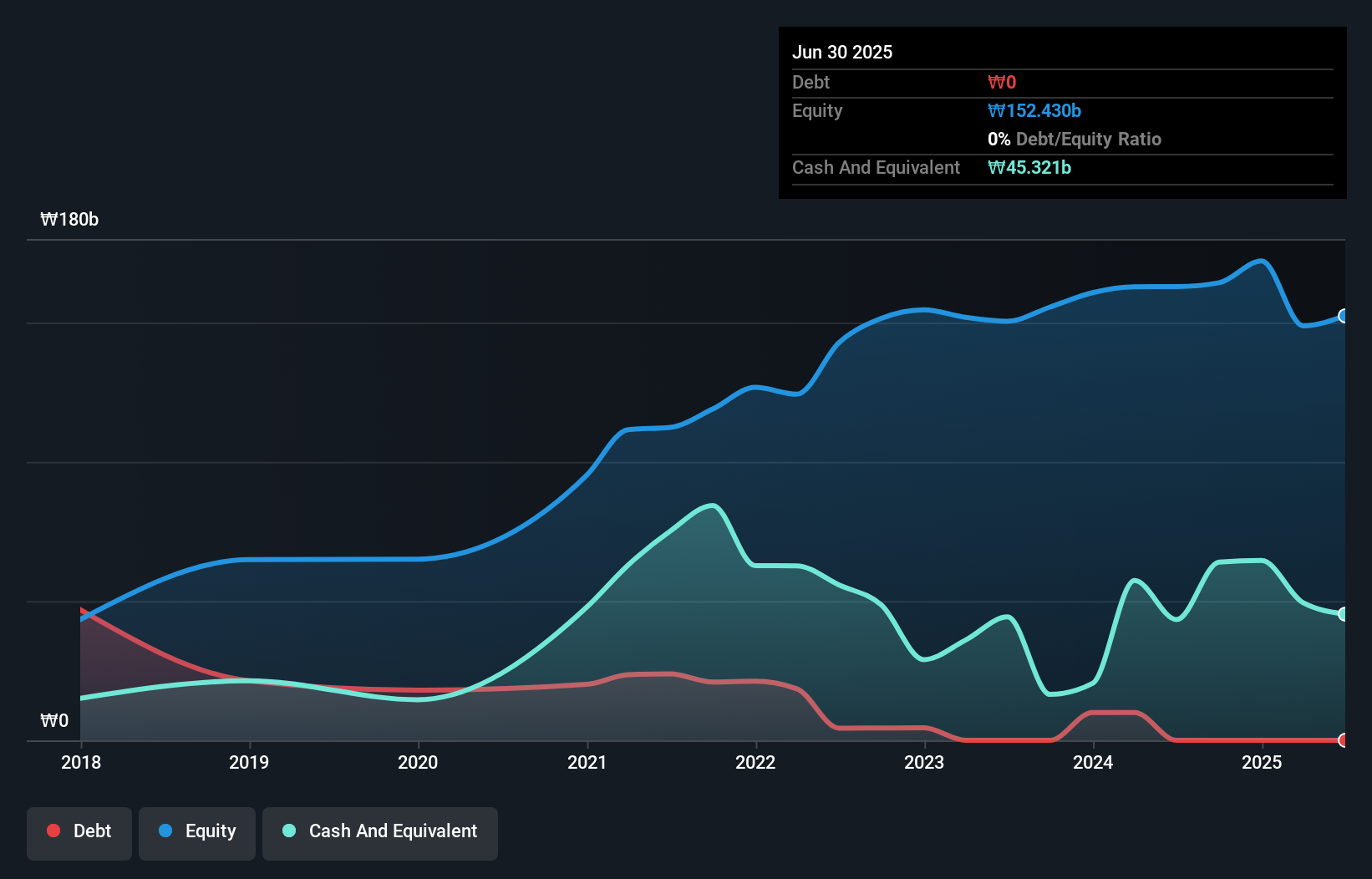

HYUNDAI MOVEX, a South Korean company, is making waves with its impressive earnings growth of 447% over the past year, outpacing the construction industry's 7%. This debt-free entity has seen significant improvement from five years ago when its debt-to-equity ratio was 30.3%, and it now trades at a substantial discount of 81% below estimated fair value. The recent announcement of a KRW 5 billion share repurchase plan aims to enhance shareholder value and could positively impact stock compensation for executives. These strategic moves highlight potential opportunities for investors seeking undervalued stocks in dynamic markets.

- Click to explore a detailed breakdown of our findings in HYUNDAI MOVEX's health report.

Gain insights into HYUNDAI MOVEX's past trends and performance with our Past report.

ASIA Holdings (KOSE:A002030)

Simply Wall St Value Rating: ★★★★★☆

Overview: Asia Holdings Co., Ltd. operates in South Korea through its subsidiaries, focusing on the manufacture and sale of various papers and paper products, with a market capitalization of approximately ₩437.66 billion.

Operations: Asia Holdings generates revenue primarily from its Paper Business and Cement Business, with the latter contributing ₩1.20 trillion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

ASIA Holdings, a financial entity in South Korea, is making waves with its strategic moves and robust financial health. Its earnings have grown by 9.8% over the past year, outpacing the Forestry industry's -9.8%. The company trades at an attractive 83.7% below its estimated fair value and boasts high-quality earnings alongside a satisfactory net debt to equity ratio of 17.4%. Recent buyback initiatives aim to stabilize stock prices and enhance shareholder value, with KRW 2 billion earmarked for repurchases until April 2025. This proactive approach underscores ASIA Holdings' commitment to strengthening its market position.

- Click here and access our complete health analysis report to understand the dynamics of ASIA Holdings.

Explore historical data to track ASIA Holdings' performance over time in our Past section.

Seize The Opportunity

- Discover the full array of 180 KRX Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade TSE, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TSE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A131290

TSE

Provides semiconductor test solutions in South Korea and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives