- Japan

- /

- Wireless Telecom

- /

- TSE:9436

Top Dividend Stocks On The Japanese Exchange To Boost Your Income

Reviewed by Simply Wall St

As Japan's stock markets experience significant fluctuations, with the Nikkei 225 Index and TOPIX Index both seeing notable declines, investors are increasingly seeking stable income sources. In such a volatile environment, dividend stocks can offer a reliable stream of income while potentially providing some cushion against market turbulence.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.41% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.13% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.08% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.21% | ★★★★★★ |

| Nippon Shokubai (TSE:4114) | 4.59% | ★★★★★★ |

| Seibu Electric & Machinery (TSE:6144) | 4.73% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.84% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Innotech (TSE:9880) | 5.00% | ★★★★★★ |

Click here to see the full list of 479 stocks from our Top Japanese Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

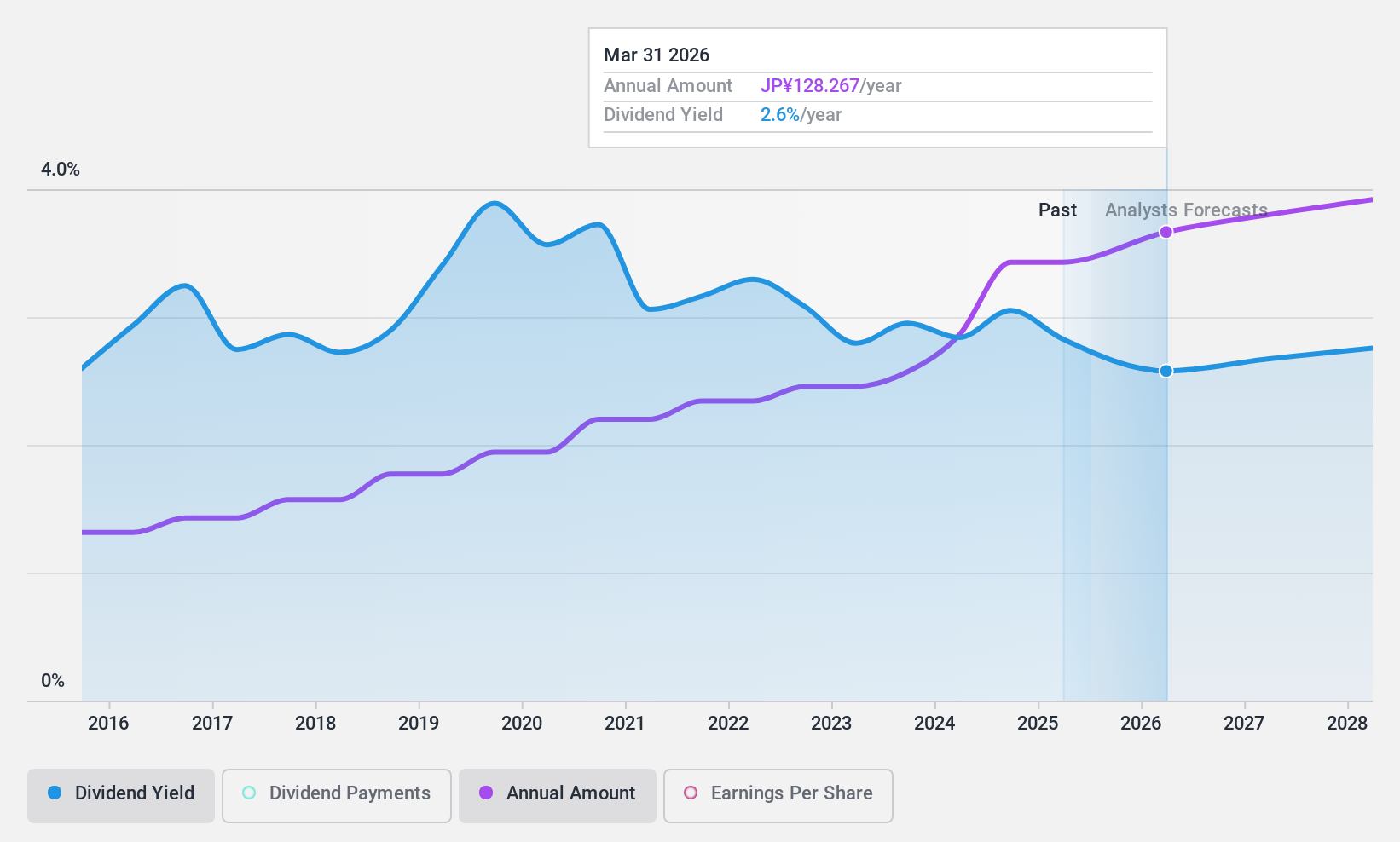

Yamazen (TSE:8051)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yamazen Corporation operates globally, offering production equipment, housing equipment/materials, and home products with a market cap of ¥135.78 billion.

Operations: Yamazen Corporation generates revenue from three main segments: ¥71.84 billion from Consumer Goods - Housing, ¥101.12 billion from Consumer Goods - Home Equipment, and ¥328.66 billion from Production Goods Related Business.

Dividend Yield: 3.3%

Yamazen's dividend payments have been volatile and unreliable over the past decade, with a payout ratio of 68.5% covered by earnings and a cash payout ratio of 51.4%. Despite lower profit margins this year (1.3%) compared to last year (2.4%), dividends remain sustainable due to adequate coverage by cash flows. The company recently completed a share buyback worth ¥978.68 million, part of a larger program aimed at enhancing capital efficiency and shareholder returns.

- Click here and access our complete dividend analysis report to understand the dynamics of Yamazen.

- Insights from our recent valuation report point to the potential overvaluation of Yamazen shares in the market.

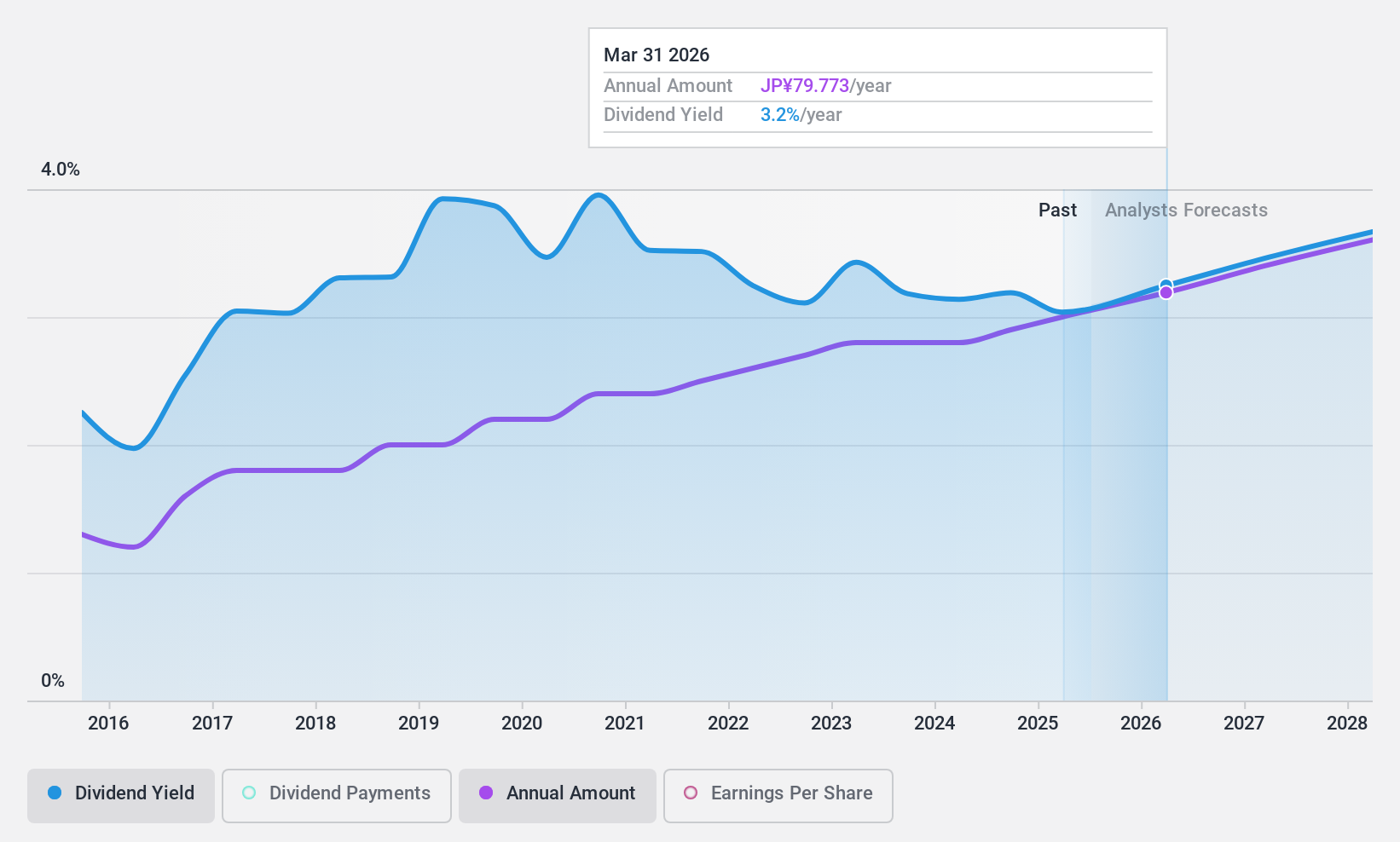

KDDI (TSE:9433)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KDDI Corporation provides telecommunications services both in Japan and internationally, with a market cap of ¥9.54 trillion.

Operations: KDDI Corporation's revenue segments include Personal at ¥4.75 billion and Business at ¥1.32 billion.

Dividend Yield: 3.2%

KDDI's dividend payments have grown over the past decade but have been volatile and unreliable. With a payout ratio of 46.1%, dividends are well covered by earnings, and a low cash payout ratio of 19.7% ensures coverage by cash flows. Trading at 39.6% below estimated fair value, KDDI offers good relative value compared to peers despite its lower dividend yield (3.16%). Recent strategic alliances aim to enhance infrastructure efficiency amid Japan's declining population.

- Take a closer look at KDDI's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that KDDI is priced lower than what may be justified by its financials.

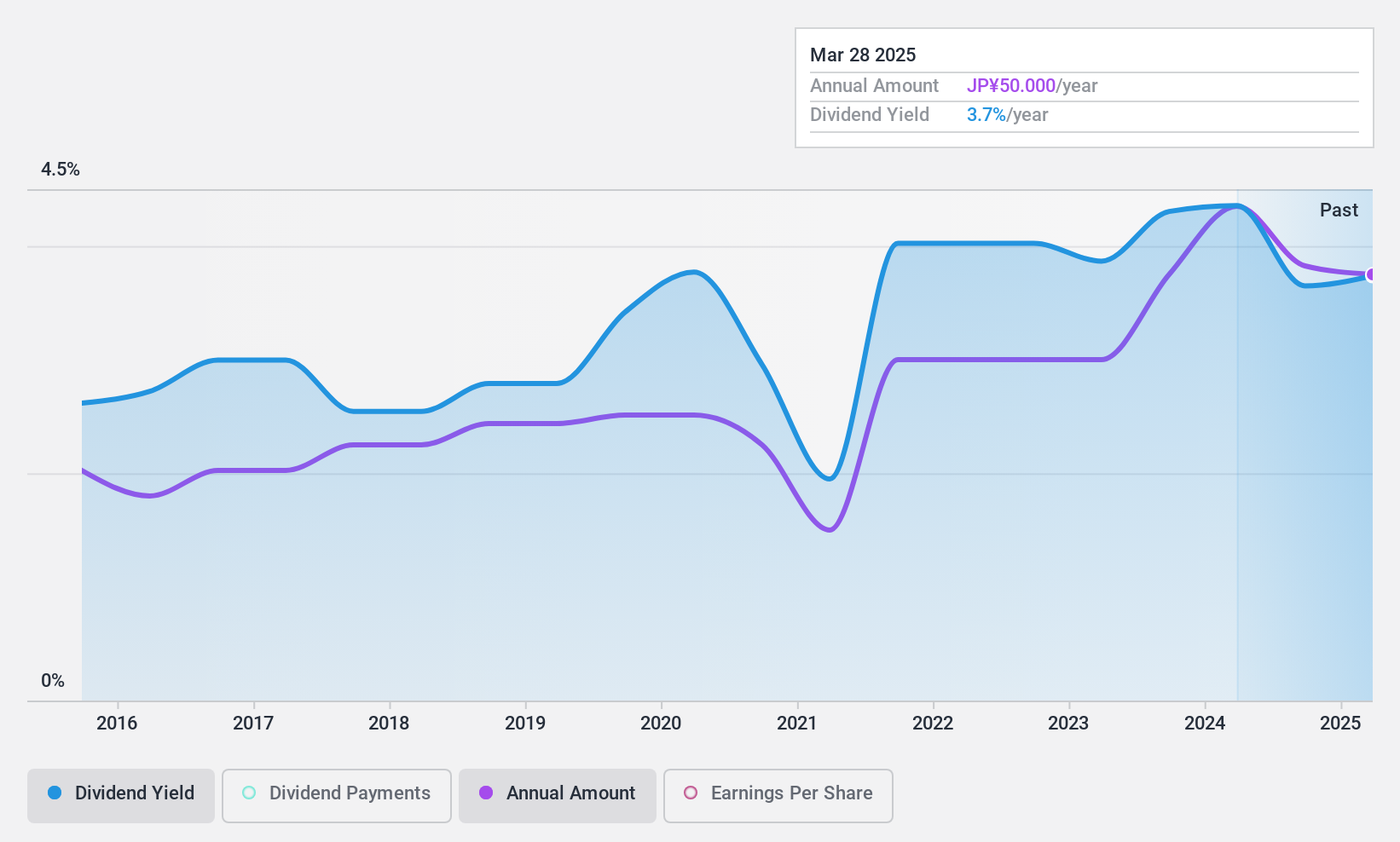

Okinawa Cellular Telephone (TSE:9436)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Okinawa Cellular Telephone Company provides telecommunication and mobile phone services in Japan, with a market cap of ¥192.14 billion.

Operations: Okinawa Cellular Telephone Company generates revenue primarily from its telecommunications business, which amounted to ¥79.30 billion.

Dividend Yield: 3%

Okinawa Cellular Telephone offers a stable dividend yield of 3.01%, with dividends well-covered by earnings (45.3% payout ratio) and cash flows (86.3% cash payout ratio). The company has consistently increased its dividend over the past decade, reflecting reliable performance. Recent share buybacks totaling ¥491.35 million enhance shareholder returns and capital efficiency, aligning with their strategy to maintain robust dividends while trading at 32.6% below fair value estimates.

- Get an in-depth perspective on Okinawa Cellular Telephone's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Okinawa Cellular Telephone shares in the market.

Taking Advantage

- Take a closer look at our Top Japanese Dividend Stocks list of 479 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9436

Okinawa Cellular Telephone

Provides telecommunication and mobile phone services in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives