- South Korea

- /

- Electrical

- /

- KOSDAQ:A294630

What Type Of Returns Would SuNam's(KOSDAQ:294630) Shareholders Have Earned If They Purchased Their SharesYear Ago?

While it may not be enough for some shareholders, we think it is good to see the SuNam Co., Ltd. (KOSDAQ:294630) share price up 26% in a single quarter. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 22% in one year, under-performing the market.

View our latest analysis for SuNam

Given that SuNam didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

SuNam's revenue didn't grow at all in the last year. In fact, it fell 17%. That's not what investors generally want to see. The stock price has languished lately, falling 22% in a year. What would you expect when revenue is falling, and it doesn't make a profit? We think most holders must believe revenue growth will improve, or else costs will decline.

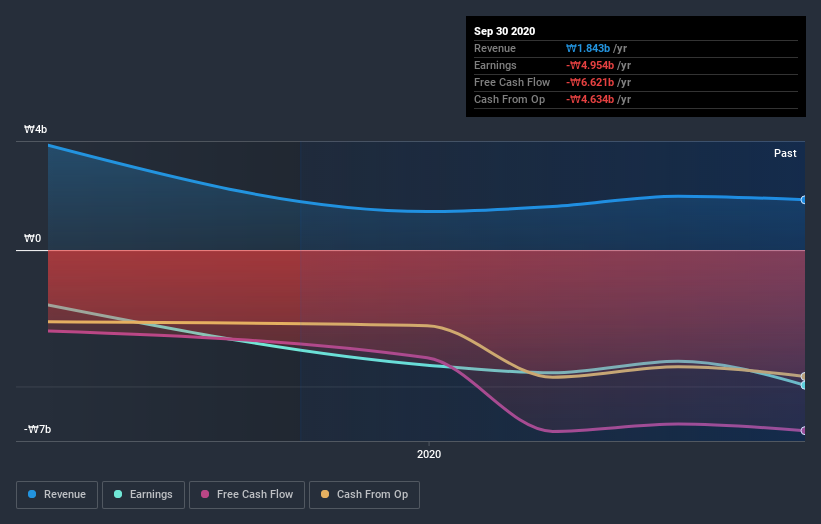

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While SuNam shareholders are down 22% for the year, the market itself is up 47%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 26% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 5 warning signs for SuNam (1 is significant!) that you should be aware of before investing here.

But note: SuNam may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade SuNam, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A294630

SuNam

Manufactures and sells conducting wire and high-magnetic materials in South Korea.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives