- Japan

- /

- Telecom Services and Carriers

- /

- TSE:9418

U-NEXT (TSE:9418) Valuation in Focus After Rakuten Mobile Bundled Service Launch Announcement

Reviewed by Kshitija Bhandaru

U-NEXT HOLDINGS Ltd (TSE:9418) has teamed up with Rakuten Mobile to roll out a combined mobile and content streaming package. The goal is to make its offerings more appealing and tackle subscriber churn. The company’s new MVNO service launches next month.

See our latest analysis for U-NEXT HOLDINGSLtd.

Shares of U-NEXT HOLDINGS have seen strong momentum this year, with a 22.8% year-to-date share price return and an impressive three-year total shareholder return of 220%. Recent product launches, including the Rakuten Mobile partnership, appear to be fueling optimism as investors weigh both growth opportunities and efforts to boost subscriber retention.

If this strategic move in mobile and streaming caught your attention, now could be a smart time to broaden your search and discover fast growing stocks with high insider ownership

With U-NEXT HOLDINGS posting impressive returns and expanding its reach through new bundled services, investors now face a key question: Is the current share price leaving room for upside, or has anticipated growth already been factored in?

Price-to-Earnings of 23.5x: Is it justified?

At ¥2,075 per share, U-NEXT HOLDINGS is currently trading at a price-to-earnings (P/E) ratio of 23.5x, a premium both to peers and the sector. This points to investor optimism but raises the question whether earnings growth can support these elevated expectations.

The P/E ratio is a widely used metric that compares the company's current share price to its earnings per share, offering a quick view of how much the market is willing to pay for each ¥1 of earnings. In sectors like telecom, a higher P/E may reflect anticipated growth or a quality market position. However, it can also signal overvaluation if growth fails to materialize.

For U-NEXT HOLDINGS, the P/E ratio of 23.5x stands well above both the Asian Telecom industry average (16.9x) and its immediate peer group (16.7x), suggesting the market is pricing in stronger earnings momentum than is typical. In comparison, a fair value P/E based on broader market models is markedly lower, at 19.2x, flagging a possible pullback if expectations do not match reality.

Explore the SWS fair ratio for U-NEXT HOLDINGSLtd

Result: Price-to-Earnings of 23.5x (OVERVALUED)

However, persistent earnings volatility or a slowdown in revenue growth could undermine the current optimism that is reflected in U-NEXT HOLDINGS’s valuation multiples.

Find out about the key risks to this U-NEXT HOLDINGSLtd narrative.

Another View: What Does the SWS DCF Model Say?

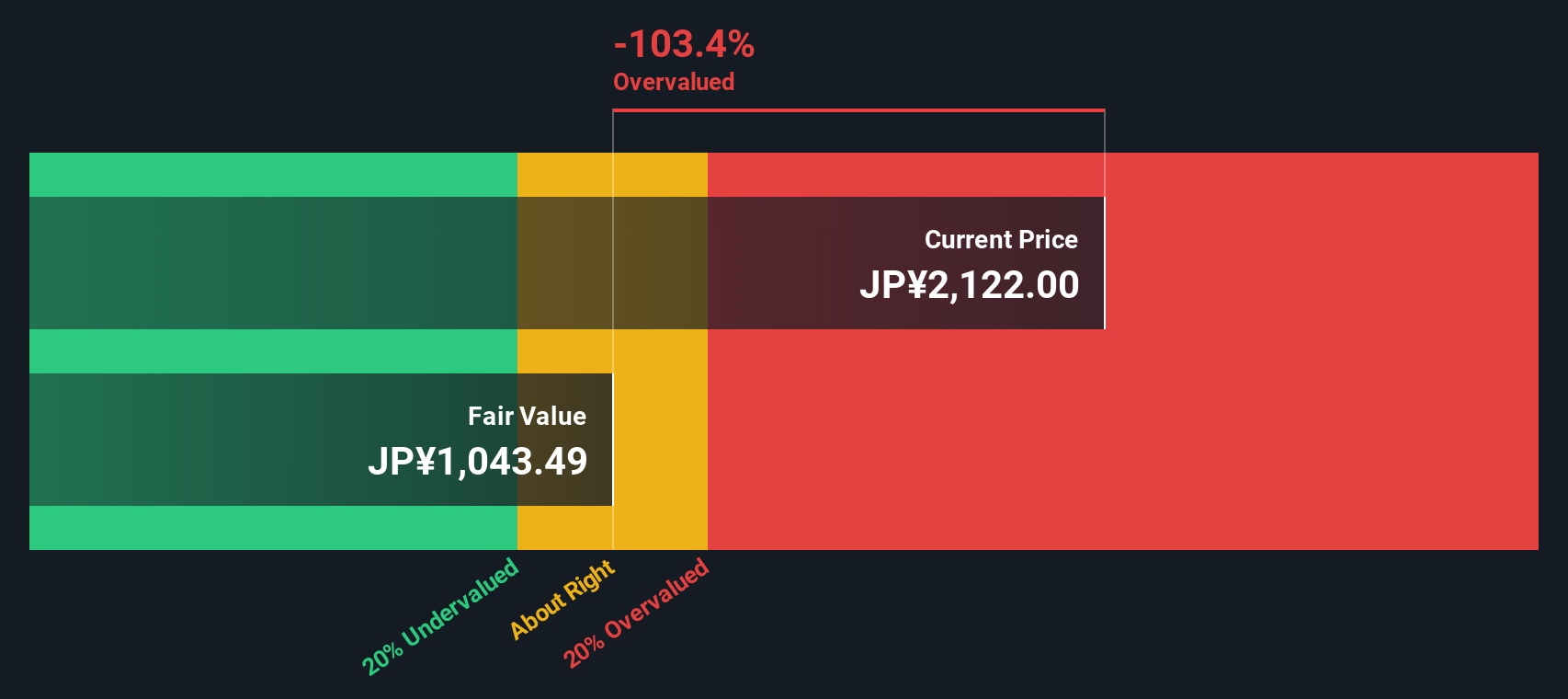

Looking at the SWS DCF model, U-NEXT HOLDINGS is valued at ¥1,043.49 per share, which is noticeably below the current market price. This suggests the stock may be overvalued if you rely on cash flow forecasts rather than earnings multiples. Does this challenge the upbeat outlook investors have priced in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out U-NEXT HOLDINGSLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own U-NEXT HOLDINGSLtd Narrative

If you want to reach your own conclusion or dig deeper into the numbers, it only takes a few minutes to create your personal narrative. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding U-NEXT HOLDINGSLtd.

Looking for more investment ideas?

Smart investing means staying ahead of the curve. You could miss rare opportunities if you overlook what’s working for others using these powerful ideas:

- Secure your future income by targeting standout companies with sustainable payouts in these 19 dividend stocks with yields > 3%, benefitting from yields over 3%.

- Jumpstart your portfolio’s innovation edge by seizing opportunities among these 24 AI penny stocks, where artificial intelligence is driving rapid growth.

- Capitalize on market inefficiencies by finding stocks priced below their fair value with these 898 undervalued stocks based on cash flows, and position yourself for upside others may miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9418

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives