As global markets navigate a mixed landscape with fluctuating consumer confidence and economic indicators, major stock indices have shown moderate gains, particularly driven by large-cap growth stocks. In such an environment, identifying growth companies with significant insider ownership can be crucial for investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 79.6% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

Here we highlight a subset of our preferred stocks from the screener.

Sung Kwang BendLtd (KOSDAQ:A014620)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sung Kwang Bend Co., Ltd. manufactures and sells pipe fittings globally, with a market cap of ₩622.47 billion.

Operations: The company's revenue primarily comes from its Machinery - Pumps segment, totaling ₩232.82 million.

Insider Ownership: 34.8%

Sung Kwang Bend Ltd. is trading significantly below its estimated fair value, suggesting potential undervaluation. The company's earnings are forecasted to grow substantially at 30.61% annually, outpacing the Korean market's growth rate. Recent share buybacks totaling KRW 19.94 billion indicate strong confidence from management, though insider trading activity has been minimal recently. Despite impressive earnings growth projections, revenue growth is expected to be moderate compared to higher benchmarks for rapid expansion companies.

- Click to explore a detailed breakdown of our findings in Sung Kwang BendLtd's earnings growth report.

- The analysis detailed in our Sung Kwang BendLtd valuation report hints at an deflated share price compared to its estimated value.

Zhejiang Starry PharmaceuticalLtd (SHSE:603520)

Simply Wall St Growth Rating: ★★★★★☆

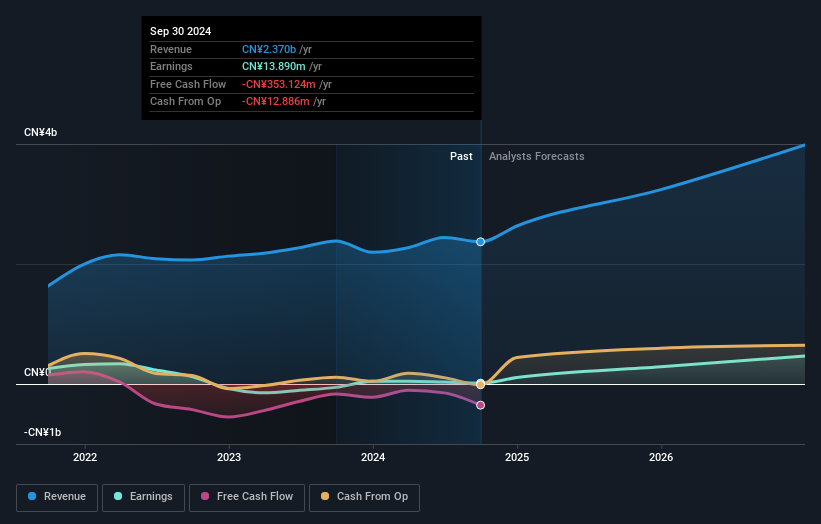

Overview: Zhejiang Starry Pharmaceutical Co., Ltd. focuses on the research, development, production, and sale of X-CT non-ionic contrast agents and fluoroquinolones drugs and intermediates both in China and internationally, with a market cap of CN¥3.81 billion.

Operations: The company generates revenue from the production and sale of X-CT non-ionic contrast agents and fluoroquinolones drugs and intermediates, serving both domestic and international markets.

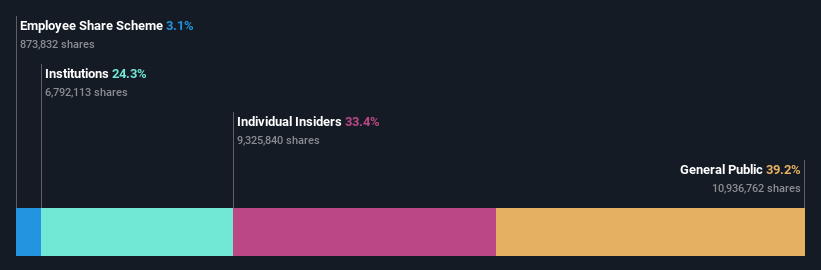

Insider Ownership: 25.9%

Zhejiang Starry Pharmaceutical Ltd. shows promising growth potential with forecasted annual earnings growth of 88.7%, significantly outpacing the Chinese market's 25.2%. Despite recent dilution, the company trades at a good value relative to peers and industry standards. However, its return on equity is projected to remain low at 13% in three years, and financial results have been impacted by large one-off items. The dividend yield of 1.13% is not well-supported by earnings or free cash flows.

- Unlock comprehensive insights into our analysis of Zhejiang Starry PharmaceuticalLtd stock in this growth report.

- In light of our recent valuation report, it seems possible that Zhejiang Starry PharmaceuticalLtd is trading behind its estimated value.

Hubei Xiangyuan New Material Technology (SZSE:300980)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hubei Xiangyuan New Material Technology Inc., with a market cap of CN¥3.09 billion, specializes in the development and production of advanced materials for various industrial applications.

Operations: The company generates revenue from its Rubber and Plastic Products segment, amounting to CN¥448.35 million.

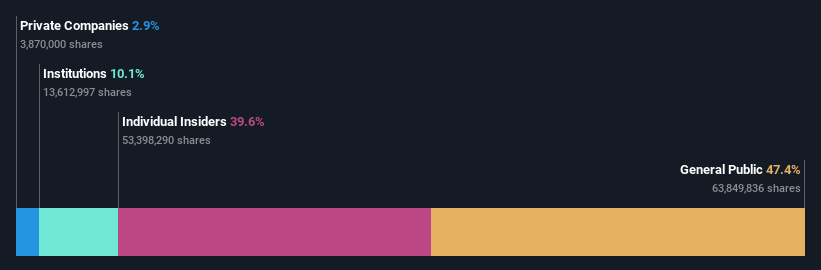

Insider Ownership: 39.6%

Hubei Xiangyuan New Material Technology demonstrates growth potential with forecasted earnings expected to rise significantly at 43.5% annually, surpassing the Chinese market's average. Despite a recent decline in profit margins from 10.7% to 6.5% and shareholder dilution, revenue is anticipated to grow faster than the market at 17.1%. The company faces challenges such as low return on equity forecasts of 7.4% and high share price volatility but benefits from stable insider ownership without substantial recent selling activities.

- Get an in-depth perspective on Hubei Xiangyuan New Material Technology's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Hubei Xiangyuan New Material Technology implies its share price may be too high.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1499 more companies for you to explore.Click here to unveil our expertly curated list of 1502 Fast Growing Companies With High Insider Ownership.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Xiangyuan New Material Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300980

Hubei Xiangyuan New Material Technology

Hubei Xiangyuan New Material Technology Inc.

Reasonable growth potential with adequate balance sheet.