- Japan

- /

- Electronic Equipment and Components

- /

- TSE:9913

3 High-Quality Dividend Stocks Yielding Up To 4.7%

Reviewed by Simply Wall St

As global markets experience a boost from cooling inflation and robust bank earnings, investors are increasingly seeking stable returns amid economic uncertainty. In this climate, high-quality dividend stocks stand out as attractive options for income generation, offering potential stability and consistent payouts even when market conditions fluctuate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.50% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.02% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

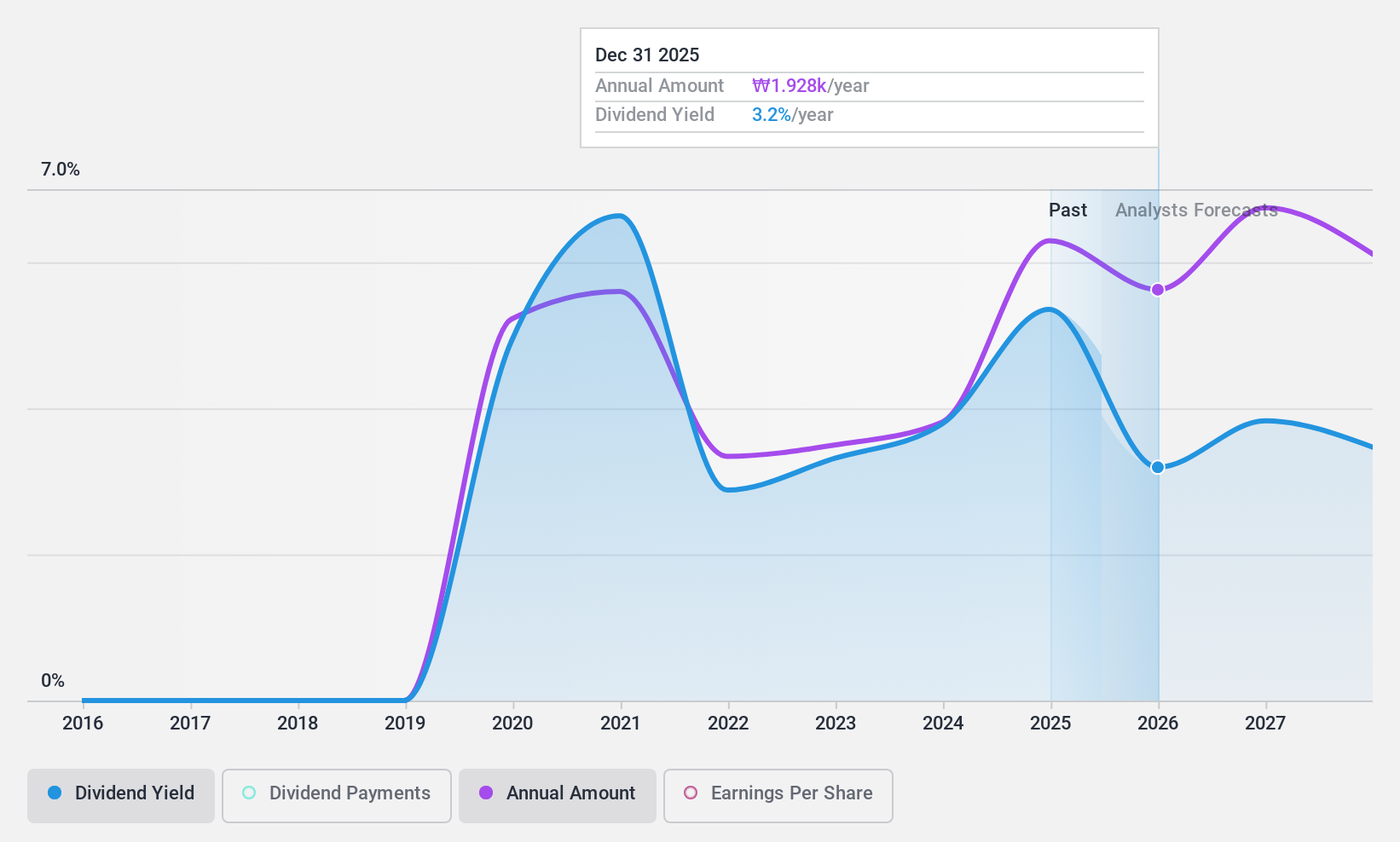

KEPCO Plant Service & EngineeringLtd (KOSE:A051600)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KEPCO Plant Service & Engineering Co., Ltd. operates in the maintenance and engineering services sector, focusing on power plants, with a market cap of ₩2.06 trillion.

Operations: KEPCO Plant Service & Engineering Co., Ltd. generates its revenue from business services amounting to ₩1.57 trillion.

Dividend Yield: 4.7%

KEPCO Plant Service & Engineering Ltd. offers a dividend yield in the top 25% of the Korean market, supported by a reasonable payout ratio of 53% and a cash payout ratio of 35.1%, indicating sustainability from earnings and cash flows. Despite recent earnings growth, its dividend history is volatile with only five years of payments, making reliability a concern for some investors seeking stable income sources. Recent financial results show robust sales and net income growth year-over-year.

- Unlock comprehensive insights into our analysis of KEPCO Plant Service & EngineeringLtd stock in this dividend report.

- In light of our recent valuation report, it seems possible that KEPCO Plant Service & EngineeringLtd is trading behind its estimated value.

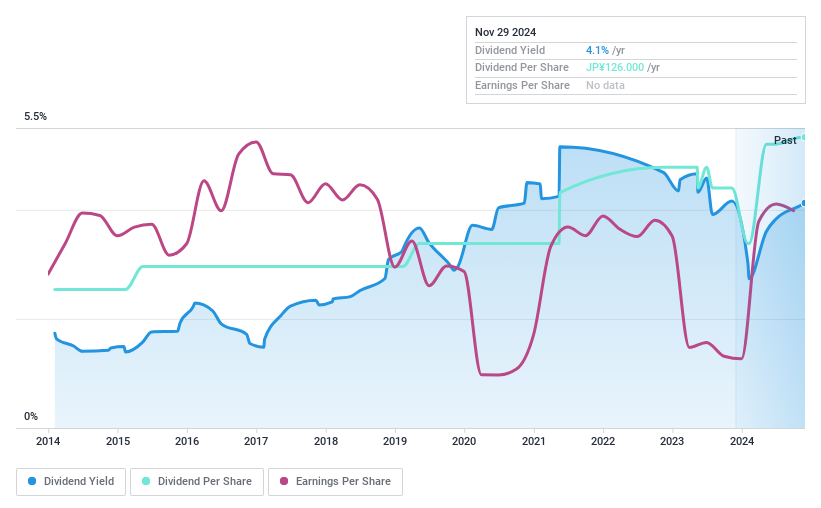

Nanto Bank (TSE:8367)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Nanto Bank, Ltd. operates in Japan through its subsidiaries, offering services in banking, securities, leasing, and credit guarantee businesses with a market cap of approximately ¥100.97 billion.

Operations: The Nanto Bank, Ltd. generates revenue primarily from its Banking and Securities segment at ¥83.90 billion and its Leasing Business at ¥11.34 billion.

Dividend Yield: 3.9%

Nanto Bank's dividend yield ranks in the top 25% of the Japanese market, with a low payout ratio of 25.1%, suggesting dividends are well covered by earnings. However, its dividend history has been volatile and unreliable over the past decade. Recent guidance indicates a decrease in year-end dividends to ¥63 per share from ¥74 last year, despite strong earnings growth of 201.9%. The bank trades significantly below estimated fair value, presenting potential value opportunities for investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Nanto Bank.

- Our comprehensive valuation report raises the possibility that Nanto Bank is priced lower than what may be justified by its financials.

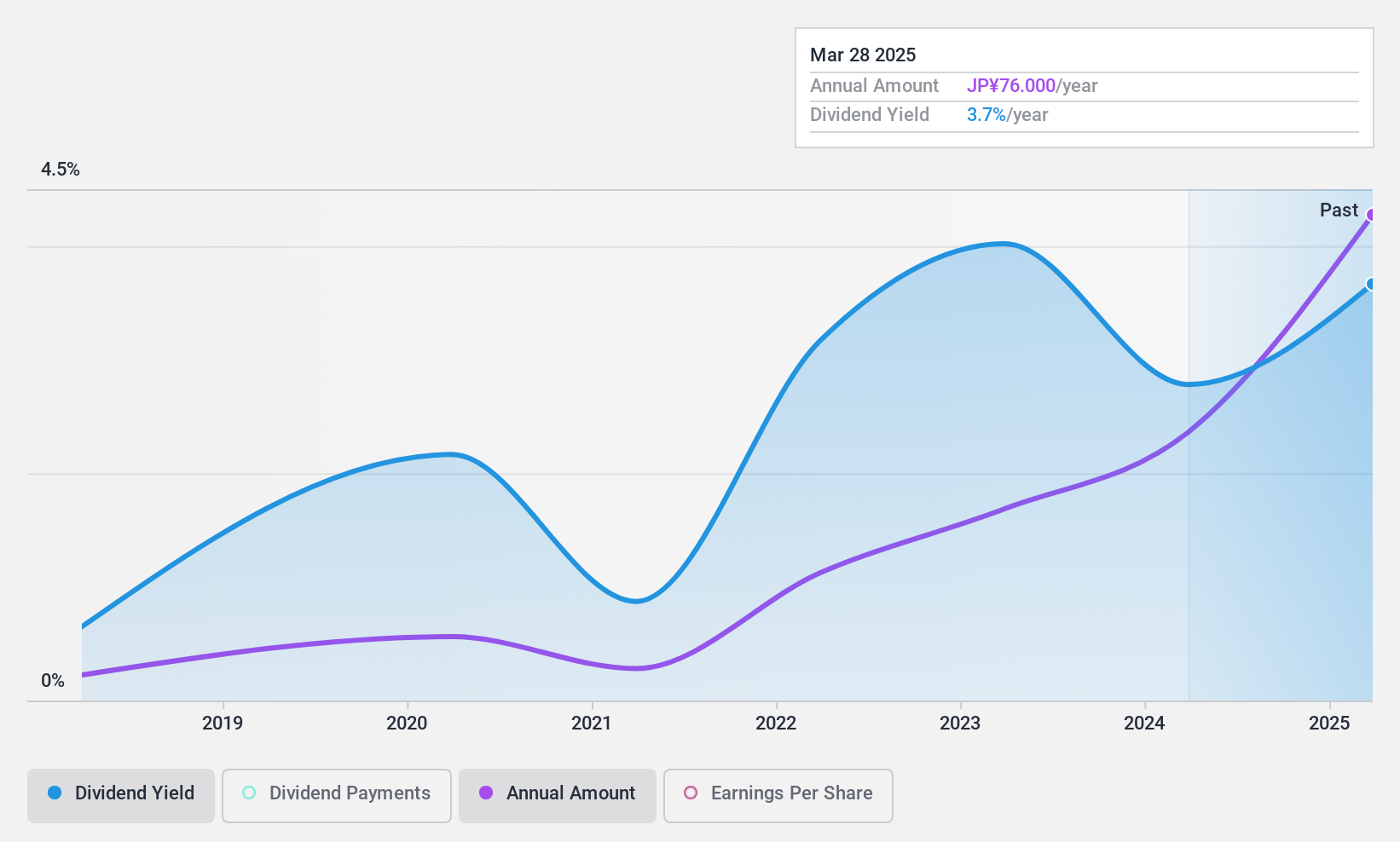

Nippo (TSE:9913)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippo Ltd., along with its subsidiaries, is engaged in the manufacturing and trading of industrial materials and plastic molded products both in Japan and internationally, with a market cap of ¥19.48 billion.

Operations: Nippo Ltd.'s revenue is primarily derived from its Electronics segment at ¥20.52 billion, followed by Mobility at ¥16.69 billion, and Medical Care Precision Mechanical Equipment at ¥6.80 billion.

Dividend Yield: 3.5%

Nippo's dividend yield is lower than the top 25% of Japanese payers, and its history shows volatility with drops over 20% annually in the past decade. Despite this, dividends are covered by earnings and cash flows with payout ratios of 48.4% and 53.5%, respectively. While payments have grown over ten years, their unreliability may concern investors seeking stable income sources from dividends.

- Get an in-depth perspective on Nippo's performance by reading our dividend report here.

- Our expertly prepared valuation report Nippo implies its share price may be too high.

Taking Advantage

- Unlock our comprehensive list of 1983 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9913

Nippo

Manufactures and trades in industrial materials and plastic molded product in Japan and internationally.

Flawless balance sheet average dividend payer.