As global markets navigate a landscape marked by mixed performances among major indexes and geopolitical developments, investors are paying close attention to the Federal Reserve's potential interest rate cuts and economic indicators like job growth. In such a dynamic environment, dividend stocks can offer stability through regular income, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.53% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.86% | ★★★★★★ |

Click here to see the full list of 1926 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Zhejiang Jiaxin SilkLtd (SZSE:002404)

Simply Wall St Dividend Rating: ★★★★★★

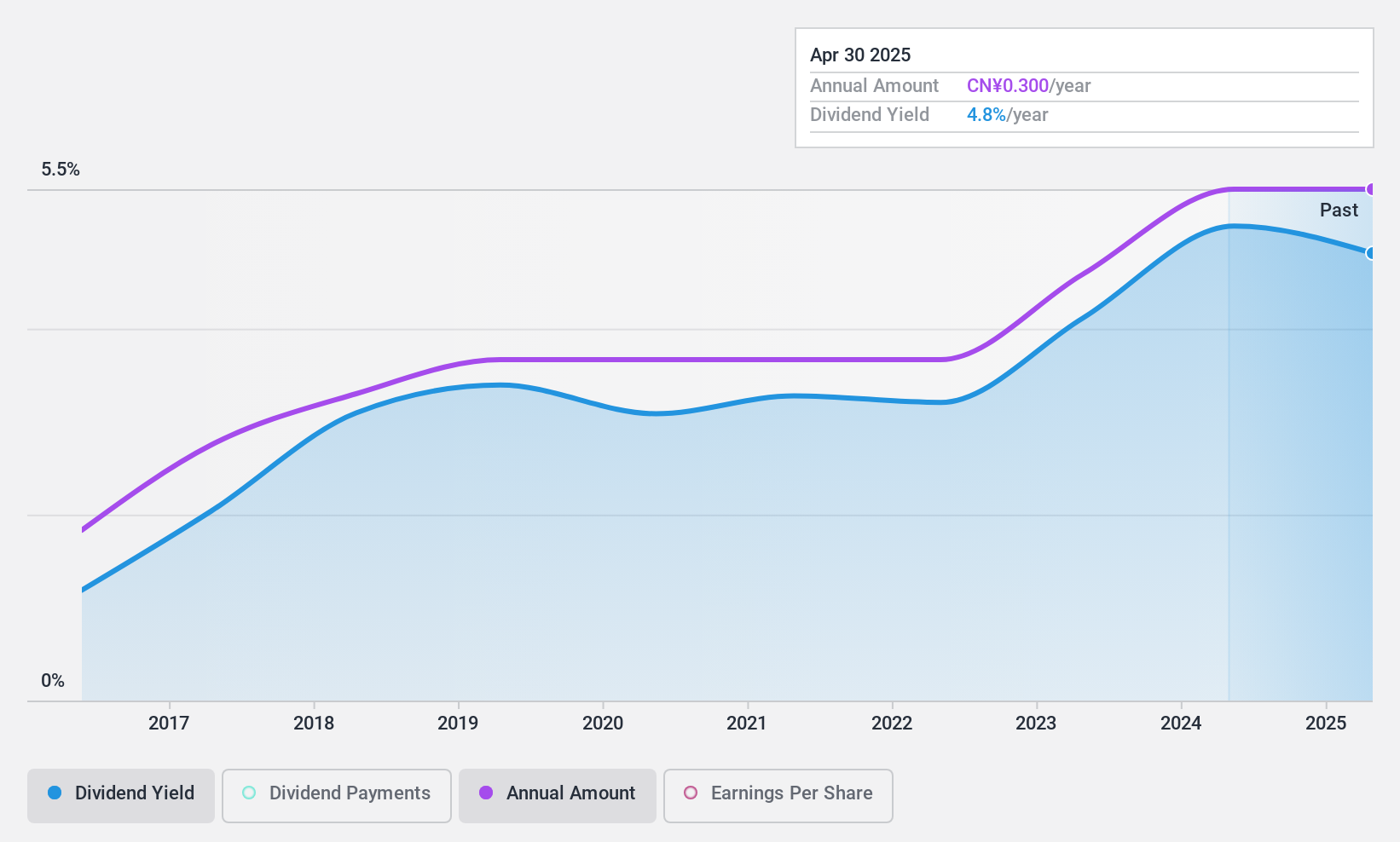

Overview: Zhejiang Jiaxin Silk Corp., Ltd. manufactures and sells silk products and has a market capitalization of CN¥3.74 billion.

Operations: Zhejiang Jiaxin Silk Corp., Ltd. generates its revenue through the manufacturing and sale of silk products.

Dividend Yield: 4.4%

Zhejiang Jiaxin Silk Ltd. has demonstrated a stable and growing dividend history over the past decade, with a current yield of 4.42%, placing it in the top tier of Chinese dividend payers. Despite recent earnings showing a decline in net income to CNY 151.86 million for the first nine months of 2024, dividends remain sustainable with an earnings payout ratio of 85.6% and cash flow coverage at 39.7%. The stock trades below its estimated fair value, enhancing its appeal to income-focused investors seeking reliable returns amidst market fluctuations.

- Click here and access our complete dividend analysis report to understand the dynamics of Zhejiang Jiaxin SilkLtd.

- Our expertly prepared valuation report Zhejiang Jiaxin SilkLtd implies its share price may be lower than expected.

NOK (TSE:7240)

Simply Wall St Dividend Rating: ★★★★☆☆

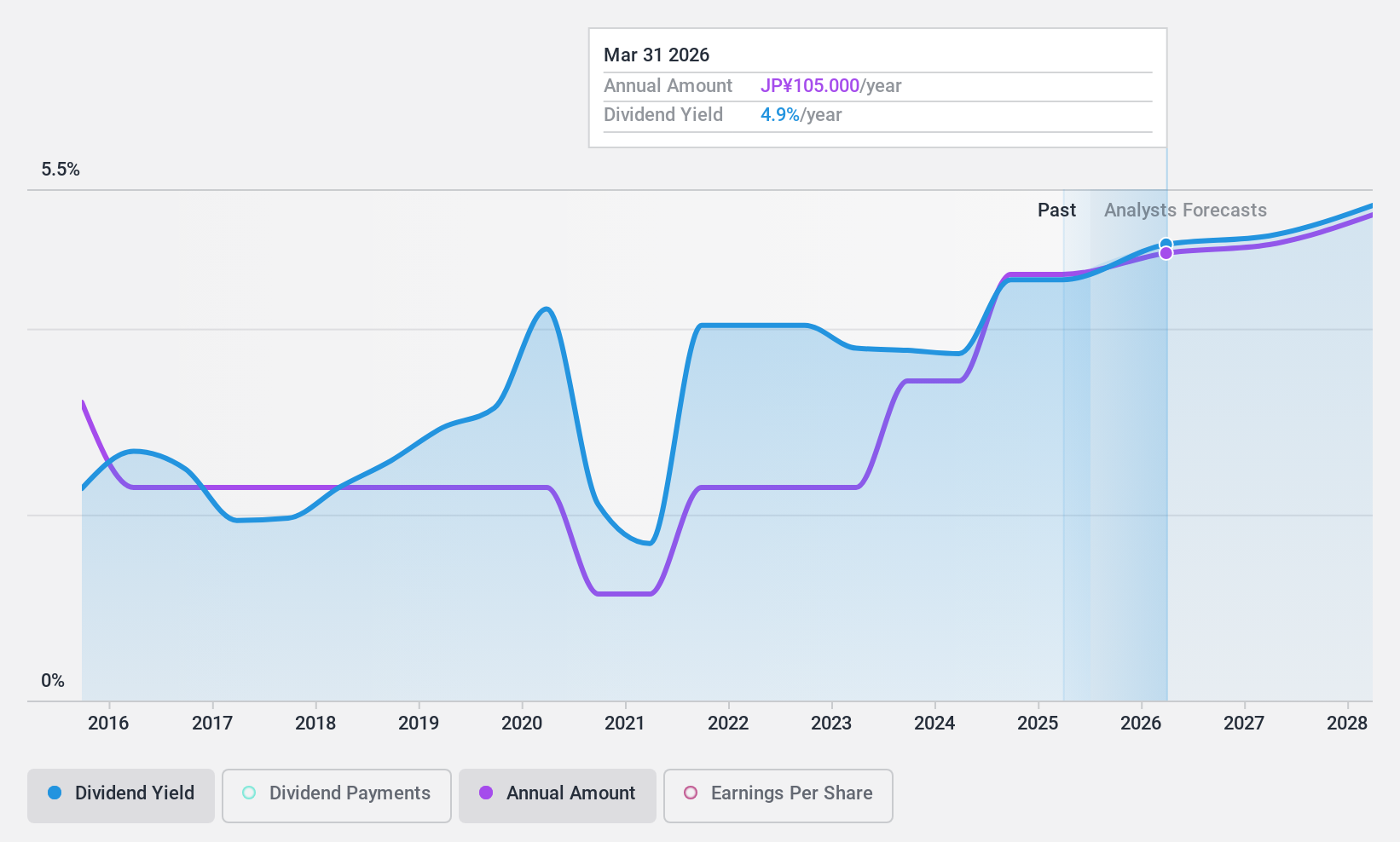

Overview: NOK Corporation is involved in the manufacturing, importing, and selling of seal products, industrial mechanical parts, hydraulic and pneumatic equipment, nuclear power equipment, synthetic chemical products, and electronic goods both in Japan and globally; it has a market cap of approximately ¥386.12 billion.

Operations: NOK Corporation generates revenue primarily from its Seal Business, which accounts for ¥362.33 billion, and its Electronic Components Business, contributing ¥396.13 billion.

Dividend Yield: 4.2%

NOK Corporation's dividend yield of 4.22% is among the top 25% in Japan, though its dividend history has been volatile over the past decade. The payout ratio of 50.1% suggests dividends are covered by earnings, yet insufficient cash flow data raises sustainability concerns. Recent share buybacks totaling ¥4.33 billion may signal management confidence but do not directly address dividend reliability issues, which remain a consideration for income-focused investors.

- Click to explore a detailed breakdown of our findings in NOK's dividend report.

- The valuation report we've compiled suggests that NOK's current price could be quite moderate.

Japan Transcity (TSE:9310)

Simply Wall St Dividend Rating: ★★★★★☆

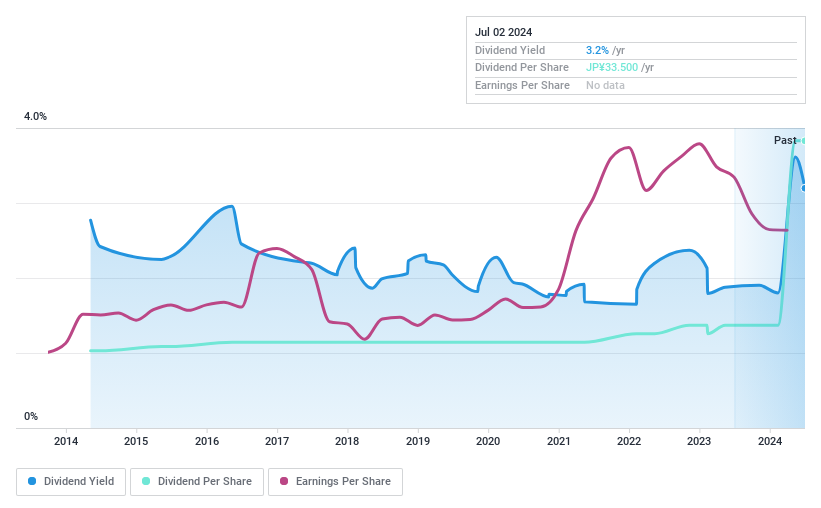

Overview: Japan Transcity Corporation operates in the logistics sector both domestically and internationally, with a market capitalization of ¥66.13 billion.

Operations: Japan Transcity Corporation's revenue segments include logistics operations both within Japan and on an international scale.

Dividend Yield: 3.4%

Japan Transcity Corporation's dividend payments have shown consistent growth over the past decade, with a recent increase to JPY 16.50 per share for Q2 2024 from JPY 6.00 a year ago. The company anticipates full-year dividends of JPY 18.00 per share, up from JPY 7.00 last year, indicating strong earnings coverage with an 8.5% payout ratio and cash flow sustainability at a cash payout ratio of 21.7%. However, its current yield of 3.36% is below Japan's top quartile dividend payers' average of 3.8%.

- Delve into the full analysis dividend report here for a deeper understanding of Japan Transcity.

- In light of our recent valuation report, it seems possible that Japan Transcity is trading beyond its estimated value.

Turning Ideas Into Actions

- Investigate our full lineup of 1926 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jiaxin SilkLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002404

Zhejiang Jiaxin SilkLtd

Research and development, production, and sales of silk products in China and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives