As global markets navigate a complex landscape marked by fluctuations in consumer confidence and economic indicators, major stock indexes have shown moderate gains despite mixed signals from various sectors. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and resilience amid changing market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Zhejiang Hechuan Technology (SHSE:688320)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Hechuan Technology Co., Ltd. focuses on the research and development, manufacturing, sale, and application integration of industrial automation products with a market capitalization of approximately CN¥5.87 billion.

Operations: Hechuan Technology specializes in industrial automation, generating revenue primarily through the sale and integration of its developed products. The company leverages its expertise in research and development to enhance product offerings, contributing to its market presence.

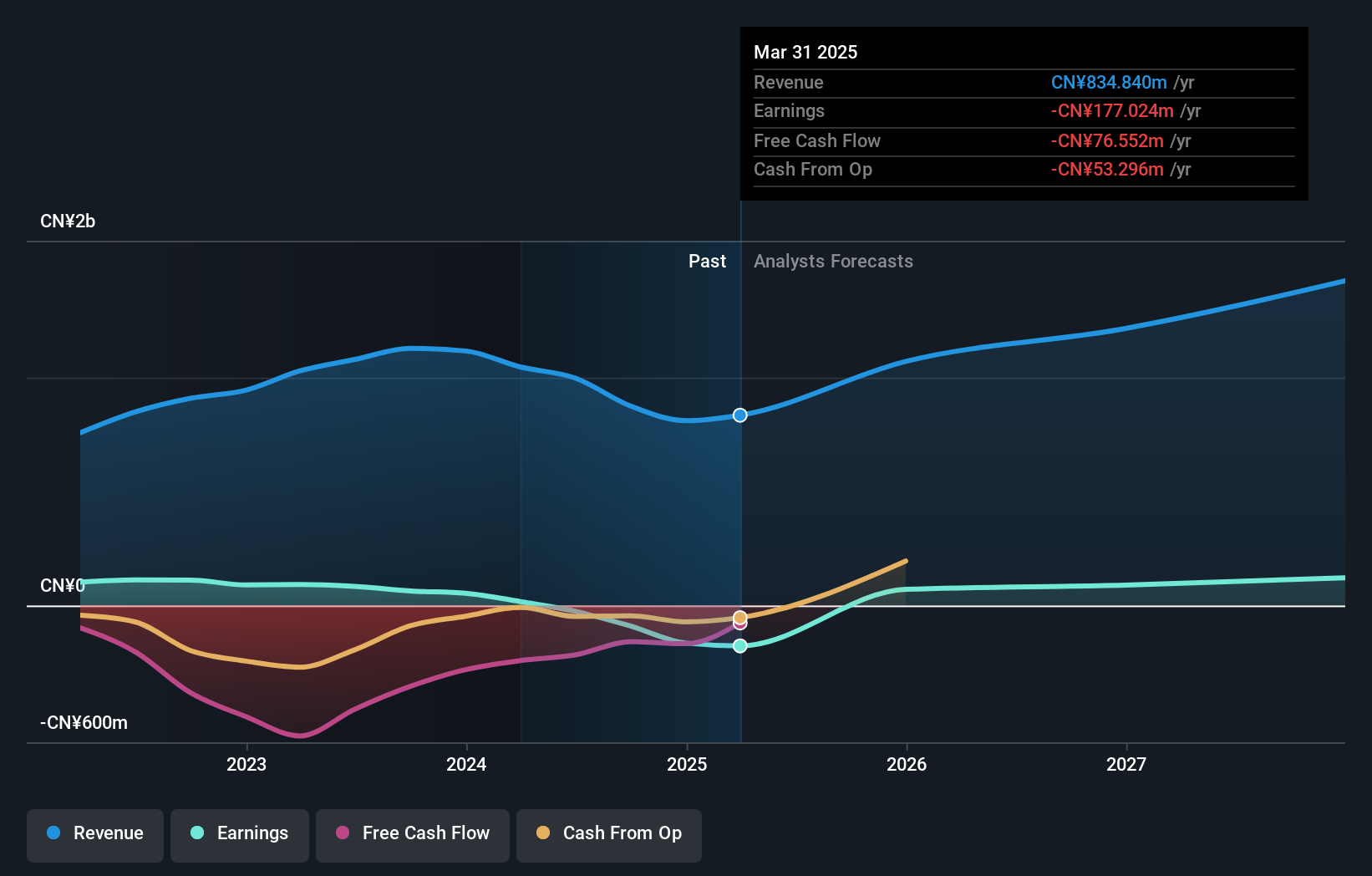

Zhejiang Hechuan Technology, despite its recent exclusion from the S&P Global BMI Index, is navigating a challenging phase with a notable shift in its financial trajectory. In the last nine months, revenue dipped to CNY 643.6 million from CNY 885.05 million year-over-year, alongside transitioning from a net profit to a loss of CNY 80.63 million. However, the company's aggressive R&D investment and forecasted annual revenue growth at 19.8%, outpacing China's market average of 13.6%, suggest potential for recovery and alignment with industry advancements in electronic technology. Moreover, their recent share buyback initiative signals confidence in long-term value, repurchasing shares worth over CNY 62 million within six months. This proactive approach towards innovation and shareholder value could position Zhejiang Hechuan as an emerging contender in high-tech sectors if it successfully leverages its R&D investments to reverse current financial downtrends and capitalize on growing market demands.

Shanghai Suochen Information TechnologyLtd (SHSE:688507)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Suochen Information Technology Ltd. is a company with a market cap of CN¥4.84 billion, focusing on providing information technology services and solutions.

Operations: Suochen Information Technology generates revenue through its diverse range of IT services and solutions. The company's cost structure is primarily driven by operational expenses associated with delivering these services. Its financial performance shows a notable trend in net profit margin, highlighting efficiency in managing costs relative to revenue generation.

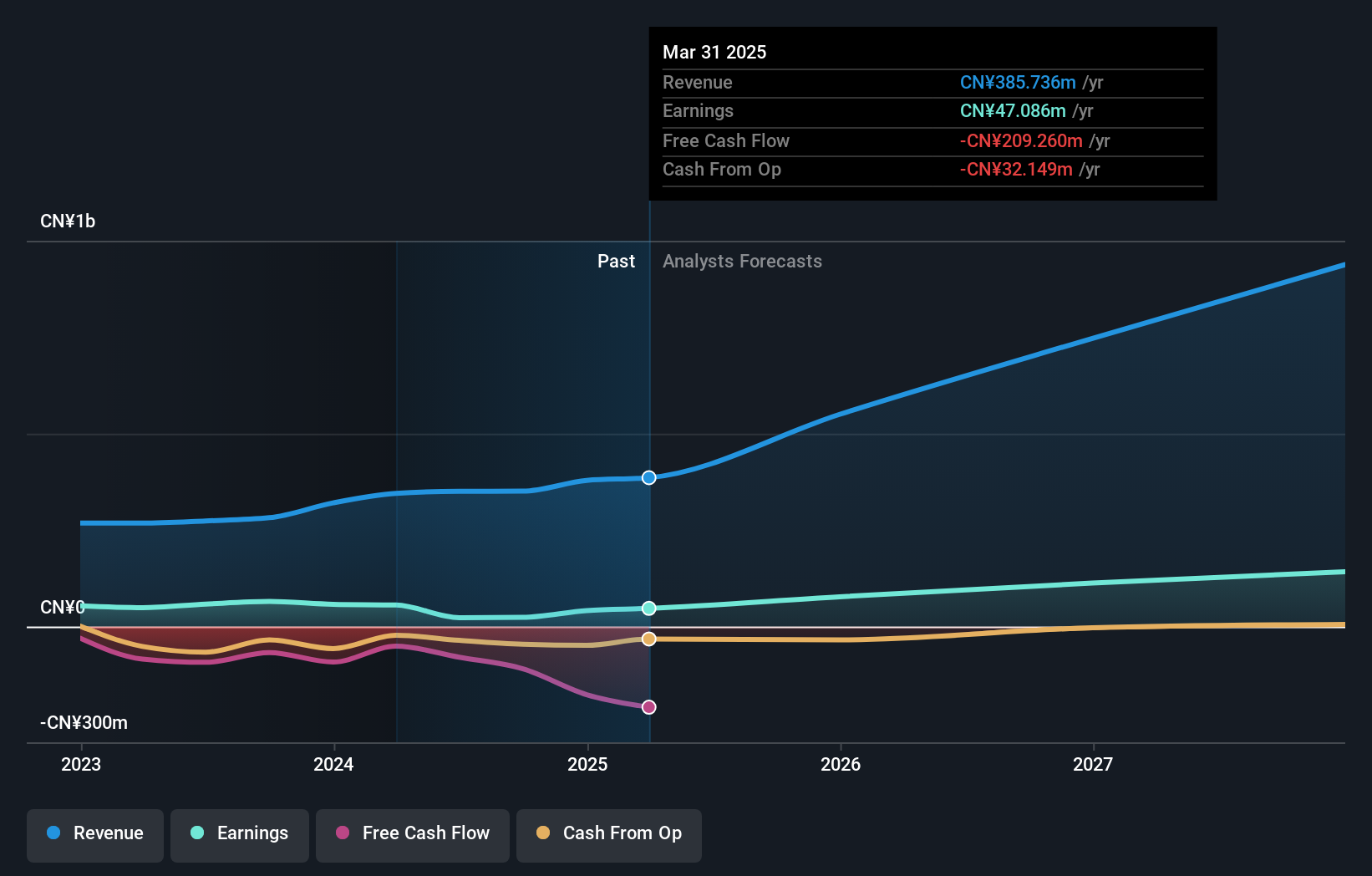

Shanghai Suochen Information TechnologyLtd. is navigating through a transformative period marked by significant financial shifts and strategic maneuvers. Despite a challenging backdrop with a net loss widening to CNY 70.65 million from CNY 37.13 million year-over-year, the company's revenue surged by 58% to CNY 82.85 million, signaling robust market demand for its offerings. This growth trajectory is underscored by an aggressive R&D investment strategy, which not only reflects the firm's commitment to innovation but also aligns with broader industry trends towards enhanced digital solutions. Moreover, the recent completion of a share buyback program totaling CNY 45.93 million exemplifies confidence in future prospects and shareholder value enhancement amidst market volatility and competitive pressures.

Digiwin (SZSE:300378)

Simply Wall St Growth Rating: ★★★★☆☆

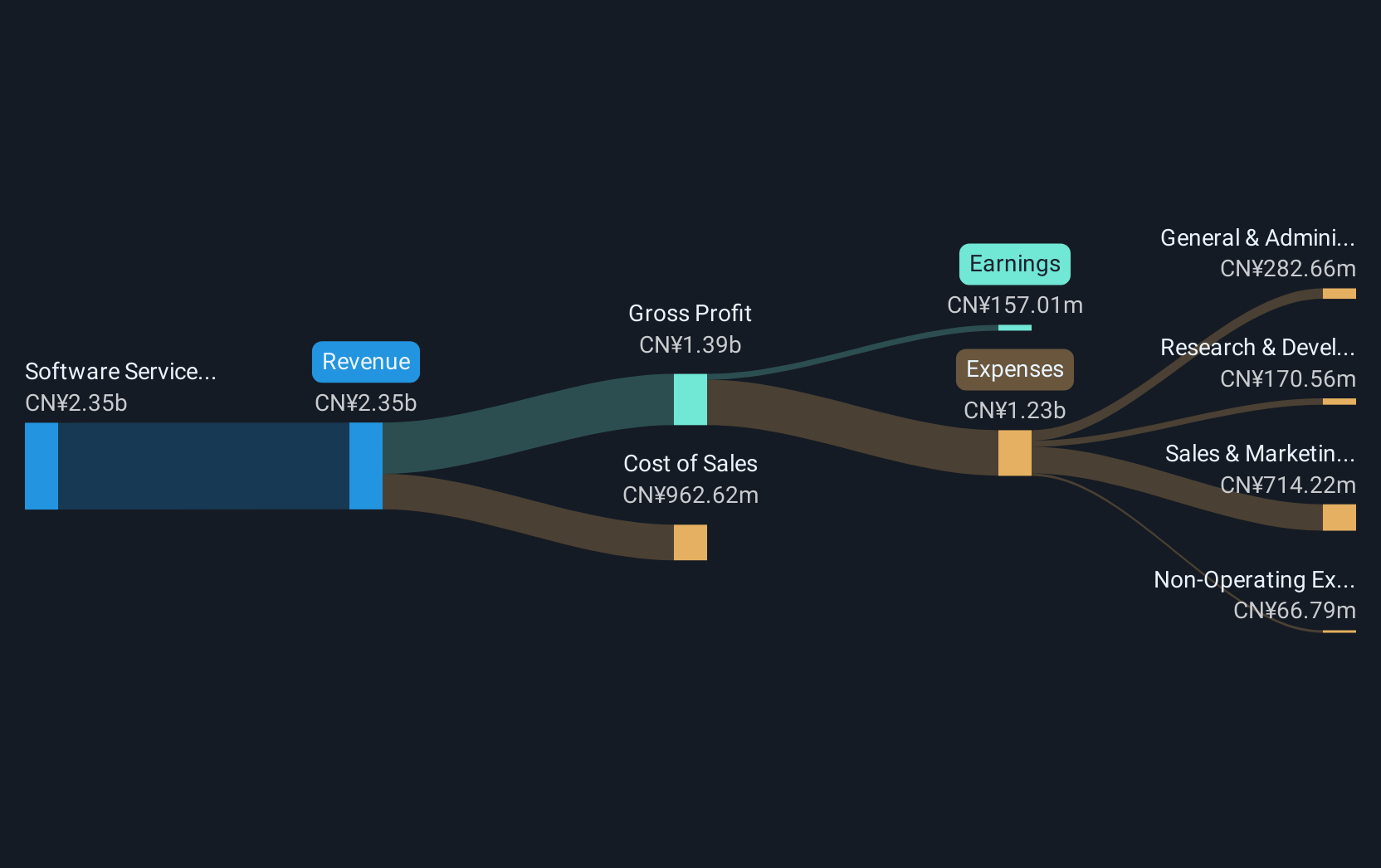

Overview: Digiwin Co., Ltd. offers industry-specific software solutions both in Mainland China and internationally, with a market cap of approximately CN¥6.98 billion.

Operations: Digiwin Co., Ltd. generates revenue primarily through its software services segment, which contributed CN¥2.39 billion. The company's focus is on providing specialized software solutions tailored to various industries across Mainland China and international markets.

Digiwin has demonstrated a solid financial performance, with revenue climbing to CNY 1.57 billion, up from CNY 1.41 billion year-over-year, a growth rate of 16.8%. This uptick is supported by earnings which also saw an increase to CNY 49.89 million from CNY 48.84 million in the same period, reflecting an earnings growth of approximately 25.4% annually. The firm's commitment to innovation is evident in its R&D efforts; however, specific figures on R&D spending were not disclosed in the recent update, highlighting a potential area for further transparency and investor insight into its future capabilities and technological advancements.

- Click here and access our complete health analysis report to understand the dynamics of Digiwin.

Examine Digiwin's past performance report to understand how it has performed in the past.

Key Takeaways

- Investigate our full lineup of 1266 High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688507

Shanghai Suochen Information TechnologyLtd

Shanghai Suochen Information Technology Co.,Ltd.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)