- South Korea

- /

- Electrical

- /

- KOSDAQ:A086520

Ecopro Co., Ltd.'s (KOSDAQ:086520) P/S Is Still On The Mark Following 27% Share Price Bounce

Ecopro Co., Ltd. (KOSDAQ:086520) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 47% over that time.

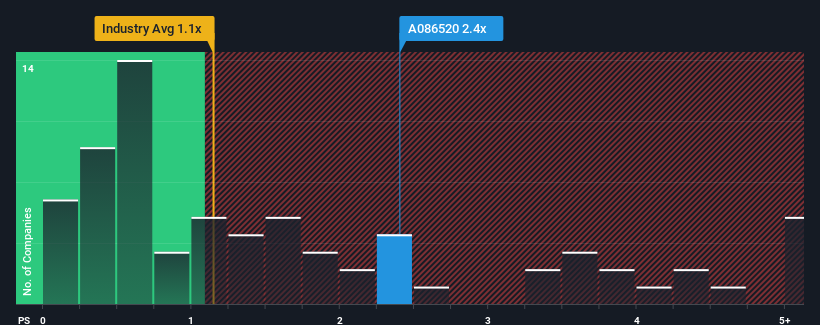

After such a large jump in price, you could be forgiven for thinking Ecopro is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in Korea's Electrical industry have P/S ratios below 1.1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Ecopro

What Does Ecopro's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Ecopro has been very sluggish. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Ecopro's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Ecopro would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 35%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Turning to the outlook, the next year should generate growth of 35% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 9.7%, the company is positioned for a stronger revenue result.

With this information, we can see why Ecopro is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in Ecopro's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Ecopro shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Ecopro that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Ecopro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A086520

Ecopro

Engages in the manufacturing and selling of air pollution prevention and eco-friendly materials in South Korea and internationally.

Mediocre balance sheet with limited growth.

Market Insights

Community Narratives