- South Korea

- /

- Machinery

- /

- KOSDAQ:A036890

We Think JINSUNG T.E.C (KOSDAQ:036890) Is Taking Some Risk With Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies JINSUNG T.E.C., Inc. (KOSDAQ:036890) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for JINSUNG T.E.C

What Is JINSUNG T.E.C's Debt?

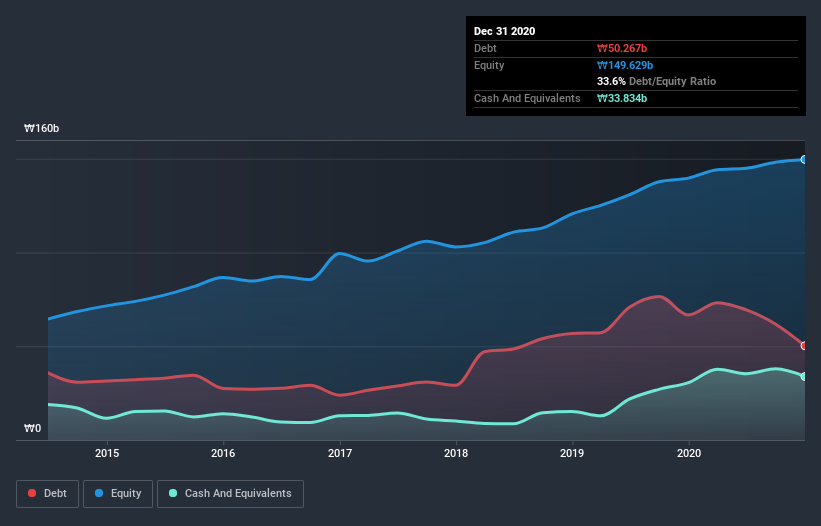

The image below, which you can click on for greater detail, shows that JINSUNG T.E.C had debt of ₩50.3b at the end of December 2020, a reduction from ₩66.7b over a year. However, it also had ₩33.8b in cash, and so its net debt is ₩16.4b.

How Healthy Is JINSUNG T.E.C's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that JINSUNG T.E.C had liabilities of ₩114.5b due within 12 months and liabilities of ₩15.9b due beyond that. Offsetting this, it had ₩33.8b in cash and ₩83.2b in receivables that were due within 12 months. So its liabilities total ₩13.4b more than the combination of its cash and short-term receivables.

Of course, JINSUNG T.E.C has a market capitalization of ₩321.4b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

JINSUNG T.E.C has a low net debt to EBITDA ratio of only 0.50. And its EBIT easily covers its interest expense, being 12.5 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. In fact JINSUNG T.E.C's saving grace is its low debt levels, because its EBIT has tanked 24% in the last twelve months. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if JINSUNG T.E.C can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, JINSUNG T.E.C created free cash flow amounting to 15% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

JINSUNG T.E.C's EBIT growth rate and conversion of EBIT to free cash flow definitely weigh on it, in our esteem. But the good news is it seems to be able to cover its interest expense with its EBIT with ease. We think that JINSUNG T.E.C's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example - JINSUNG T.E.C has 2 warning signs we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading JINSUNG T.E.C or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A036890

JINSUNG T.E.C

Engages in the production and sale of heavy construction equipment under carriage parts in South Korea and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)