- Japan

- /

- Electrical

- /

- TSE:6652

January 2025's Top Stock Selections Possibly Priced Below Fair Value

Reviewed by Simply Wall St

As January 2025 unfolds, global markets are experiencing a period of optimism driven by easing core U.S. inflation and robust bank earnings, propelling major stock indices higher. In this environment, value stocks have notably outperformed growth shares, particularly in the energy and financial sectors. Identifying undervalued stocks during such times can be beneficial for investors seeking opportunities that may be priced below their intrinsic worth, especially when market conditions suggest potential for future growth or stability.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY38.94 | TRY77.88 | 50% |

| Aidma Holdings (TSE:7373) | ¥1810.00 | ¥3616.14 | 49.9% |

| Tabuk Cement (SASE:3090) | SAR13.46 | SAR26.85 | 49.9% |

| Fevertree Drinks (AIM:FEVR) | £6.595 | £13.12 | 49.7% |

| World Fitness Services (TWSE:2762) | NT$92.60 | NT$183.67 | 49.6% |

| CYND (TSE:4256) | ¥1055.00 | ¥2100.49 | 49.8% |

| Mentice (OM:MNTC) | SEK25.10 | SEK49.91 | 49.7% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥14.00 | CN¥27.77 | 49.6% |

| Verra Mobility (NasdaqCM:VRRM) | US$26.08 | US$52.02 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5879.00 | ¥11701.41 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

United Company RUSAL International (SEHK:486)

Overview: United Company RUSAL International Public Joint-Stock Company is involved in the production and trading of aluminium and related products in Russia, with a market cap of approximately HK$48.87 billion.

Operations: The company's revenue primarily comes from two segments: Aluminium, contributing $10.48 billion, and Alumina, which accounts for $4.49 billion.

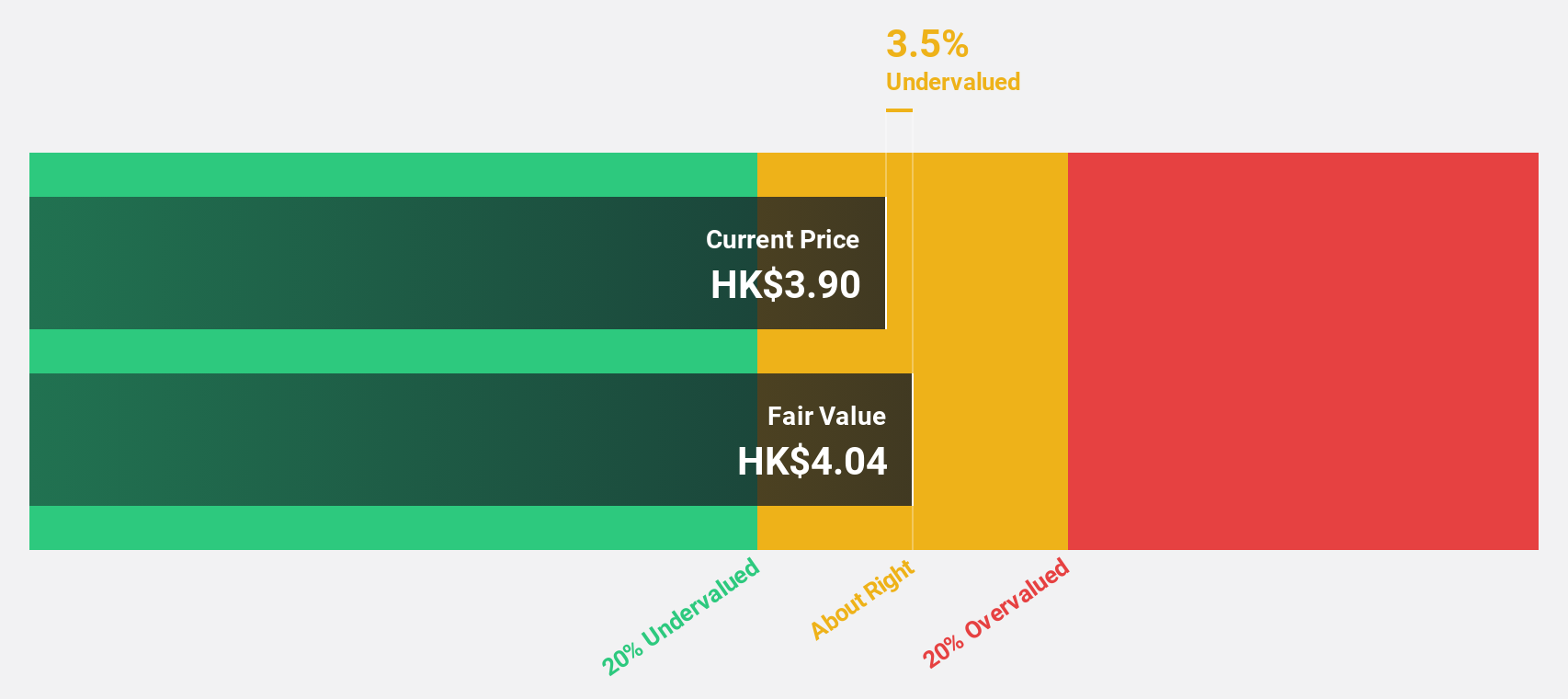

Estimated Discount To Fair Value: 33.6%

United Company RUSAL International is trading at HK$3.21, significantly below its estimated fair value of HK$4.83, indicating potential undervaluation based on cash flows. While earnings are forecast to grow substantially at 100.1% annually, surpassing the Hong Kong market average of 11.3%, revenue growth is expected at a slower pace of 11.6% per year. Despite these positive growth forecasts, the company's debt coverage by operating cash flow remains inadequate, posing a financial risk factor for investors to consider.

- Our earnings growth report unveils the potential for significant increases in United Company RUSAL International's future results.

- Navigate through the intricacies of United Company RUSAL International with our comprehensive financial health report here.

ANYCOLOR (TSE:5032)

Overview: ANYCOLOR Inc. is an entertainment company operating in Japan and internationally with a market cap of ¥175.18 billion.

Operations: ANYCOLOR Inc.'s revenue segments include digital content, live events, and merchandise sales.

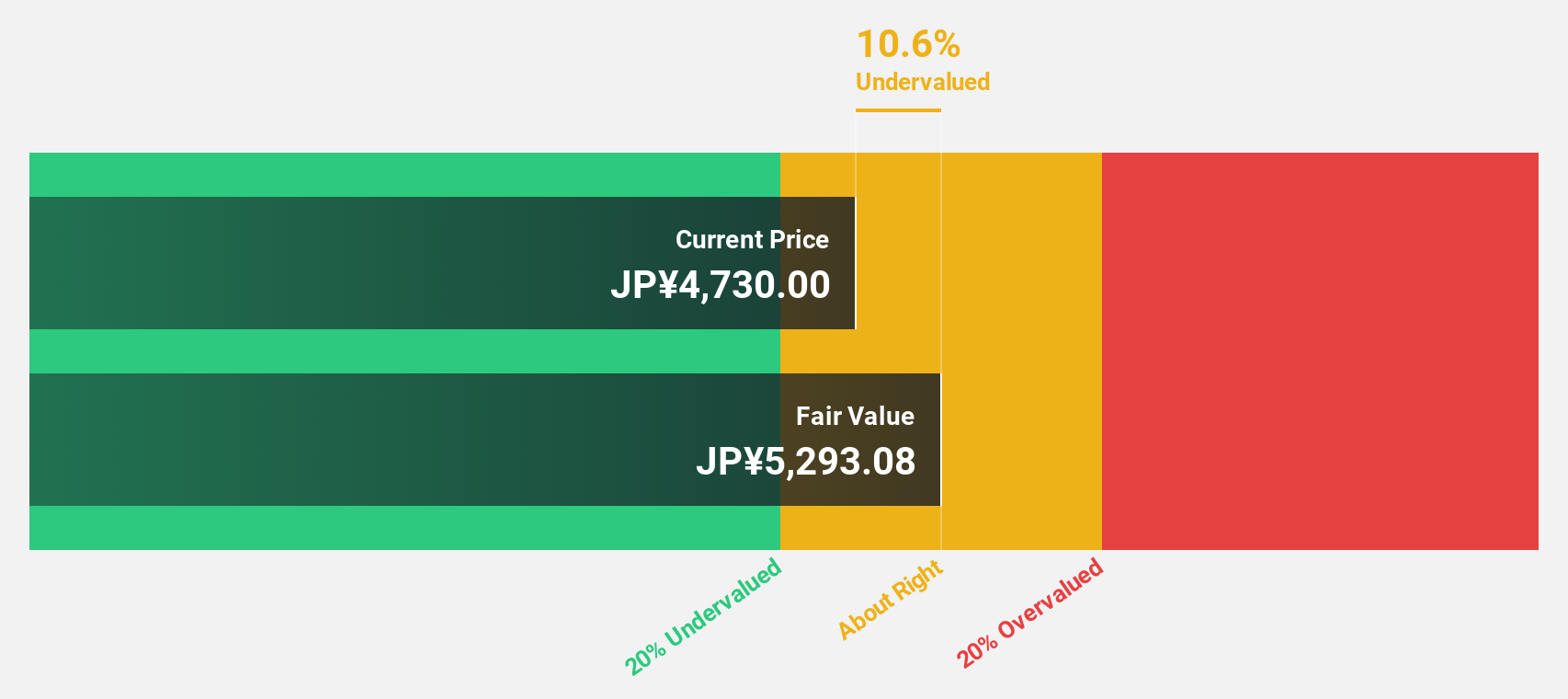

Estimated Discount To Fair Value: 44.6%

ANYCOLOR Inc. is trading at ¥2,884, significantly below its estimated fair value of ¥5,201.14, highlighting potential undervaluation based on cash flows. Earnings are projected to grow at 14.7% annually, outpacing the Japanese market's average of 8.1%. However, revenue growth is forecasted at a moderate 13.9% per year. Despite high volatility in share price recently and substantial non-cash earnings, the company offers good relative value compared to peers and industry standards.

- Our growth report here indicates ANYCOLOR may be poised for an improving outlook.

- Take a closer look at ANYCOLOR's balance sheet health here in our report.

IDEC (TSE:6652)

Overview: IDEC Corporation develops human machine interfaces, industrial switches, control devices, and daily life scenes in Japan and internationally, with a market cap of ¥75.27 billion.

Operations: The company's revenue segments are distributed across Japan (¥34.33 billion), the Americas (¥14.49 billion), Asia-Pacific (¥17.50 billion), and Europe, Middle East and Africa (EMEA) (¥18.77 billion).

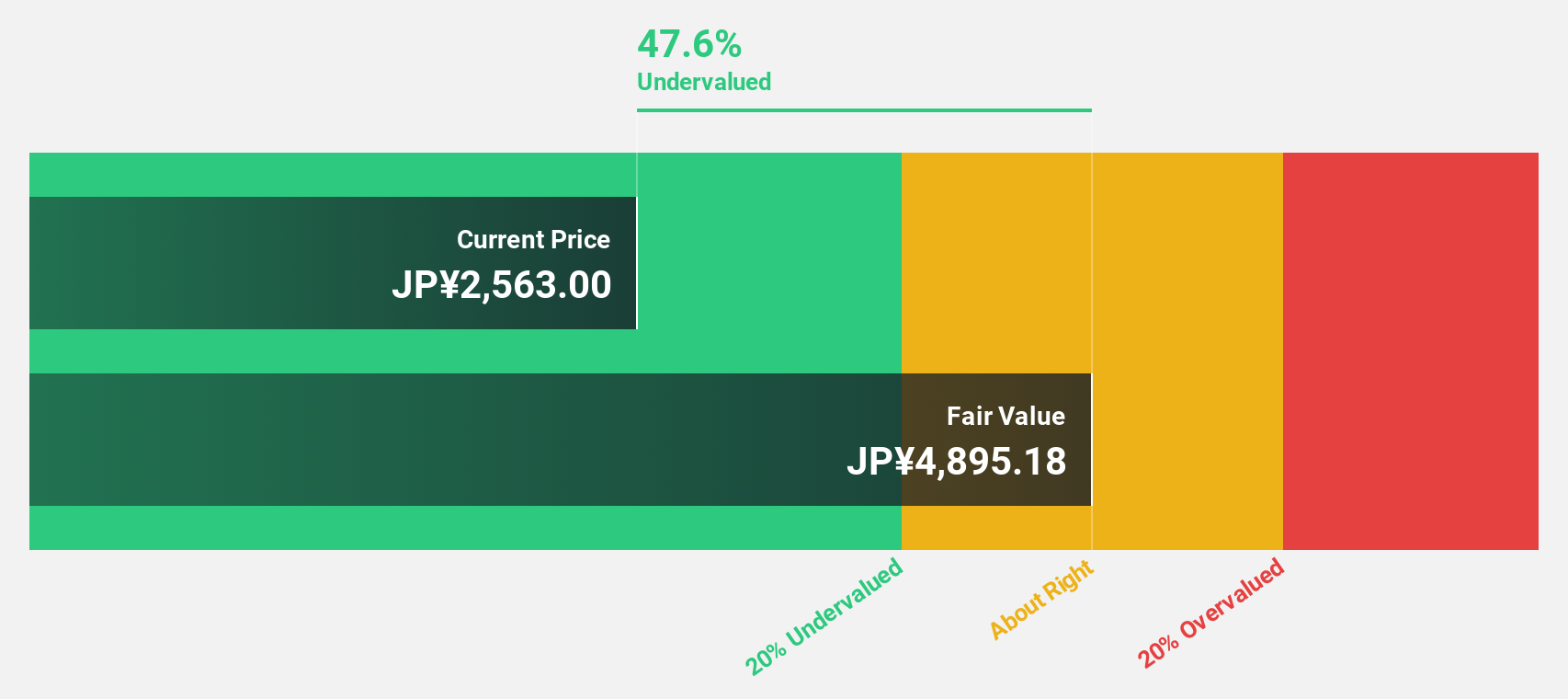

Estimated Discount To Fair Value: 41.3%

IDEC is trading at ¥2,553, significantly below its estimated fair value of ¥4,351.28, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins to 3.7% from last year's 9.7%, earnings are expected to grow significantly at 25.03% annually, surpassing the Japanese market's average growth of 8.1%. However, the dividend yield of 5.09% is not well covered by earnings and return on equity remains low at a forecasted 9.4%.

- In light of our recent growth report, it seems possible that IDEC's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of IDEC.

Summing It All Up

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 878 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6652

IDEC

Engages in the development of human machine interfaces, industrial switches, control devices, and daily life scenes in Japan and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives