- Japan

- /

- Transportation

- /

- TSE:9022

Does Regulatory Scrutiny Reveal Deeper Compliance Challenges for Central Japan Railway (TSE:9022)?

Reviewed by Sasha Jovanovic

- Central Japan Railway Company and its subsidiary recently received draft cease and desist and surcharge payment orders from the Japan Fair Trade Commission following an on-site inspection related to suspected Antimonopoly Act violations during railway overpass inspection coordination.

- While the company's expected financial loss is minor, the regulatory response highlights the scrutiny surrounding compliance practices in essential infrastructure management.

- We'll take a closer look at how regulatory enforcement actions and compliance concerns are influencing Central Japan Railway's current investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Central Japan Railway's Investment Narrative?

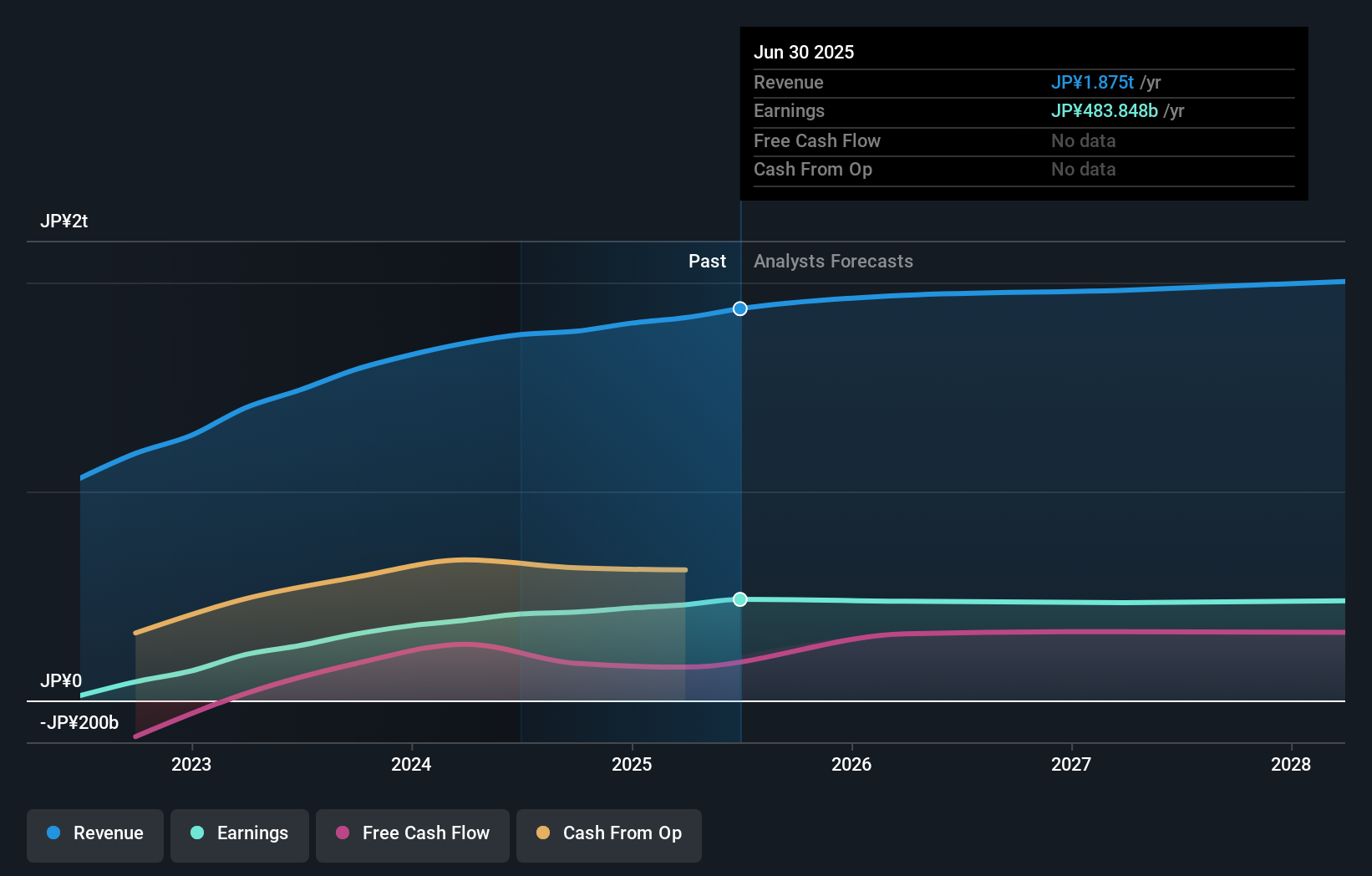

Owning Central Japan Railway often means believing in the resilience of essential infrastructure and the company’s reputation for efficient operations, visible in recent buybacks and consistent dividends. For many, the investment story has centered on continued ridership, disciplined capital management, and long-term asset value. While the latest regulatory development around the Antimonopoly Act has put a spotlight on compliance practices, the company estimates the direct financial impact will be minor, with a provision of ¥140 million against a much larger revenue base. Near-term catalysts like earnings releases, steady guidance, and capital returns remain largely intact. That said, even minor enforcement actions can sharpen regulatory risks, especially if market confidence wavers or scrutiny extends beyond current findings. Investors may find the bigger picture unchanged but should monitor any shifts in sentiment and oversight closely.

But regulatory attention can change sentiment quickly, here’s why investors should watch compliance risk. Central Japan Railway's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Central Japan Railway - why the stock might be worth less than half the current price!

Build Your Own Central Japan Railway Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Central Japan Railway research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Central Japan Railway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Central Japan Railway's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9022

Central Japan Railway

Engages in the railway and related businesses in Japan.

Proven track record and fair value.

Market Insights

Community Narratives