- Japan

- /

- Marine and Shipping

- /

- TSE:9101

Will Nippon Yusen (TSE:9101) Share Buyback Shape a New Capital Allocation Story?

Reviewed by Sasha Jovanovic

- Between July and September 2025, Nippon Yusen Kabushiki Kaisha completed its share buyback program, repurchasing 11,712,000 shares, equivalent to 2.72% of its outstanding shares, for ¥61.10 billion.

- This reduction in share count stands out as a significant measure to enhance shareholder value and could influence analysts' outlooks on the company’s capital efficiency.

- We'll explore how the successful buyback program may shape the company's investment narrative, especially regarding future earnings per share growth.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Nippon Yusen Kabushiki Kaisha Investment Narrative Recap

For shareholders of Nippon Yusen Kabushiki Kaisha, the investment case centers on confidence in management’s ability to sustain earnings amid pressure from shifting freight rates and evolving global logistics dynamics. The completed buyback program in the third quarter of 2025, while supporting short-term shareholder value, does not materially change the near-term catalyst of expected declines in freight rates or offset the ongoing risk of profit headwinds in air cargo due to business restructuring.

The company's latest earnings guidance, issued in August 2025, projects profits for the year ending March 2026 at ¥240,000 million, with earnings per share of ¥560.18. While this sets investors’ expectations, the underlying risk from structural changes, particularly the impact of air cargo partnership changes with ANA, remains at the forefront as a key issue for forward-looking valuations and business momentum.

However, investors need to be mindful that despite these capital efficiency moves, exposure to a prolonged downturn in air cargo profits could still...

Read the full narrative on Nippon Yusen Kabushiki Kaisha (it's free!)

Nippon Yusen Kabushiki Kaisha is projected to generate ¥2,409.5 billion in revenue and ¥218.4 billion in earnings by 2028. This outlook assumes a 1.7% annual decline in revenue and a decrease in earnings of ¥201.2 billion from the current ¥419.6 billion.

Uncover how Nippon Yusen Kabushiki Kaisha's forecasts yield a ¥5457 fair value, a 8% upside to its current price.

Exploring Other Perspectives

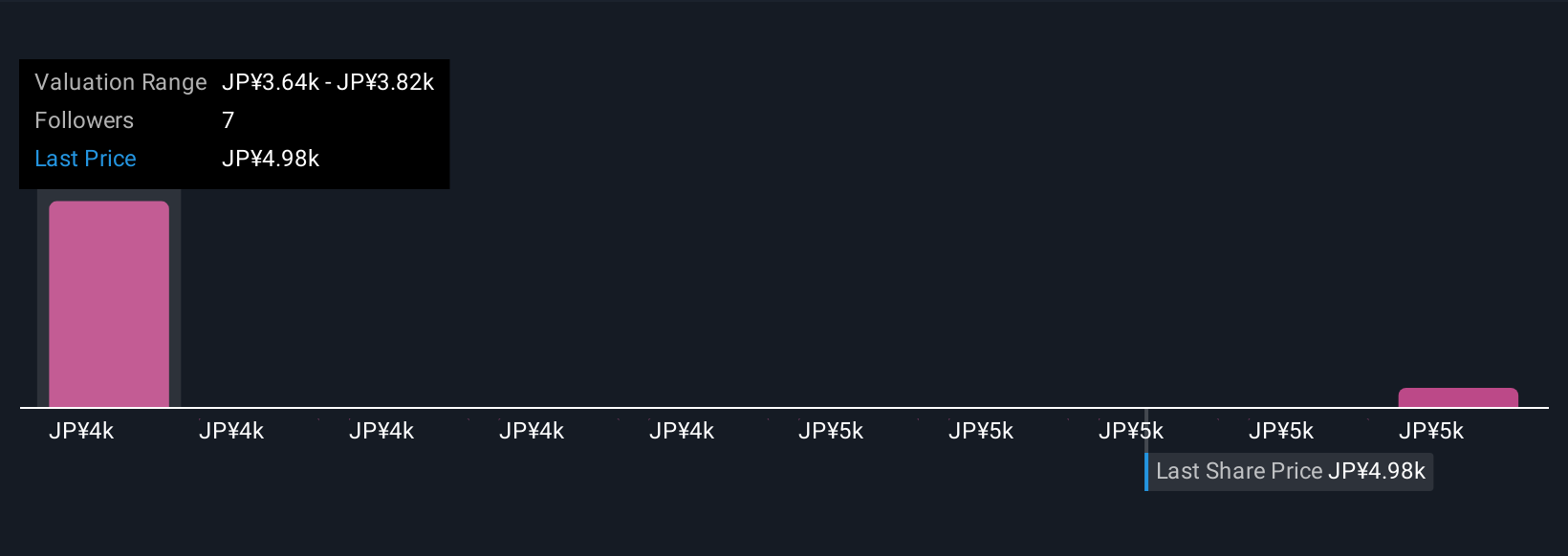

Simply Wall St Community members provided only two fair value estimates, ranging from ¥3,606 to ¥5,457 per share. While these opinions span a broad spectrum, keep in mind the anticipated fall in key segment profits could weigh on the company’s near-term outlook and shape expectations differently among market participants.

Explore 2 other fair value estimates on Nippon Yusen Kabushiki Kaisha - why the stock might be worth as much as 8% more than the current price!

Build Your Own Nippon Yusen Kabushiki Kaisha Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nippon Yusen Kabushiki Kaisha research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nippon Yusen Kabushiki Kaisha research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nippon Yusen Kabushiki Kaisha's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Yusen Kabushiki Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9101

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives