- Japan

- /

- Trade Distributors

- /

- TSE:8053

3 Dividend Stocks Offering Yields Up To 4.4%

Reviewed by Simply Wall St

As global markets continue to reach new highs, driven by geopolitical developments and domestic policy shifts, investors are increasingly seeking stable income sources amid the volatility. In this context, dividend stocks offering yields up to 4.4% present an attractive opportunity for those looking to capitalize on consistent returns while navigating the current economic landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.48% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

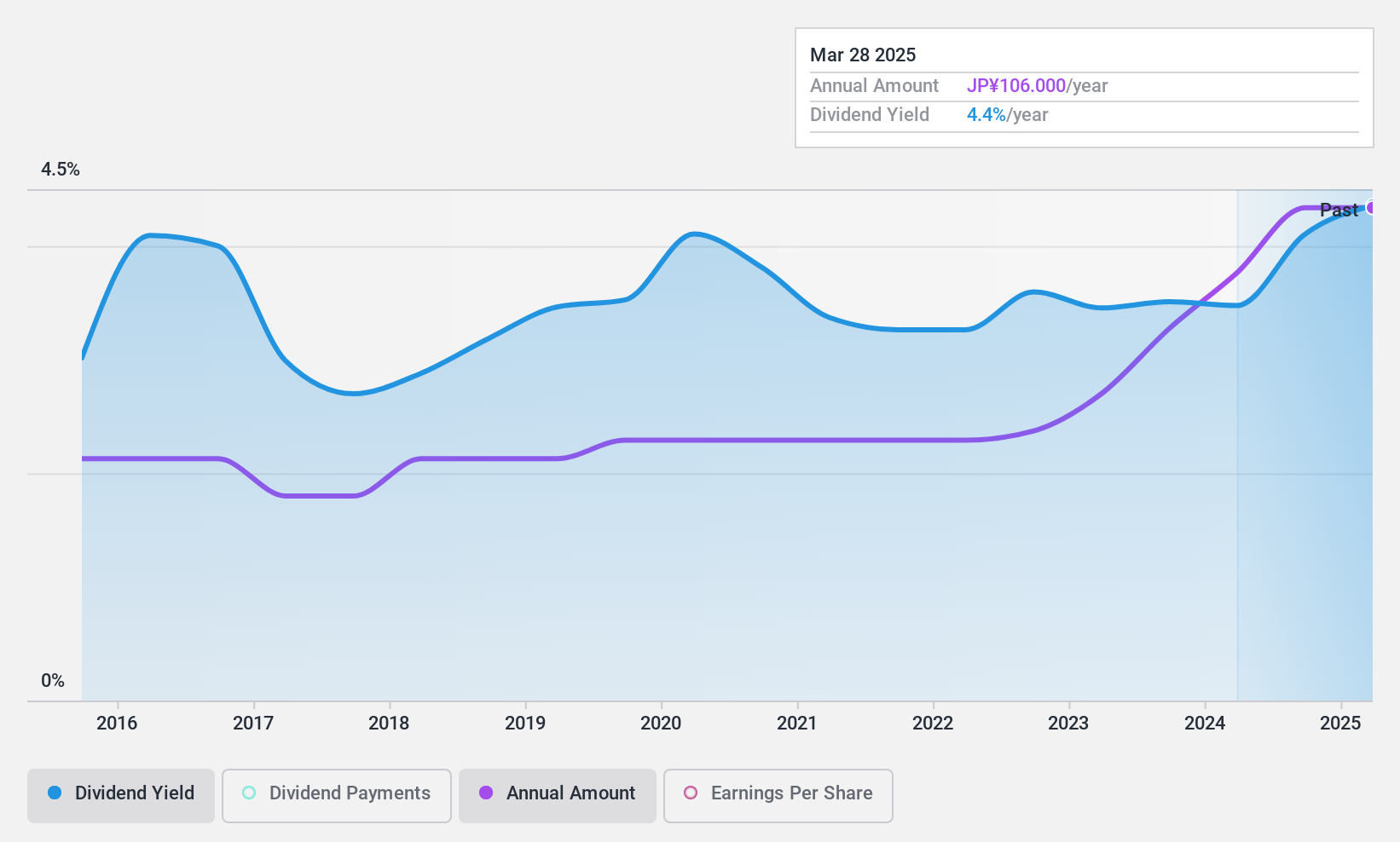

Mory Industries (TSE:5464)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mory Industries Inc. manufactures and sells stainless steel and welded carbon steel products in Japan, with a market cap of ¥37.24 billion.

Operations: Mory Industries Inc. generates revenue from its operations in Japan, contributing ¥44.54 billion, and Indonesia, adding ¥2.26 billion.

Dividend Yield: 3.7%

Mory Industries has demonstrated consistent dividend growth over the past decade, with stable and reliable payments. The company's dividends are well-covered by both earnings and cash flows, maintaining a payout ratio of 27.6% and a cash payout ratio of 30.3%. Despite trading at a significant discount to its estimated fair value, its dividend yield of 3.73% is slightly below the top tier in Japan's market, which stands at 3.83%.

- Dive into the specifics of Mory Industries here with our thorough dividend report.

- Our valuation report unveils the possibility Mory Industries' shares may be trading at a discount.

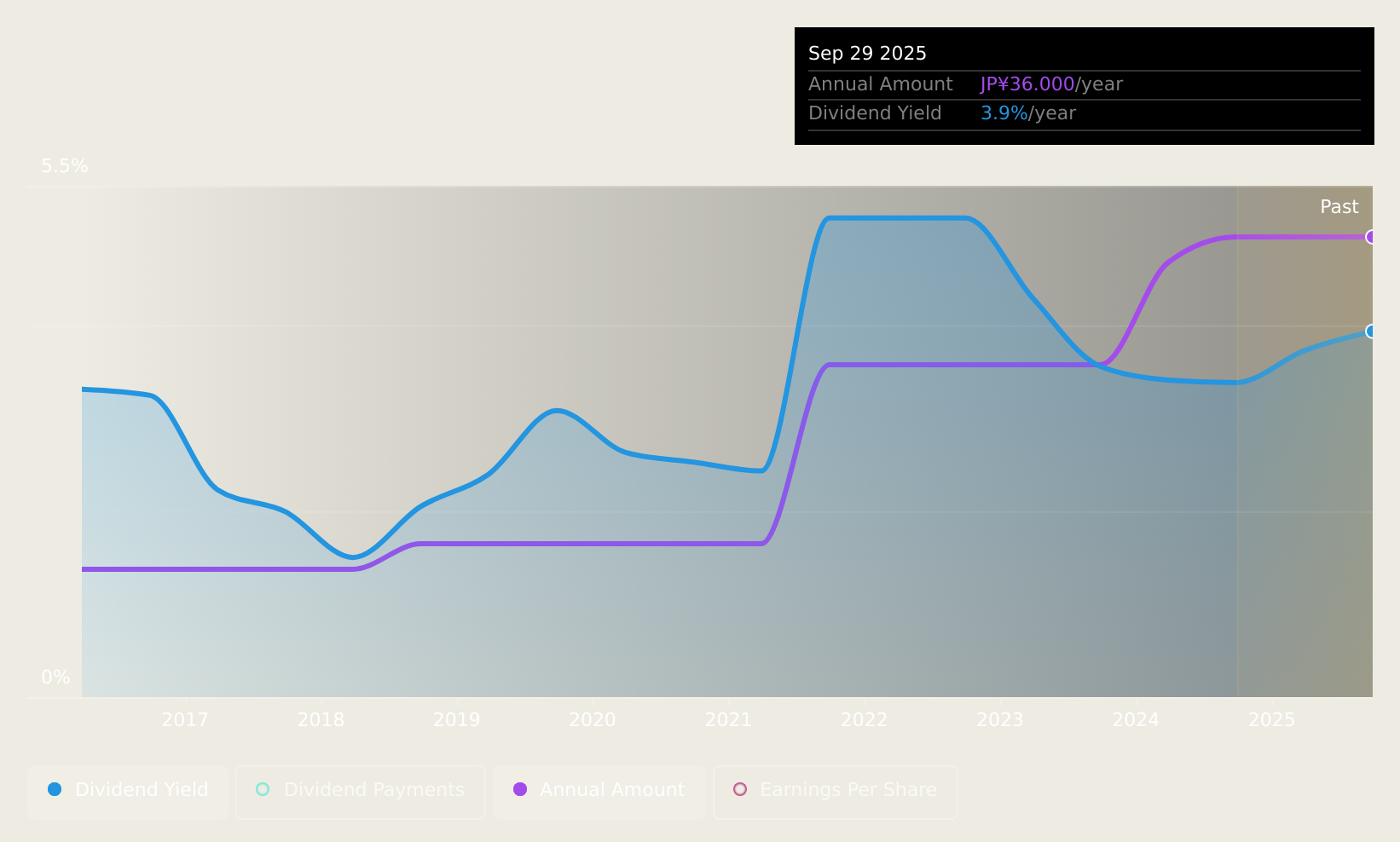

Sumitomo (TSE:8053)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sumitomo Corporation operates as a general trading company with a market capitalization of approximately ¥4.02 trillion.

Operations: Sumitomo Corporation's revenue segments include Steel at ¥1.66 billion, Media & Digital at ¥0.51 billion, and Transportation & Construction Systems at ¥1.43 billion.

Dividend Yield: 3.9%

Sumitomo Corporation's dividend yield is among the top 25% in Japan, with a payout ratio of 43.7%, indicating dividends are well-covered by earnings and cash flows. However, its dividend history is marked by volatility over the past decade. Recent strategic alliances, such as partnerships with Rikkeisoft and MineHub Technologies, aim to drive growth through digital transformation initiatives. Despite challenges in debt coverage by operating cash flow, Sumitomo trades below its fair value estimate.

- Click here and access our complete dividend analysis report to understand the dynamics of Sumitomo.

- The analysis detailed in our Sumitomo valuation report hints at an deflated share price compared to its estimated value.

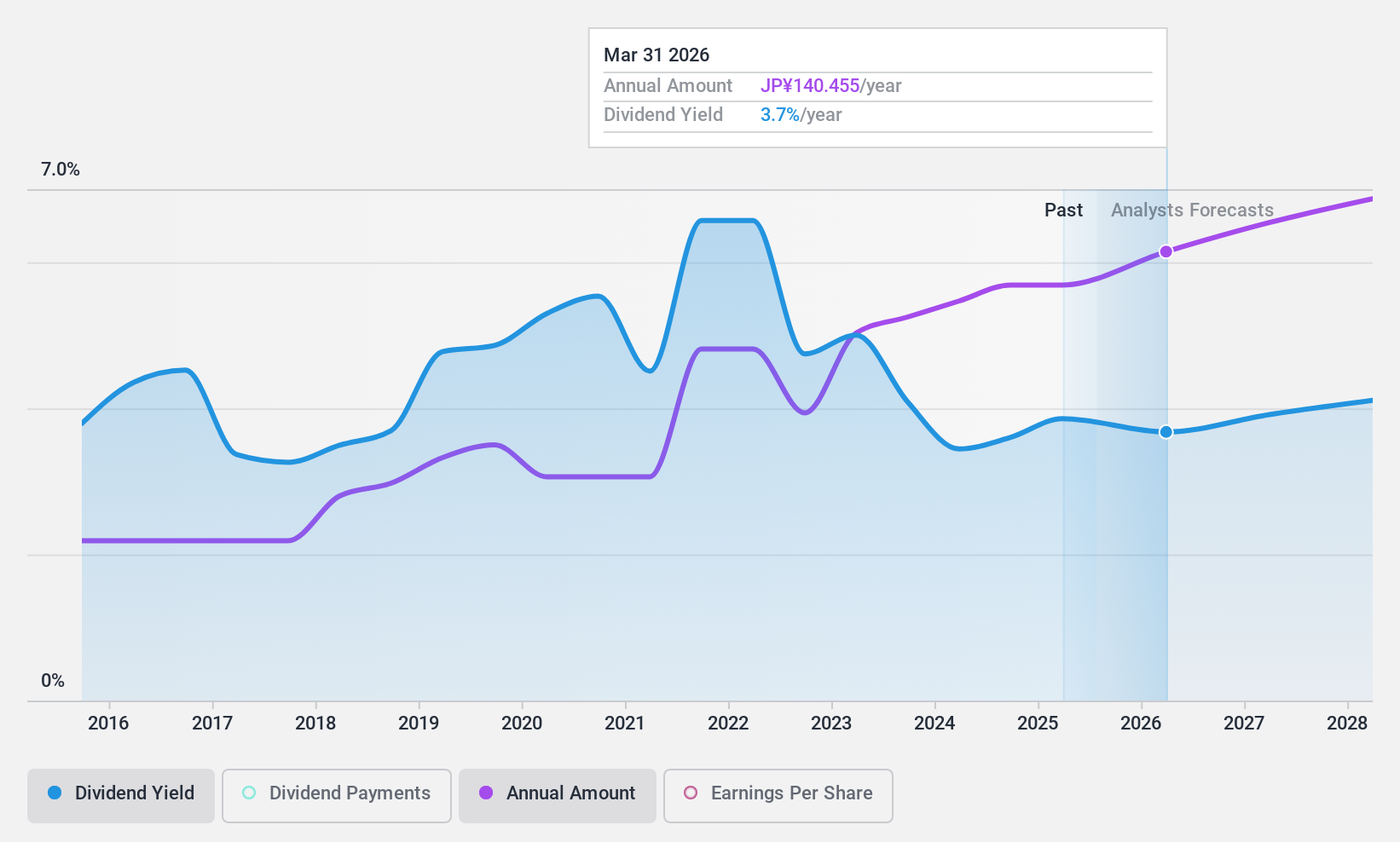

Ryoden (TSE:8084)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ryoden Corporation operates in the sale of factory automation systems, cooling and heating systems, information and communication technologies, facilities systems, and electronics both in Japan and internationally, with a market cap of approximately ¥52.02 billion.

Operations: Ryoden Corporation's revenue segments include Electronics at ¥149.31 billion, Factory Automation Systems at ¥49.93 billion, and X - Tech at ¥7.51 billion.

Dividend Yield: 4.5%

Ryoden's dividend yield ranks in the top 25% of Japanese stocks, supported by a low payout ratio of 27.5%, ensuring coverage by earnings and cash flows. Despite this, its dividend history has been volatile over the past decade. Recent guidance revision indicates lower expected profits due to delayed recovery in FA systems and economic challenges in China, affecting future stability. The stock trades significantly below its estimated fair value, presenting potential investment opportunities amidst uncertainties.

- Click to explore a detailed breakdown of our findings in Ryoden's dividend report.

- Our comprehensive valuation report raises the possibility that Ryoden is priced lower than what may be justified by its financials.

Summing It All Up

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1945 more companies for you to explore.Click here to unveil our expertly curated list of 1948 Top Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8053

Established dividend payer with adequate balance sheet.