- Japan

- /

- Transportation

- /

- TSE:9022

Did Central Japan Railway’s ¥110 Billion Buyback Plan Just Shift (TSE:9022) Investors’ Focus on Capital Returns?

Reviewed by Sasha Jovanovic

- Earlier in 2025, Central Japan Railway Company began executing a Board-approved share repurchase program, buying back over 3 million shares as part of an authorization covering up to 48 million shares and as much as ¥110 billion through market purchases on the Tokyo Stock Exchange.

- This sizable buyback initiative underlines management’s focus on returning capital to shareholders and refining the company’s capital structure over time.

- Next, we’ll examine how this large-scale share repurchase plan shapes Central Japan Railway’s investment narrative and potential appeal to long-term investors.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Central Japan Railway's Investment Narrative?

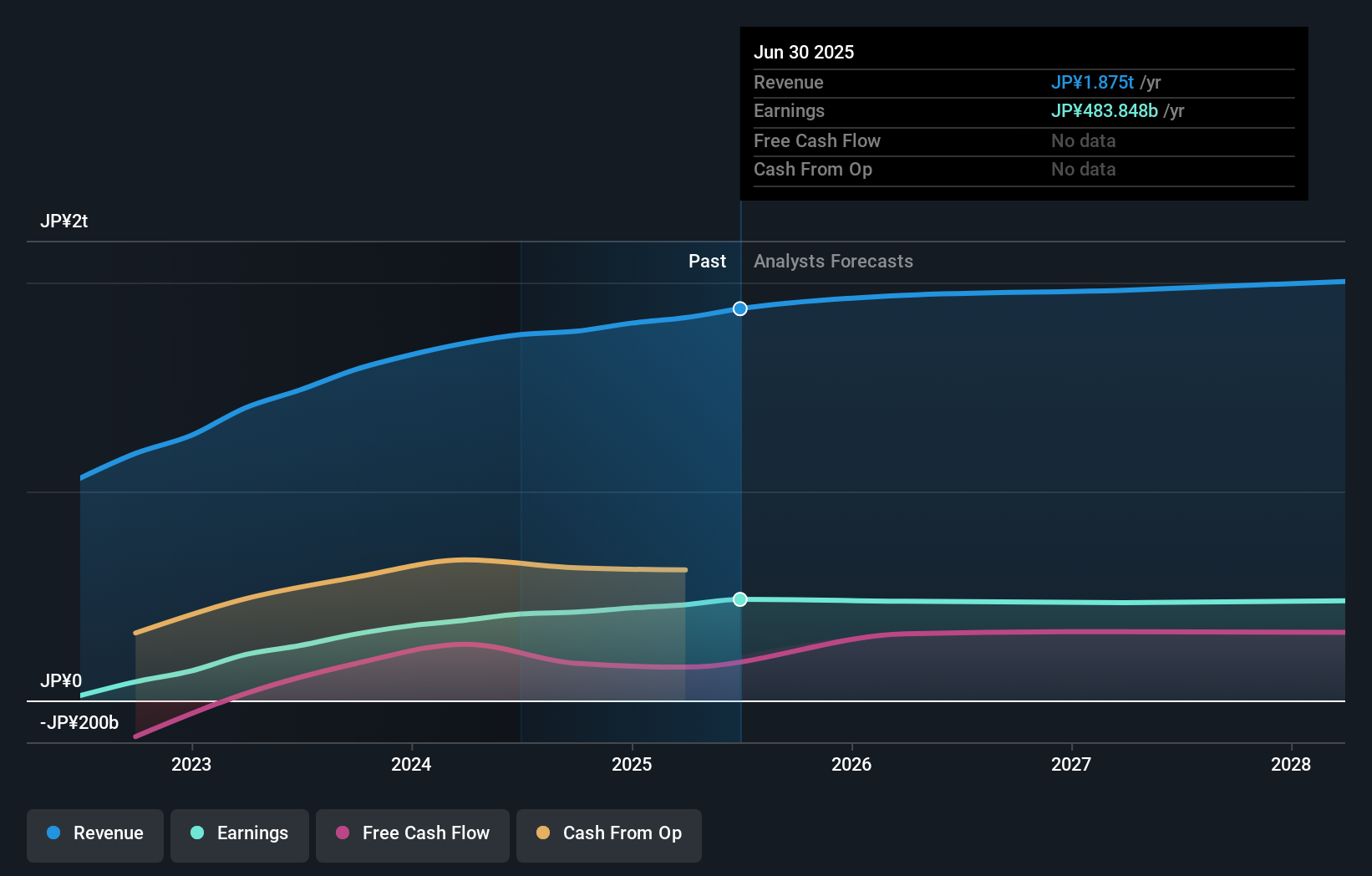

To own Central Japan Railway, you really need to believe in the resilience of its core rail business and the company’s ability to convert that stability into steady cash generation, even if analyst forecasts point to gently declining earnings over the next few years. Short-term, the key catalysts still sit around how closely results track the upgraded FY2026 guidance and whether passenger volumes and margins can support those higher profit targets. The ongoing buyback, now extended with over 3 million additional shares repurchased, reinforces the current focus on capital returns and may modestly lift earnings per share if completed at similar prices, but it does not fundamentally change the operational risks, such as relatively low forecast return on equity and limited revenue growth compared with the broader Japanese market.

However, investors should not overlook the implications of low forecast earnings growth and modest ROE. Central Japan Railway's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on Central Japan Railway - why the stock might be worth as much as ¥4332!

Build Your Own Central Japan Railway Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Central Japan Railway research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Central Japan Railway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Central Japan Railway's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9022

Central Japan Railway

Engages in the railway and related businesses in Japan.

Proven track record and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026