- South Korea

- /

- Auto Components

- /

- KOSDAQ:A123410

Korea Fuel-Tech Corporation's (KOSDAQ:123410) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Despite an already strong run, Korea Fuel-Tech Corporation (KOSDAQ:123410) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 83% in the last year.

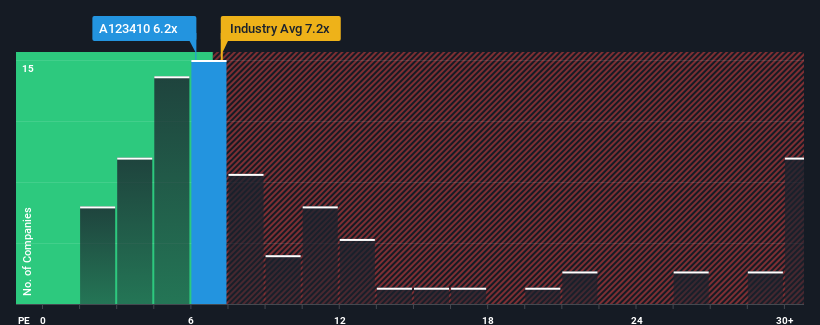

Although its price has surged higher, Korea Fuel-Tech may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.2x, since almost half of all companies in Korea have P/E ratios greater than 15x and even P/E's higher than 31x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Korea Fuel-Tech certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Korea Fuel-Tech

Is There Any Growth For Korea Fuel-Tech?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Korea Fuel-Tech's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 236%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 37% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Korea Fuel-Tech's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

Korea Fuel-Tech's recent share price jump still sees its P/E sitting firmly flat on the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Korea Fuel-Tech revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Korea Fuel-Tech that you need to take into consideration.

Of course, you might also be able to find a better stock than Korea Fuel-Tech. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Korea Fuel-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A123410

Korea Fuel-Tech

Manufactures and sells automotive fuel systems and components in South Korea and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success