- Japan

- /

- Renewable Energy

- /

- TSE:9513

How J-POWER's Investment in Perovskite Solar Start-Up Has Changed Its Investment Story (TSE:9513)

Reviewed by Sasha Jovanovic

- J-POWER recently announced an investment in the US-based perovskite solar technology start-up Active Surfaces, reinforcing its commitment to renewable energy innovation.

- This move signals heightened interest in next-generation solar solutions as J-POWER seeks to expand its clean energy portfolio through international partnerships.

- We'll look at how investing in perovskite solar technology adds a new layer to J-POWER's renewable energy investment narrative.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Electric Power Development's Investment Narrative?

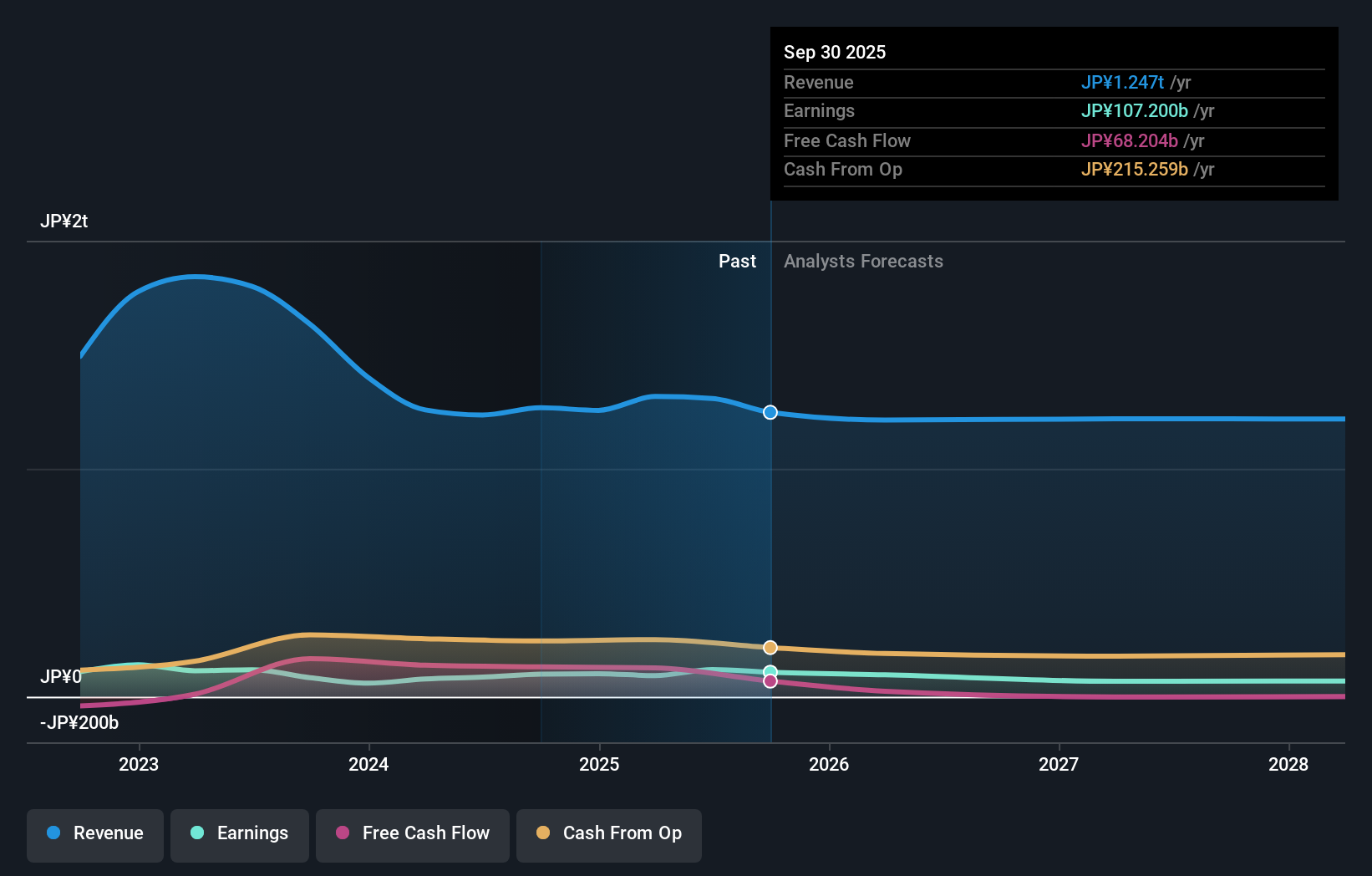

To see value in Electric Power Development (J-POWER), investors have typically believed in the strength of its recurring cash flows, attractive dividend, and disciplined approach to capital management. The company’s recent investment in perovskite solar start-up Active Surfaces marks a noteworthy pivot, adding a fresh tech-focused angle to J-POWER’s renewables ambitions and raising the profile of its international renewable portfolio. In the short term, however, the financial impact of this relatively early-stage bet is likely to be modest given J-POWER’s sizable operations, stable earnings guidance, and ongoing buyback program. Major risks remain steady and center around forecast declines in revenue and profit, as well as management’s ability to offset these trends with new growth projects. Recent stronger price momentum may reflect optimism, but near-term results will still hinge on core utilities business health and execution.

But investors should bear in mind the company’s expected earnings decline over the coming years. Electric Power Development's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Electric Power Development - why the stock might be worth 43% less than the current price!

Build Your Own Electric Power Development Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Electric Power Development research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Electric Power Development research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Electric Power Development's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Electric Power Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9513

Electric Power Development

Operates as electric utility company in Japan.

Established dividend payer with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)