- South Korea

- /

- Building

- /

- KOSDAQ:A014620

Asian Growth Companies With High Insider Ownership Revealed

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties, including trade tensions and inflationary pressures, the Asian market remains a focal point for investors seeking growth opportunities. In this environment, companies with high insider ownership often stand out as they may signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| PharmaResearch (KOSDAQ:A214450) | 38.6% | 26.4% |

| Samyang Foods (KOSE:A003230) | 11.6% | 29.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 42.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 77% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 92.8% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 32.9% | 53.5% |

| Oscotec (KOSDAQ:A039200) | 21.2% | 148.5% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

We're going to check out a few of the best picks from our screener tool.

Sung Kwang BendLtd (KOSDAQ:A014620)

Simply Wall St Growth Rating: ★★★★☆☆

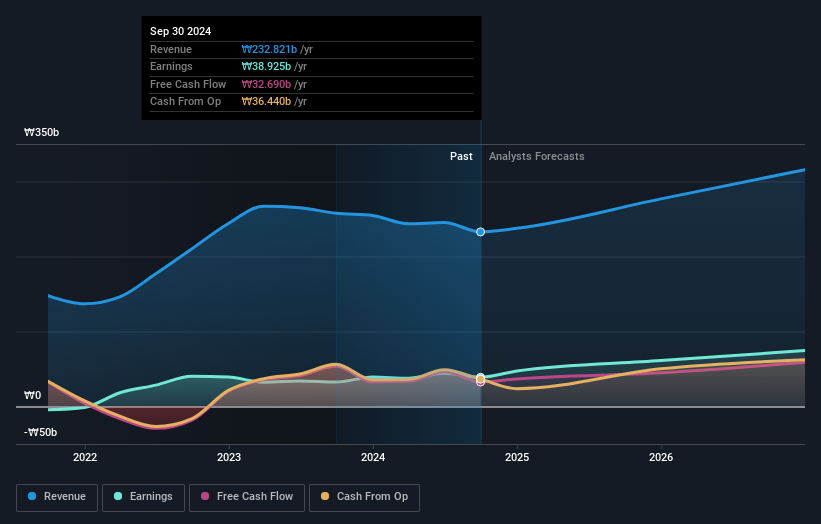

Overview: Sung Kwang Bend Co., Ltd. is involved in the global manufacture and sale of pipe fittings, with a market cap of ₩797.84 billion.

Operations: The company generates revenue from its Machinery - Pumps segment, amounting to ₩232.82 million.

Insider Ownership: 34.8%

Revenue Growth Forecast: 14.5% p.a.

Sung Kwang Bend Ltd. demonstrates robust growth potential with earnings forecasted to rise by 26.35% annually, surpassing the Korean market's average of 25.5%. Revenue is expected to grow at 14.5% per year, outpacing the broader market's 9.2%. Despite trading significantly below fair value estimates, its return on equity remains low at a projected 10.8% in three years. Recent dividend increases highlight shareholder returns but lack substantial insider trading activity recently noted.

- Take a closer look at Sung Kwang BendLtd's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Sung Kwang BendLtd shares in the market.

Miracle Automation EngineeringLtd (SZSE:002009)

Simply Wall St Growth Rating: ★★★★★☆

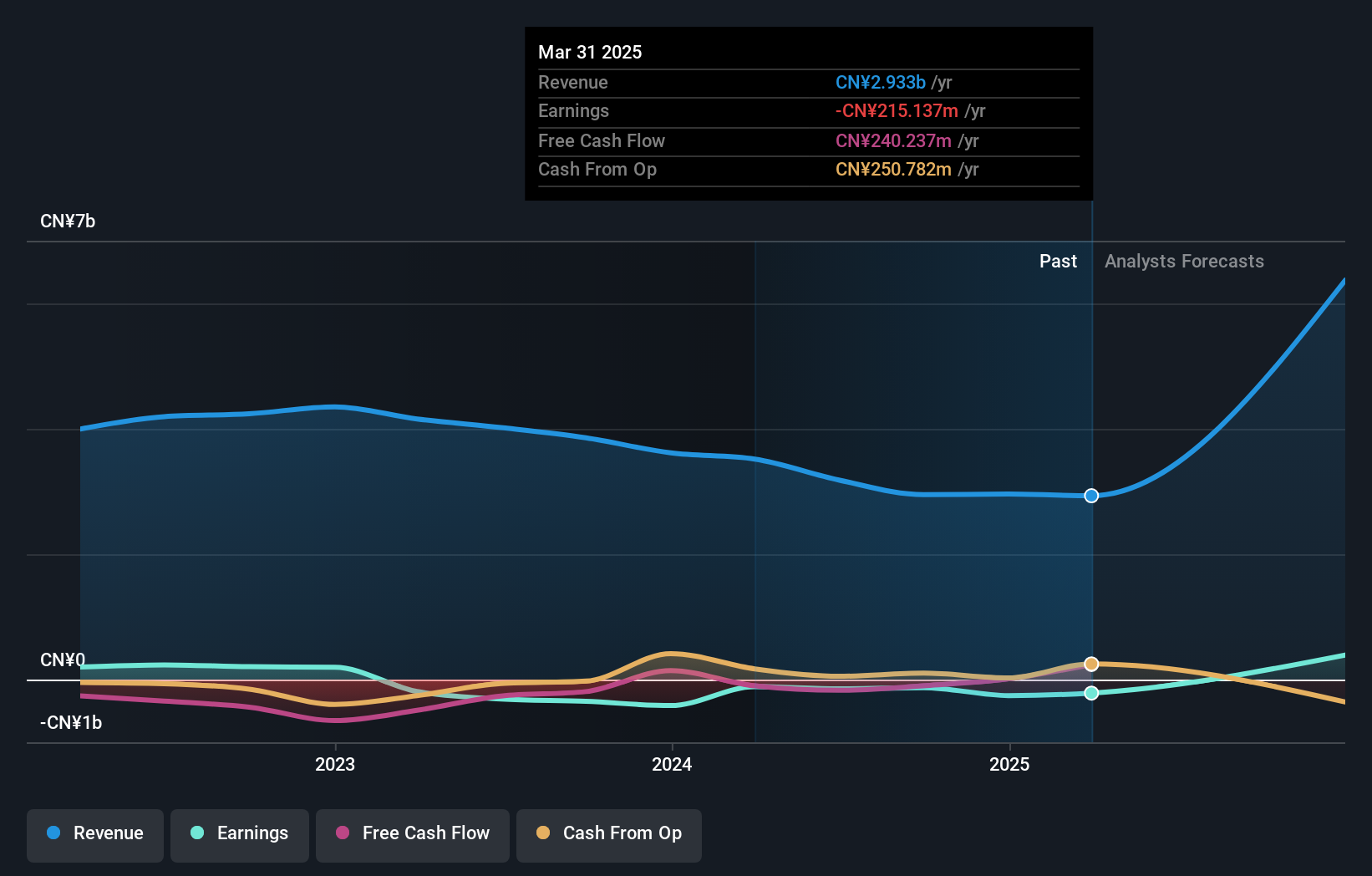

Overview: Miracle Automation Engineering Co. Ltd offers intelligent equipment solutions and services both in China and internationally, with a market cap of CN¥7.29 billion.

Operations: Miracle Automation Engineering Co. Ltd's revenue is derived from providing intelligent equipment solutions and services across domestic and international markets.

Insider Ownership: 28.1%

Revenue Growth Forecast: 47.3% p.a.

Miracle Automation Engineering Ltd. is set for substantial growth, with earnings projected to rise by 114.23% annually and revenue expected to increase by 47.3% per year, outstripping the Chinese market's average growth of 13.3%. Despite its volatile share price recently, it trades at a favorable value compared to peers. The company's financial position is strained due to debt not being well covered by operating cash flow, yet insider trading activity remains minimal in recent months.

- Click here and access our complete growth analysis report to understand the dynamics of Miracle Automation EngineeringLtd.

- According our valuation report, there's an indication that Miracle Automation EngineeringLtd's share price might be on the cheaper side.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★☆

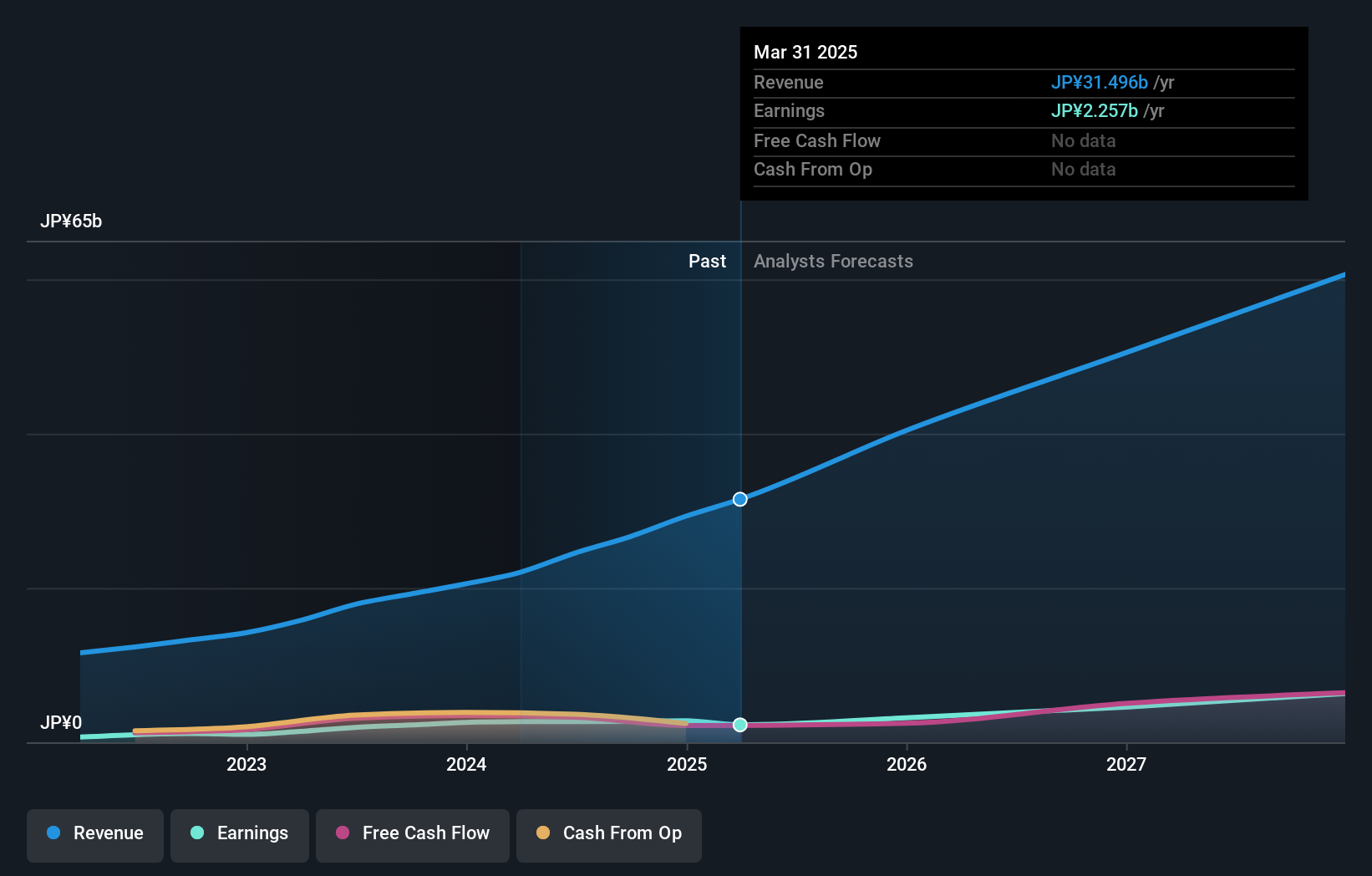

Overview: Medley, Inc. operates recruitment and medical business platforms in Japan and the United States with a market cap of ¥99.51 billion.

Operations: The company's revenue segments include the Medical Platform Business at ¥7.35 billion, the Human Resource Platform Business at ¥21.11 billion, and New Services at ¥849 million.

Insider Ownership: 34.1%

Revenue Growth Forecast: 17.4% p.a.

Medley, Inc. is positioned for robust growth in Asia, with earnings anticipated to rise by 22.5% annually and revenue projected to grow at 17.4% per year, both surpassing the Japanese market averages. Despite recent share price volatility and large one-off items affecting results, Medley's strategic initiatives include a share repurchase program worth ¥1,500 million and potential mergers with subsidiaries. The company expects net sales of ¥39.8 billion and operating profit of ¥3 billion for fiscal year 2025.

- Navigate through the intricacies of Medley with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Medley's share price might be too optimistic.

Seize The Opportunity

- Take a closer look at our Fast Growing Asian Companies With High Insider Ownership list of 645 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A014620

Sung Kwang BendLtd

Engages in the manufacture and sale of pipe fittings worldwide.

Flawless balance sheet with reasonable growth potential.