- South Korea

- /

- Auto Components

- /

- KOSE:A004840

Market Might Still Lack Some Conviction On DRB Holding Co., Ltd. (KRX:004840) Even After 42% Share Price Boost

DRB Holding Co., Ltd. (KRX:004840) shareholders would be excited to see that the share price has had a great month, posting a 42% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 65%.

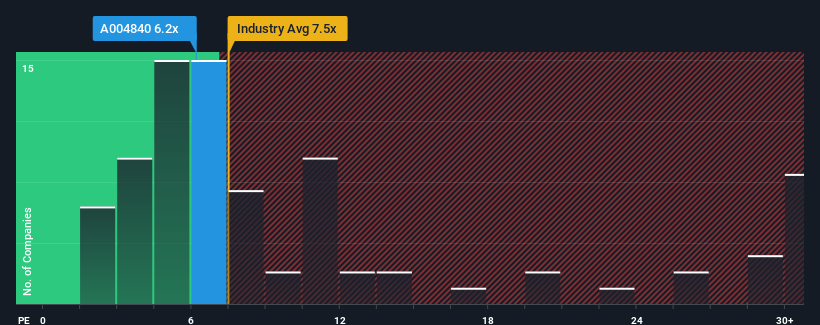

Although its price has surged higher, DRB Holding may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.2x, since almost half of all companies in Korea have P/E ratios greater than 15x and even P/E's higher than 31x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been quite advantageous for DRB Holding as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for DRB Holding

Is There Any Growth For DRB Holding?

The only time you'd be truly comfortable seeing a P/E as depressed as DRB Holding's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 414%. The latest three year period has also seen an excellent 568% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that DRB Holding is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Shares in DRB Holding are going to need a lot more upward momentum to get the company's P/E out of its slump. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of DRB Holding revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware DRB Holding is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

Of course, you might also be able to find a better stock than DRB Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A004840

DRB Holding

Engages in the manufacture and sale of vehicle sealing products, construction materials, and seismic isolation and vibration controls in South Korea and internationally.

Acceptable track record with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)