- South Korea

- /

- Machinery

- /

- KOSDAQ:A137400

Introducing People & Technology (KOSDAQ:137400), The Stock That Soared 370% In The Last Five Years

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. Don't believe it? Then look at the People & Technology Inc. (KOSDAQ:137400) share price. It's 370% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. In more good news, the share price has risen 2.2% in thirty days. But the price may well have benefitted from a buoyant market, since stocks have gained 14% in the last thirty days.

View our latest analysis for People & Technology

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

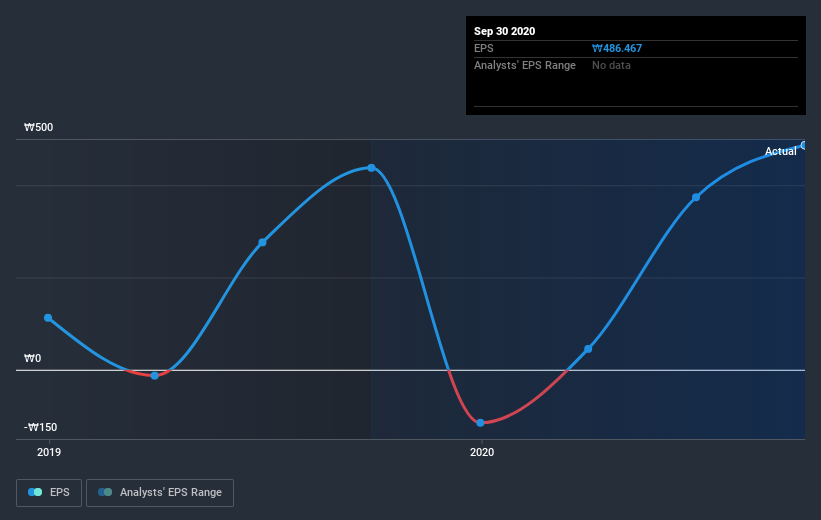

During the five years of share price growth, People & Technology moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the People & Technology share price is up 232% in the last three years. Meanwhile, EPS is up 17% per year. Notably, the EPS growth has been slower than the annualised share price gain of 49% over three years. So it's fair to assume the market has a higher opinion of the business than it did three years ago.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on People & Technology's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between People & Technology's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. People & Technology's TSR of 374% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that People & Technology shareholders have received a total shareholder return of 262% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 37% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand People & Technology better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for People & Technology (of which 2 are potentially serious!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade People & Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade People & Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A137400

People & Technology

Offers coating, calendaring, slitting, automation, and other machineries.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives