Amid global economic uncertainties and regulatory challenges, Asian markets have been navigating a complex landscape influenced by geopolitical tensions and inflationary pressures. As investors seek stability and income generation in this environment, dividend stocks have emerged as an attractive option due to their potential for providing regular income streams. Identifying strong dividend stocks involves looking for companies with solid financial health, consistent earnings, and a commitment to shareholder returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.52% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.97% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.19% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.14% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.94% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.87% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.31% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

| Chudenko (TSE:1941) | 3.81% | ★★★★★★ |

Click here to see the full list of 1141 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

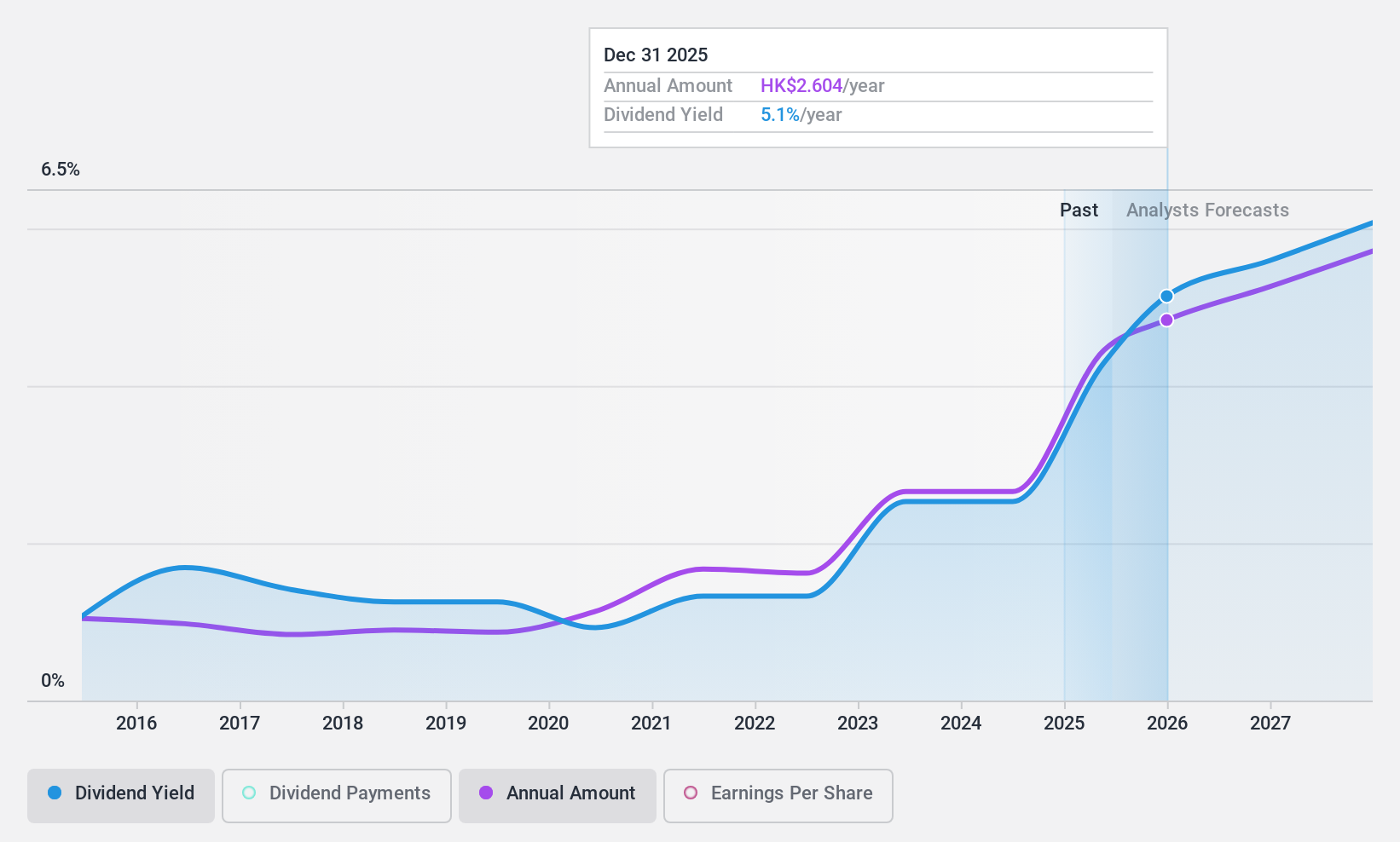

Tsingtao Brewery (SEHK:168)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tsingtao Brewery Company Limited, along with its subsidiaries, is involved in the production, distribution, wholesale, and retail sale of beer products across Mainland China, Hong Kong, Macau, and international markets with a market cap of approximately HK$87.95 billion.

Operations: Tsingtao Brewery's revenue primarily stems from its beer production and sales operations in Mainland China, Hong Kong, Macau, and international markets.

Dividend Yield: 4%

Tsingtao Brewery's dividend profile shows both strengths and weaknesses. The company has a history of stable and growing dividends over the past decade, supported by high-quality earnings with a reasonable payout ratio of 62.6%. However, its current dividend yield of 4.02% is below top-tier levels in Hong Kong, and cash flow coverage is weak with a cash payout ratio at 150.9%. Recent leadership changes are not expected to disrupt its strategic direction or corporate governance stability.

- Delve into the full analysis dividend report here for a deeper understanding of Tsingtao Brewery.

- In light of our recent valuation report, it seems possible that Tsingtao Brewery is trading behind its estimated value.

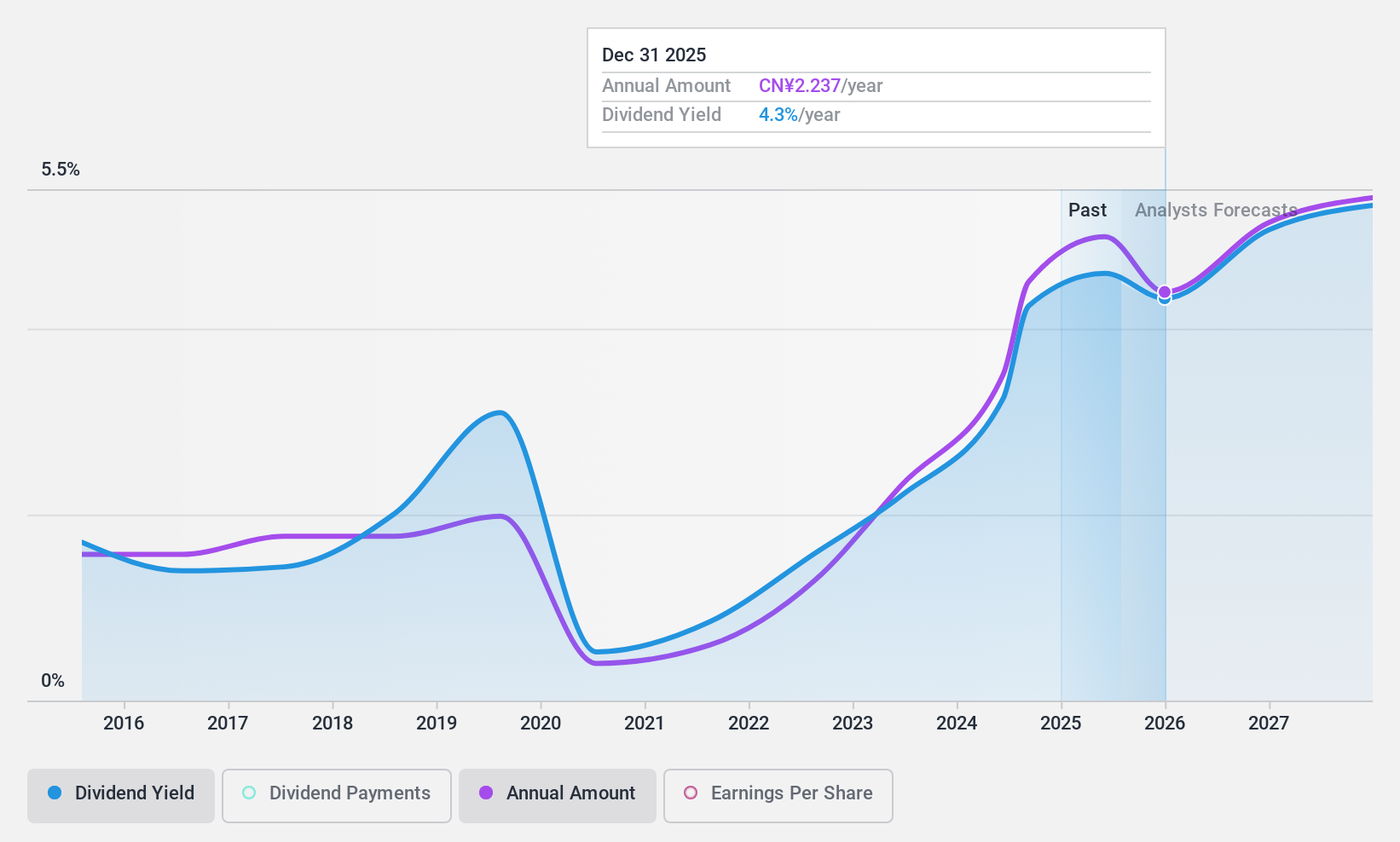

Dong-E-E-JiaoLtd (SZSE:000423)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dong-E-E-Jiao Co., Ltd. engages in the research, development, production, and sale of Ejiao along with various Chinese patent medicines, health foods, and foods, with a market cap of CN¥37.19 billion.

Operations: Dong-E-E-Jiao Co., Ltd.'s revenue primarily comes from the operation of Ejiao and its series of products, totaling CN¥5.62 billion.

Dividend Yield: 4%

Dong-E-E-Jiao Ltd. offers a mixed dividend profile with a notable yield of 3.96%, placing it among the top 25% in China, though its high payout ratio of 123.8% raises sustainability concerns. Cash flow coverage is reasonable at 72.7%, but past dividend volatility and unreliability are drawbacks for income-focused investors. Recent corporate guidance indicates strong earnings growth, driven by strategic initiatives across pharmaceuticals and health consumer products, which may support future dividend stability if sustained effectively.

- Get an in-depth perspective on Dong-E-E-JiaoLtd's performance by reading our dividend report here.

- Our valuation report here indicates Dong-E-E-JiaoLtd may be undervalued.

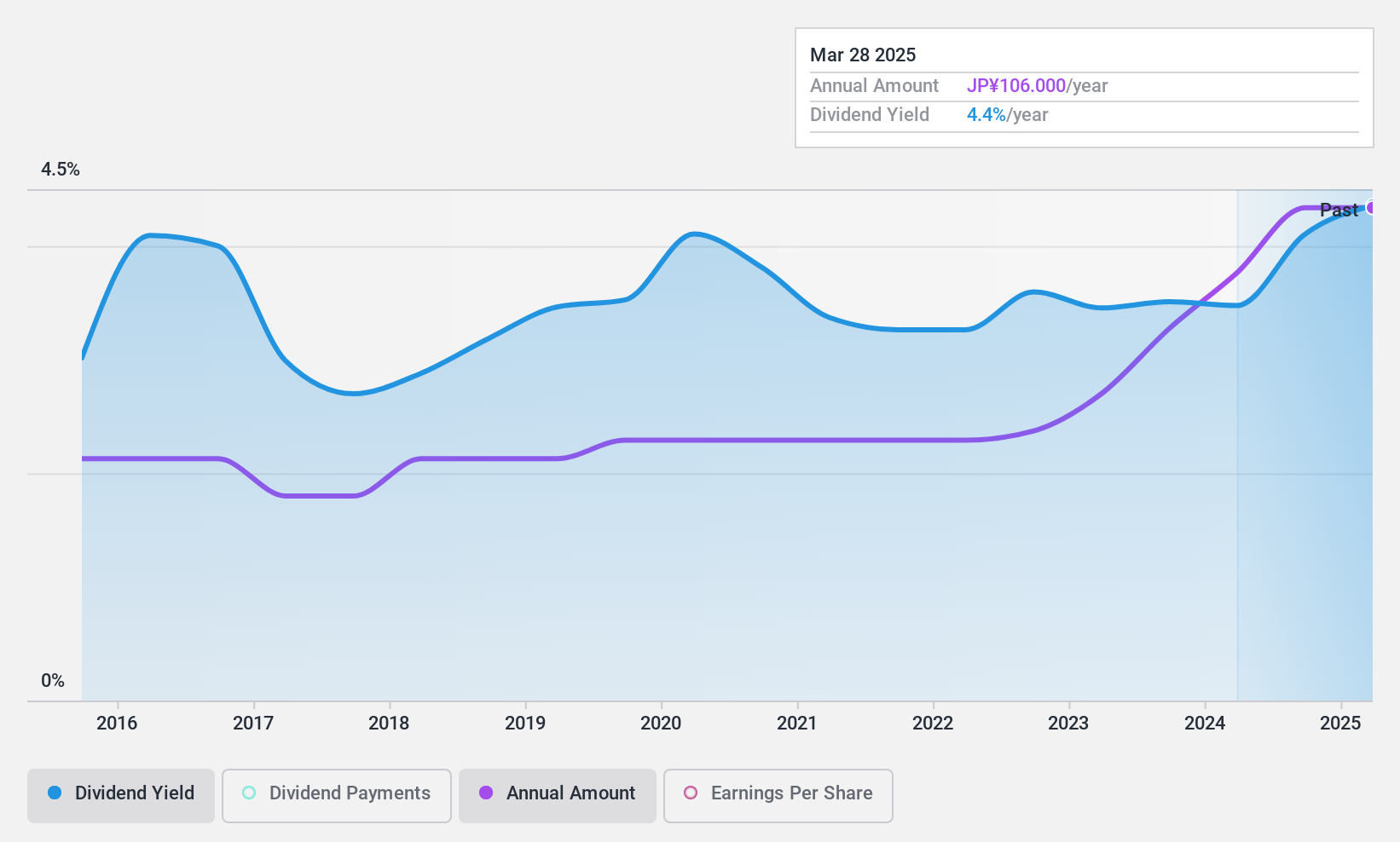

Ryoden (TSE:8084)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ryoden Corporation operates in the sale of factory automation systems, cooling and heating systems, information and communication technologies, facilities systems, and electronics both in Japan and internationally, with a market cap of ¥54.47 billion.

Operations: Ryoden Corporation's revenue is derived from the sale of factory automation systems, cooling and heating systems, information and communication technologies, facilities systems, and electronics.

Dividend Yield: 4.3%

Ryoden's dividend profile is characterized by a strong yield of 4.27%, ranking in the top 25% of Japanese dividend payers. The dividends are well-supported by earnings and cash flows, with payout ratios of 58.1% and 16.9%, respectively, indicating sustainability despite historical volatility over the past decade. Recent share buybacks totaling ¥1,019.47 million signal a commitment to enhancing shareholder returns through flexible capital policies, although past dividend instability may concern some investors seeking reliability.

- Click to explore a detailed breakdown of our findings in Ryoden's dividend report.

- Our comprehensive valuation report raises the possibility that Ryoden is priced lower than what may be justified by its financials.

Seize The Opportunity

- Access the full spectrum of 1141 Top Asian Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsingtao Brewery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:168

Tsingtao Brewery

Engages in the production, distribution, wholesale, and retail sale of beer products in Mainland China, Hong Kong, Macau, and internationally.

Flawless balance sheet, good value and pays a dividend.