- Japan

- /

- Wireless Telecom

- /

- TSE:9984

Is SoftBank Group’s Stock Run Justified After Tether Funding Talks in 2025?

Reviewed by Bailey Pemberton

Wondering what to make of SoftBank Group’s soaring stock price? You’re far from alone. Whether you’ve been riding the wave or watching from the sidelines, it’s tough to ignore a return of 104.1% year to date or a striking 290.5% gain over the last three years. Sharp moves like the recent 18.4% surge in the past month inevitably get investors asking the big questions: Is the bullish momentum just getting started, or is risk increasing with every new headline?

There is certainly no shortage of stories fueling the excitement and anxiety. Fresh news about SoftBank exploring a funding round in crypto giant Tether and making ambitious AI-focused adjustments, including staffing changes at the Vision Fund, have added both optimism and uncertainty to the mix. In addition, the company’s involvement in delayed AI joint ventures highlights strategic pivots that could shape future growth or bring near-term setbacks. All of this has played into the changing risk perception, at times boosting the mood and at others making investors more cautious.

Despite the recent run-up, SoftBank’s value score comes in at only 2 out of 6 based on major valuation checks. In other words, while the company is undervalued by some metrics, there is still room for debate about whether it justifies buying in at these levels or waiting. Next, I’ll break down the key valuation methods typically used to size up a stock like SoftBank. I will also share an alternative approach to judging value by the end of this article.

SoftBank Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: SoftBank Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today using an appropriate rate. This approach helps investors determine what a business is fundamentally worth, independent of market price swings.

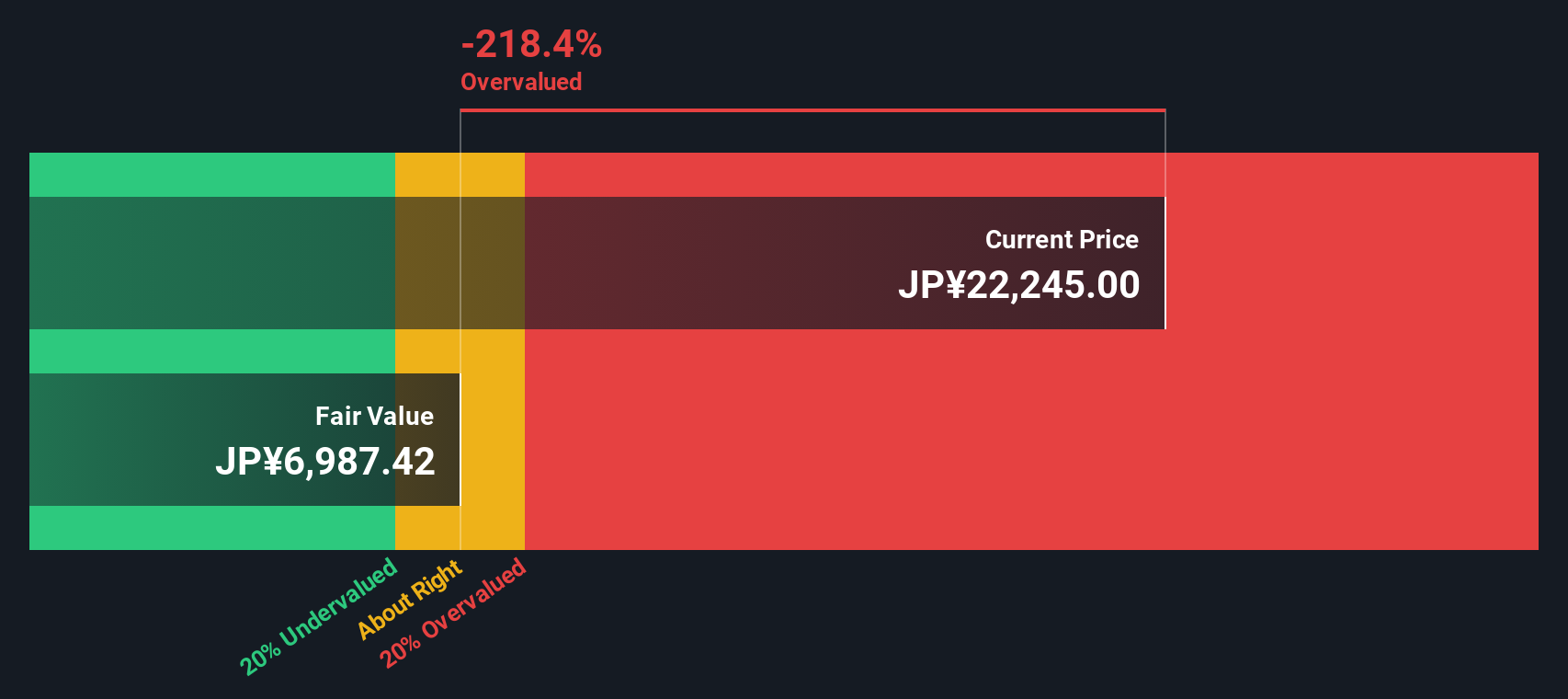

For SoftBank Group, the latest reported Free Cash Flow (FCF) was a negative ¥787 billion. While this shows the company has recently been spending more cash than it brings in, analysts expect improvement. Projections suggest FCF will turn positive, reaching ¥504 billion by fiscal year 2030. Analyst-sourced forecasts are provided for the next five years. Further projections are extrapolated by Simply Wall St and estimate stepwise increases to the end of the ten-year period.

After discounting all these projected cash flows back to the present, the DCF model arrives at an intrinsic value of ¥6,865 per share. This suggests the current price is roughly 174.5% above what these projections justify, a signal that the stock is substantially overvalued based on this method.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for SoftBank Group.

Approach 2: SoftBank Group Price vs Earnings

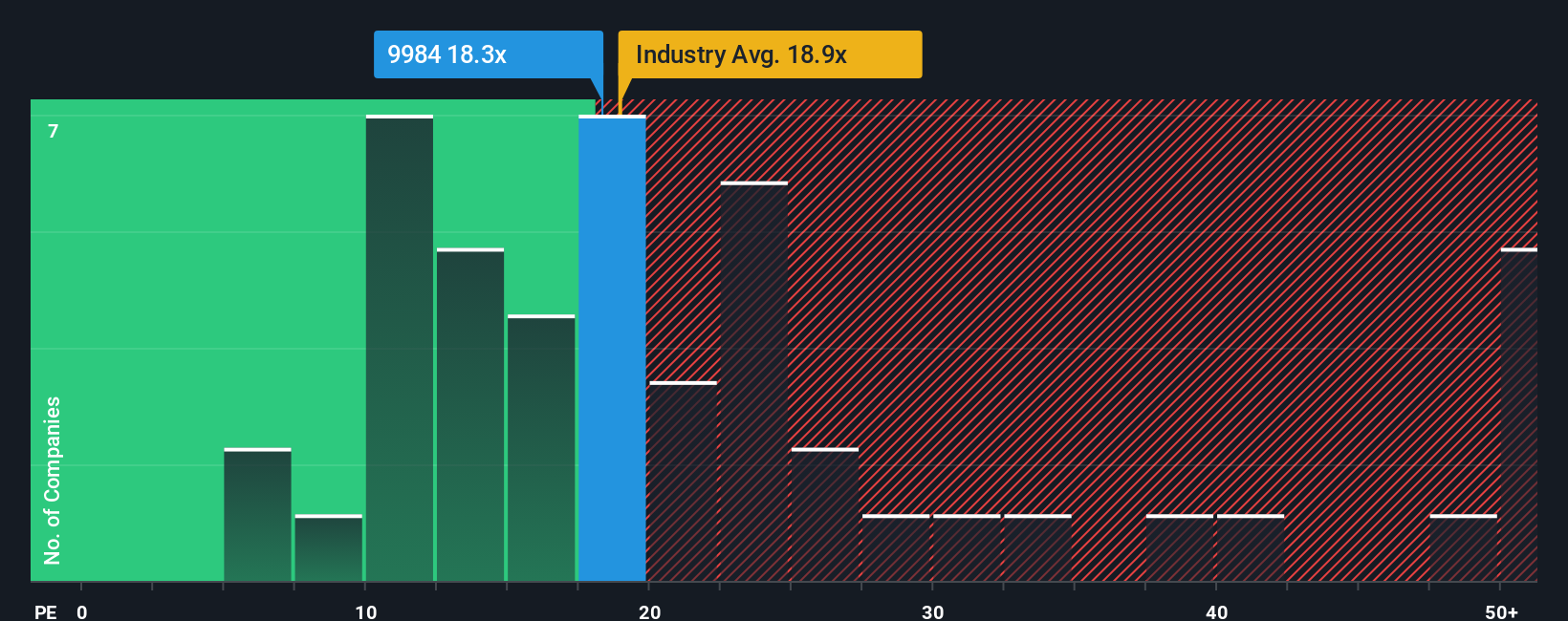

The price-to-earnings (PE) ratio is a widely used metric for valuing established, profitable companies because it directly compares a stock's price to its earnings power. It helps investors gauge how much they're paying for each yen of current profits, making it a simple yet effective starting point for valuation.

However, what counts as a “reasonable” PE ratio varies based on expectations for future growth and the level of risk investors are willing to tolerate. Higher growth and lower risk typically command a higher PE, while uncertainty or sluggish growth can drag it down. SoftBank Group currently trades at a PE of 15.5x, which is below the wireless telecom industry average of 17.7x and its peer group average of 17.1x. On the surface, this could suggest the stock is somewhat discounted compared to others in the same sector.

But rather than just comparing with industry or peers, Simply Wall St’s proprietary "Fair Ratio" incorporates SoftBank's earnings growth outlook, profit margins, sector, risks, and company size. This metric aims to pinpoint what a more accurate PE should be for this specific business. For SoftBank, the Fair Ratio is 10.8x, which is meaningfully lower than its current PE. This indicates that, even after factoring in its unique characteristics and risks, the stock is trading above what would be considered a fair valuation based on earnings.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your SoftBank Group Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story or perspective about a company, connecting why you believe in a business with what you expect for its future revenue, earnings, and margins, all the way through to a resulting fair value.

Rather than just crunching numbers, Narratives help you tie together the “why” and “how much,” grounding forecasts and valuation in your unique view of the company’s future. On Simply Wall St’s Community page, used by millions of investors, you can easily create, share, or follow these dynamic Narratives and see how the story evolves with every new report or headline.

Narratives make it easier to decide whether to buy or sell: by comparing your calculated Fair Value against today’s price, you instantly see if your story tells you to act or to wait. Plus, since Narratives update automatically as new earnings, forecasts, or news arrive, your investment perspective stays relevant without extra work.

For instance, some investors see SoftBank Group’s future fair value topping ¥20,000, driven by AI and tech IPO optimism, while others set it closer to ¥9,400, focusing on risks like high leverage or regulatory changes. This shows exactly how Narratives help you invest with confidence, your way.

Do you think there's more to the story for SoftBank Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9984

SoftBank Group

Provides telecommunication services in Japan and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives