- South Korea

- /

- Electrical

- /

- KOSDAQ:A033100

Subdued Growth No Barrier To Cheryong Electric Co.,Ltd. (KOSDAQ:033100) With Shares Advancing 31%

Despite an already strong run, Cheryong Electric Co.,Ltd. (KOSDAQ:033100) shares have been powering on, with a gain of 31% in the last thirty days. The last month tops off a massive increase of 281% in the last year.

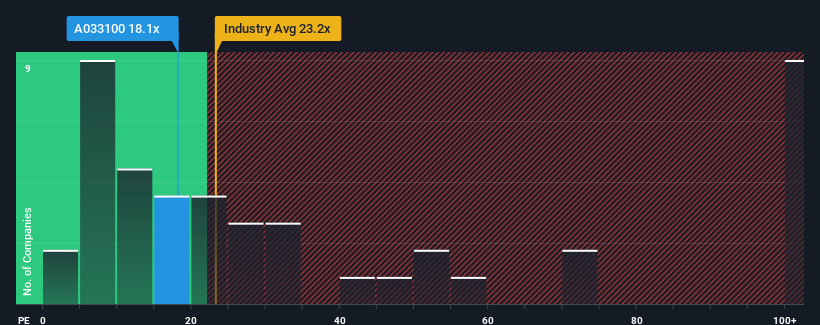

After such a large jump in price, given around half the companies in Korea have price-to-earnings ratios (or "P/E's") below 13x, you may consider Cheryong ElectricLtd as a stock to potentially avoid with its 18.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Cheryong ElectricLtd has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Cheryong ElectricLtd

How Is Cheryong ElectricLtd's Growth Trending?

In order to justify its P/E ratio, Cheryong ElectricLtd would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 352% last year. Pleasingly, EPS has also lifted 1,503% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 16% as estimated by the only analyst watching the company. Meanwhile, the rest of the market is forecast to expand by 29%, which is noticeably more attractive.

With this information, we find it concerning that Cheryong ElectricLtd is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Cheryong ElectricLtd's P/E is getting right up there since its shares have risen strongly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Cheryong ElectricLtd currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Cheryong ElectricLtd that you need to be mindful of.

If these risks are making you reconsider your opinion on Cheryong ElectricLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A033100

Cheryong ElectricLtd

Manufactures and sells power electric equipment in South Korea.

Flawless balance sheet and good value.

Market Insights

Community Narratives