- Japan

- /

- Food and Staples Retail

- /

- TSE:8242

Undiscovered Gems Featuring Guodian Nanjing Automation And Two Other Small Caps With Solid Foundations

Reviewed by Simply Wall St

In a global market environment characterized by easing core U.S. inflation and robust bank earnings, major indices like the S&P 600 for small-cap stocks have experienced notable gains, reflecting renewed investor confidence. Amidst this backdrop, identifying stocks with solid foundations becomes crucial as these companies can potentially navigate economic fluctuations more effectively and offer stability in an otherwise volatile landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

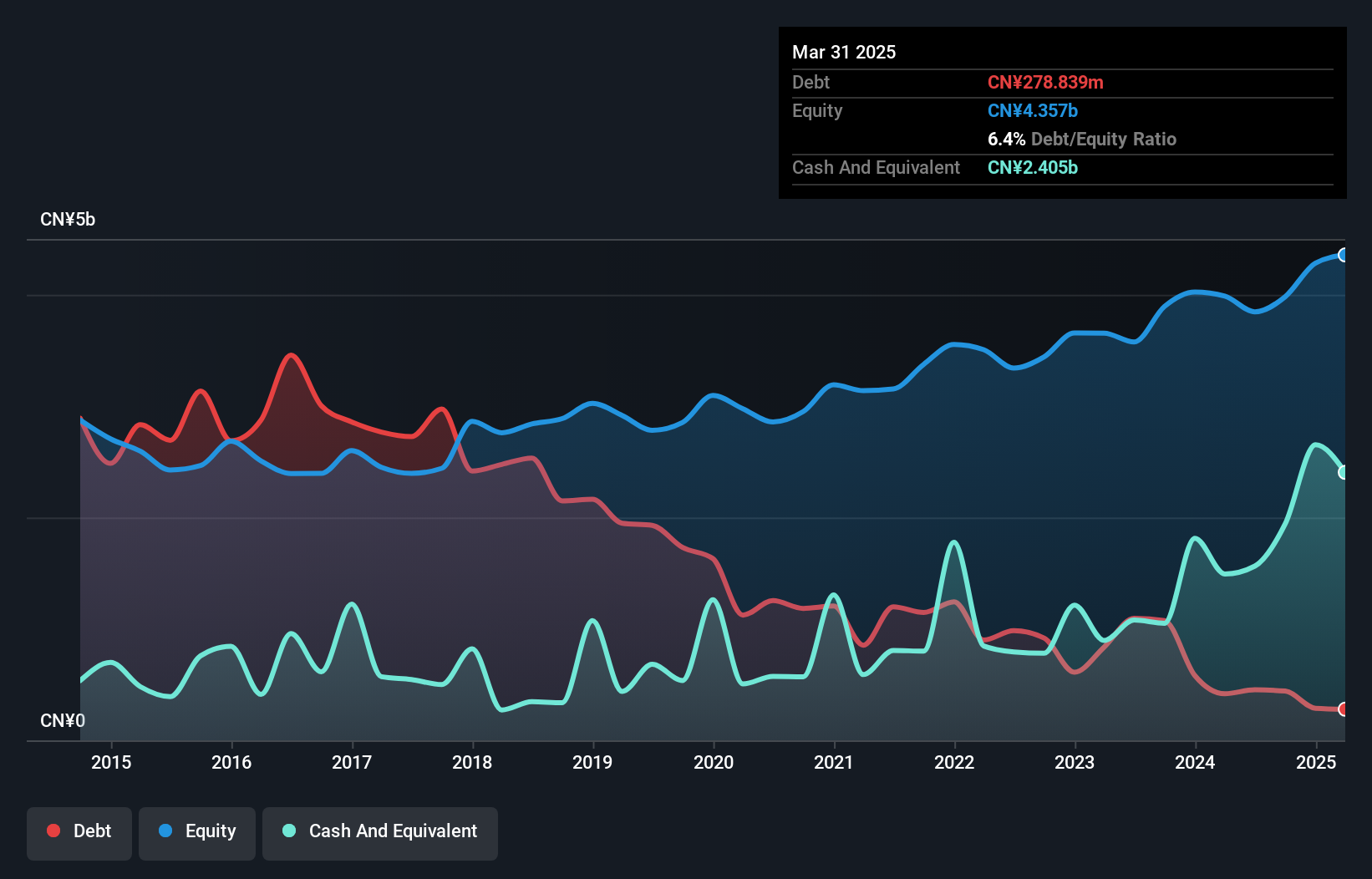

Guodian Nanjing Automation (SHSE:600268)

Simply Wall St Value Rating: ★★★★★★

Overview: Guodian Nanjing Automation Co., Ltd. is involved in the manufacture and sale of industrial power automation equipment both in China and internationally, with a market cap of CN¥6.79 billion.

Operations: The primary revenue stream for Guodian Nanjing Automation comes from its power automation equipment segment, generating CN¥8.05 billion.

Guodian Nanjing Automation is gaining traction with a notable earnings growth of 43.4% over the past year, outpacing the Electrical industry average of 1.1%. The company's debt to equity ratio has impressively decreased from 60.7% to 11.1% in five years, indicating improved financial health and more cash than total debt suggests strong liquidity management. Trading at a significant discount of 91.3% below its estimated fair value, it seems undervalued with high-quality earnings backing its performance. Recent results showed sales rising to CNY 5,538 million and net income increasing to CNY 104 million compared to last year’s figures.

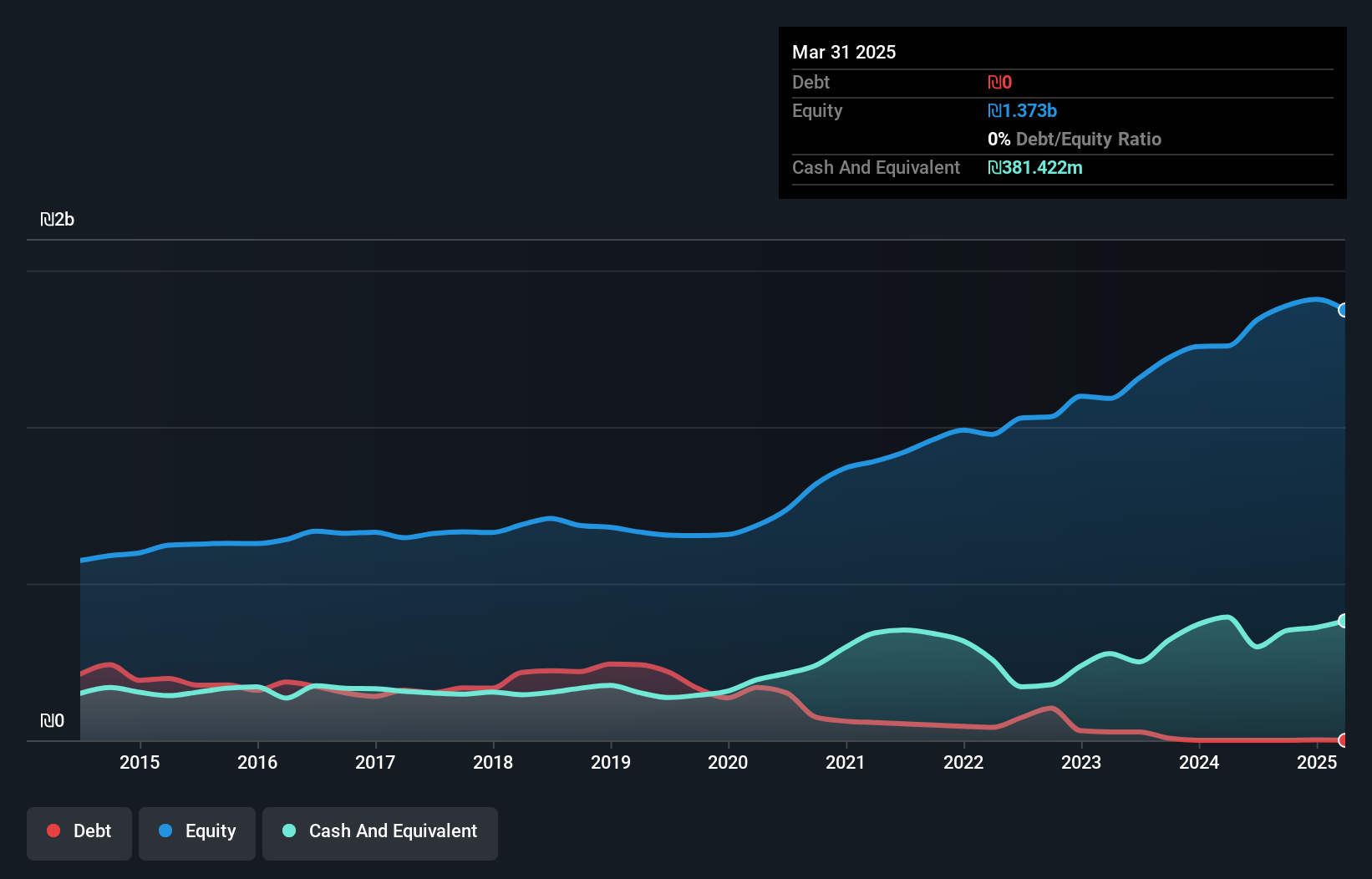

Palram Industries (1990) (TASE:PLRM)

Simply Wall St Value Rating: ★★★★★★

Overview: Palram Industries (1990) Ltd specializes in the manufacturing and sale of thermoplastic sheets, panel systems, and finished products both in Israel and internationally, with a market cap of ₪2.38 billion.

Operations: Palram Industries generates revenue primarily from the Polycarbonate Sector, contributing ₪965.66 million, followed by the PVC and Canopia Sectors with revenues of ₪436.67 million and ₪265.80 million, respectively. The Pur-U Sector adds another ₪197.89 million to the company's revenue stream.

Palram Industries, a nimble player in the chemicals sector, has made waves with its impressive earnings growth of 42% over the past year, outpacing the industry average of 10%. The company reported third-quarter sales of ILS 490 million and net income of ILS 62 million, showcasing solid performance. With no debt on its books now compared to a debt-to-equity ratio of 25% five years ago, Palram stands on firm financial ground. Its inclusion in the TA-125 Index highlights growing recognition. Trading at nearly 2% below fair value estimates suggests potential upside for investors eyeing this promising entity.

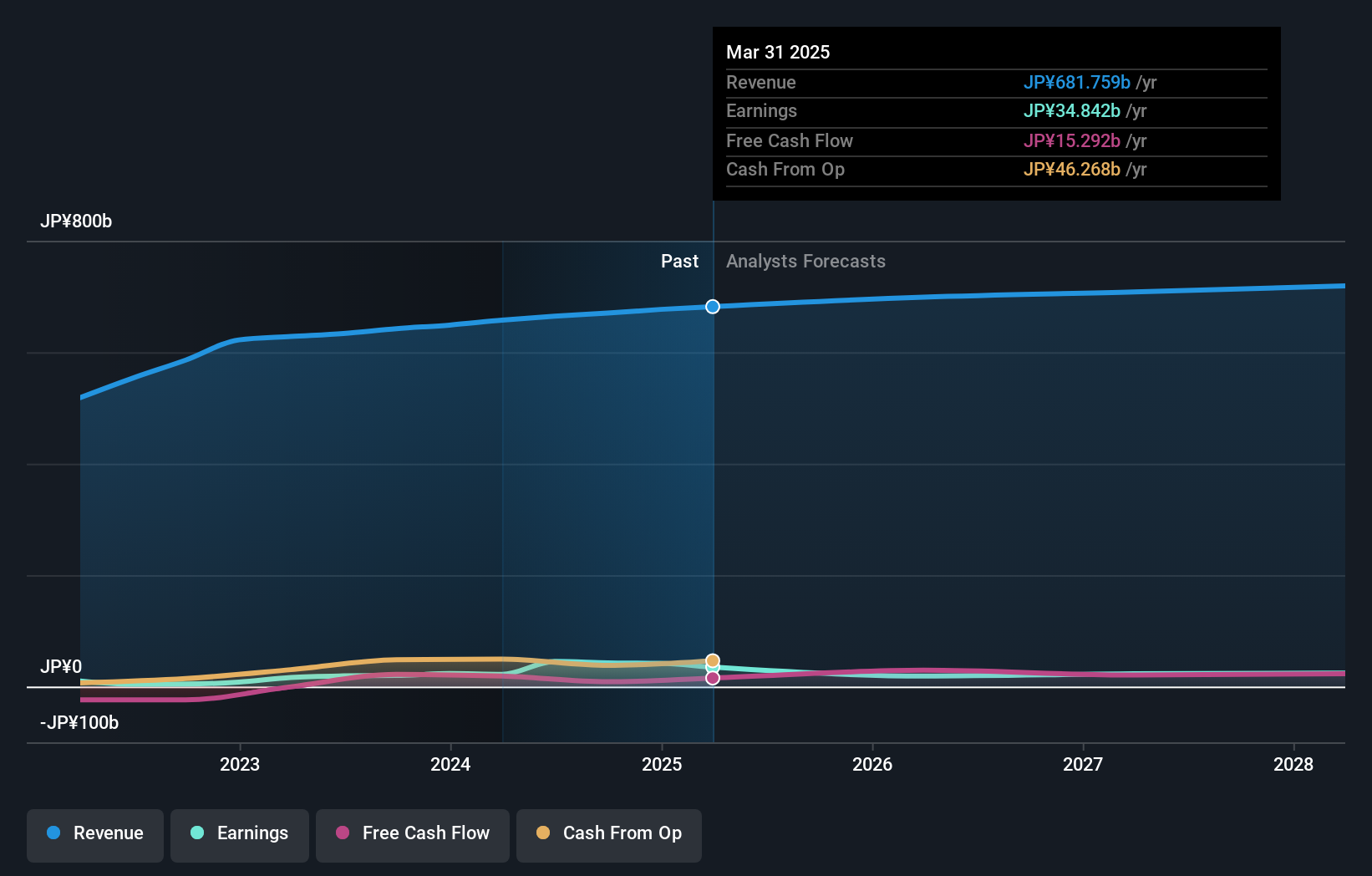

H2O Retailing (TSE:8242)

Simply Wall St Value Rating: ★★★★☆☆

Overview: H2O Retailing Corporation is a Japanese company that operates department stores, supermarkets, and shopping centers with a market capitalization of ¥273.61 billion.

Operations: H2O Retailing generates revenue primarily from its Food Business, contributing ¥412.54 billion, followed by its Department Store segment at ¥189.66 billion, and Commercial Facility Business at ¥40.95 billion. The company's cost structure and profitability are influenced by these diverse revenue streams.

H2O Retailing, a company with a market presence that might not be widely recognized, has shown impressive performance recently. Earnings surged by 115% last year, outpacing the Consumer Retailing industry significantly. The company's net debt to equity ratio stands satisfactorily at 37%, indicating sound financial management. Trading at about 82% below its estimated fair value suggests potential undervaluation compared to peers. A notable ¥19 billion one-off gain impacted recent results, reflecting non-recurring income elements. December sales were robust at over 108% year-on-year growth, and a share repurchase program was executed for ¥754 million in November 2024, enhancing shareholder returns.

- Click to explore a detailed breakdown of our findings in H2O Retailing's health report.

Evaluate H2O Retailing's historical performance by accessing our past performance report.

Seize The Opportunity

- Get an in-depth perspective on all 4657 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H2O Retailing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8242

H2O Retailing

Operates department stores, supermarkets, and shopping centers in Japan.

Undervalued with proven track record.