- South Korea

- /

- Machinery

- /

- KOSDAQ:A090710

Hyulim ROBOTLtd (KOSDAQ:090710) adds ₩15b to market cap in the past 7 days, though investors from a year ago are still down 56%

This week we saw the Hyulim ROBOT Co.,Ltd. (KOSDAQ:090710) share price climb by 10%. But that isn't much consolation to those who have suffered through the declines of the last year. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 56% in that time. The share price recovery is not so impressive when you consider the fall. It may be that the fall was an overreaction.

While the stock has risen 10% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Hyulim ROBOTLtd

Because Hyulim ROBOTLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Hyulim ROBOTLtd saw its revenue grow by 36%. That's definitely a respectable growth rate. Unfortunately it seems investors wanted more, because the share price is down 56% in that time. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

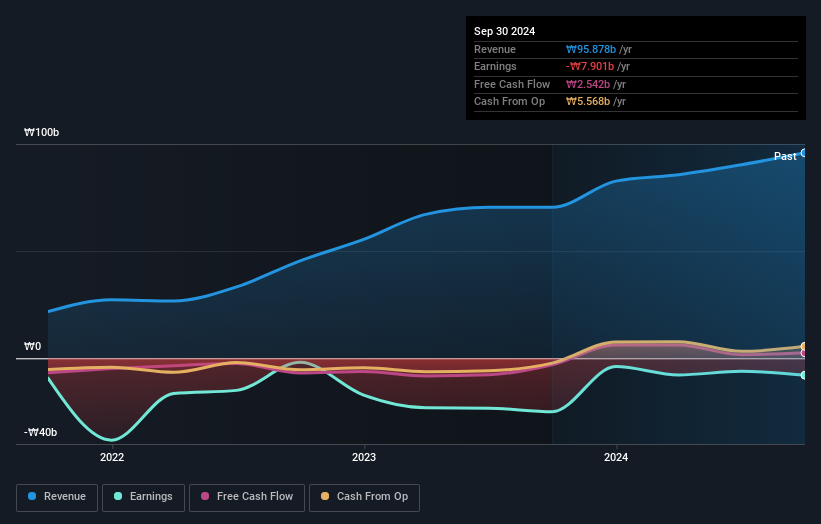

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Hyulim ROBOTLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Hyulim ROBOTLtd shareholders are down 56% for the year. Unfortunately, that's worse than the broader market decline of 11%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Hyulim ROBOTLtd (at least 2 which make us uncomfortable) , and understanding them should be part of your investment process.

But note: Hyulim ROBOTLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

If you're looking to trade Hyulim ROBOTLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hyulim ROBOTLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A090710

Mediocre balance sheet low.

Market Insights

Community Narratives