As global markets navigate a landscape marked by political developments and economic data releases, major U.S. stock indexes have shown mixed results, with growth stocks leading the charge while value stocks lag behind. Amidst this backdrop of record highs in indices like the S&P 500 and Nasdaq Composite, dividend stocks remain an attractive option for investors seeking stability and income in uncertain times. A strong dividend stock typically combines a reliable payout history with solid financial health, making it a potential anchor in portfolios during periods of market volatility or economic uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.61% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.99% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.41% | ★★★★★★ |

Click here to see the full list of 1944 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

JW Holdings (KOSE:A096760)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JW Holdings Corporation, with a market cap of ₩211.53 billion, operates as a healthcare company through its subsidiaries in South Korea, the United States, Japan, China, and other international markets.

Operations: JW Holdings Corporation generates revenue primarily from Medicines (₩1.11 billion), with additional contributions from its Holding Business (₩53.86 million) and Medical Equipment (₩21.57 million).

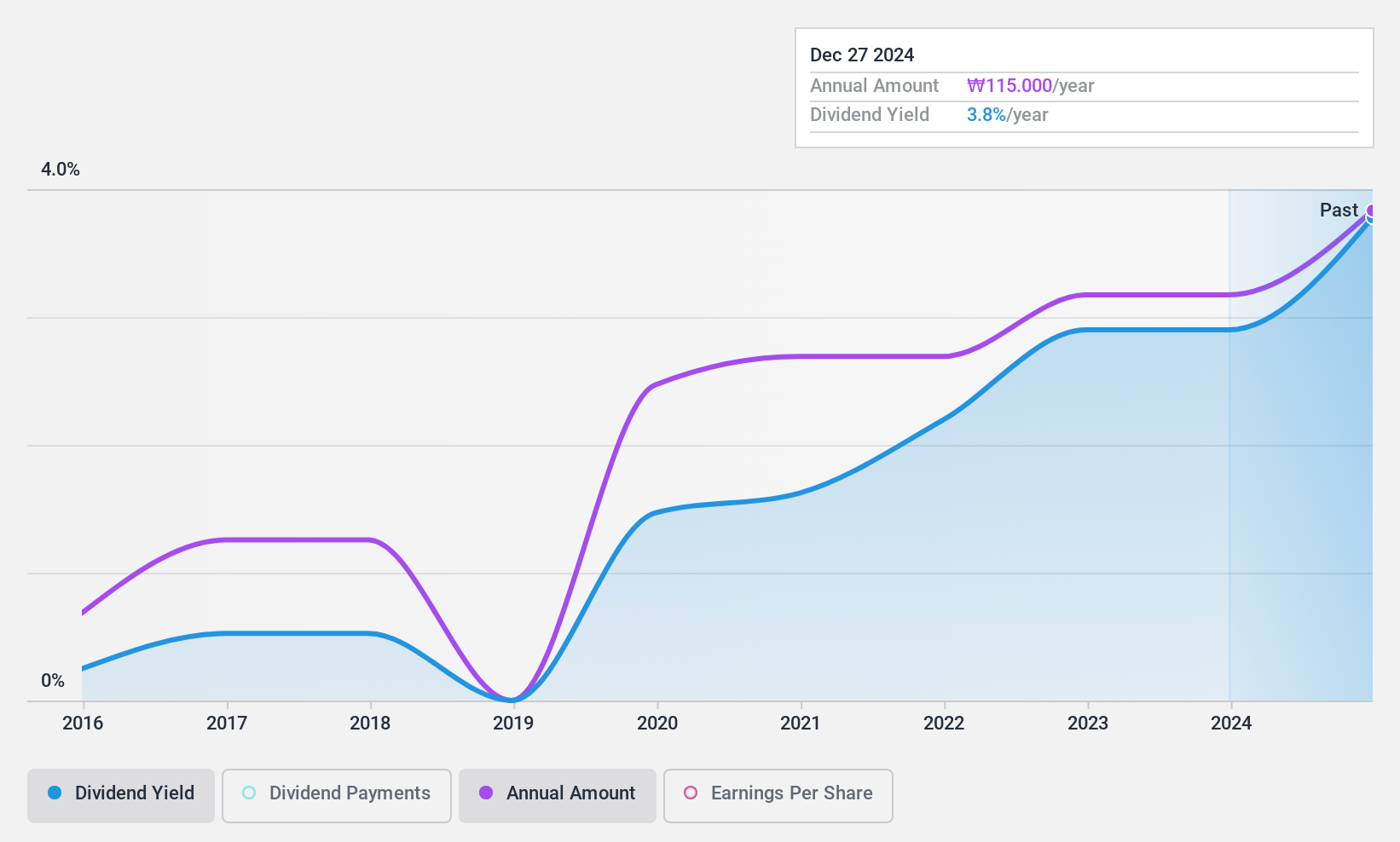

Dividend Yield: 3.6%

JW Holdings has demonstrated strong earnings growth, with a notable increase in net income and earnings per share over the past year. Despite a high level of debt, its dividends are well-covered by both earnings and cash flows, with low payout ratios indicating sustainability. The dividend yield is reliable and has grown steadily over the past decade, though it remains slightly below top-tier market yields. Recent financial performance underscores its potential as a stable dividend payer.

- Click here and access our complete dividend analysis report to understand the dynamics of JW Holdings.

- Our comprehensive valuation report raises the possibility that JW Holdings is priced lower than what may be justified by its financials.

Startia HoldingsInc (TSE:3393)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Startia Holdings, Inc. operates in the IT sector both in Japan and internationally, with a market cap of ¥20.75 billion.

Operations: Startia Holdings, Inc. generates revenue primarily from its IT Infrastructure Related Business, including business applications, amounting to ¥16.86 billion, and its Digital Marketing Related Business, which contributes ¥3.67 billion.

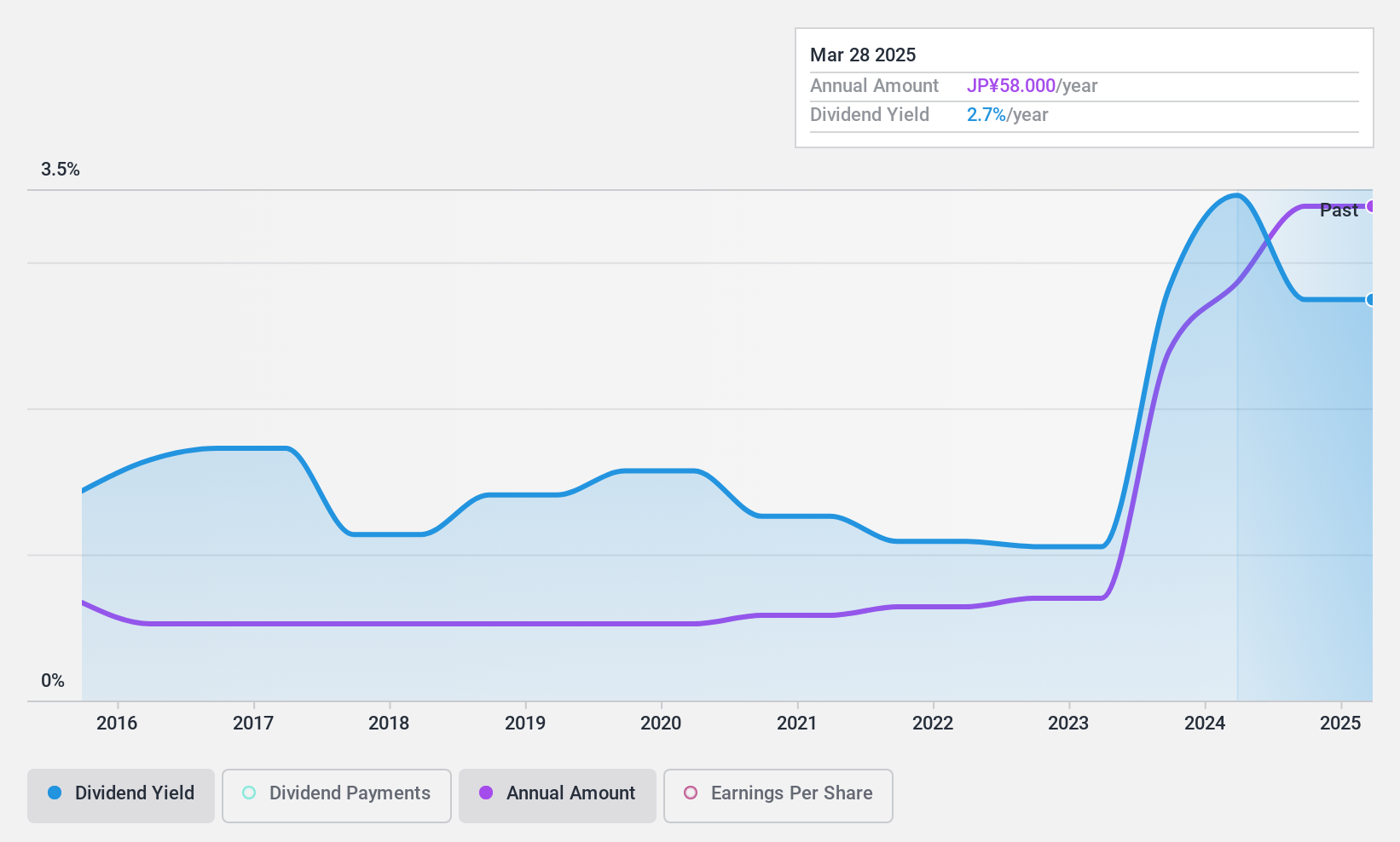

Dividend Yield: 5.1%

Startia Holdings has increased its dividend to ¥46.00 per share for the second quarter, with a forecast of ¥56.00 per share for the fiscal year ending March 2025, up from ¥48.00 last year. Despite a volatile dividend history, recent growth in earnings by 22.8% and a low payout ratio of 45.9% suggest coverage is sustainable by earnings but less so by cash flows at an 85.3% ratio. A recent buyback program aims to enhance shareholder value amidst these developments.

- Get an in-depth perspective on Startia HoldingsInc's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Startia HoldingsInc's share price might be too optimistic.

Mitsubishi Research Institute (TSE:3636)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsubishi Research Institute, Inc. offers research, consulting, and ICT solutions to both public and private sectors in Japan, with a market cap of ¥69.97 billion.

Operations: Mitsubishi Research Institute, Inc.'s revenue is primarily generated from its IT Service segment, which accounts for ¥71.37 billion, and its Think Tank Consulting Service segment, contributing ¥45.49 billion.

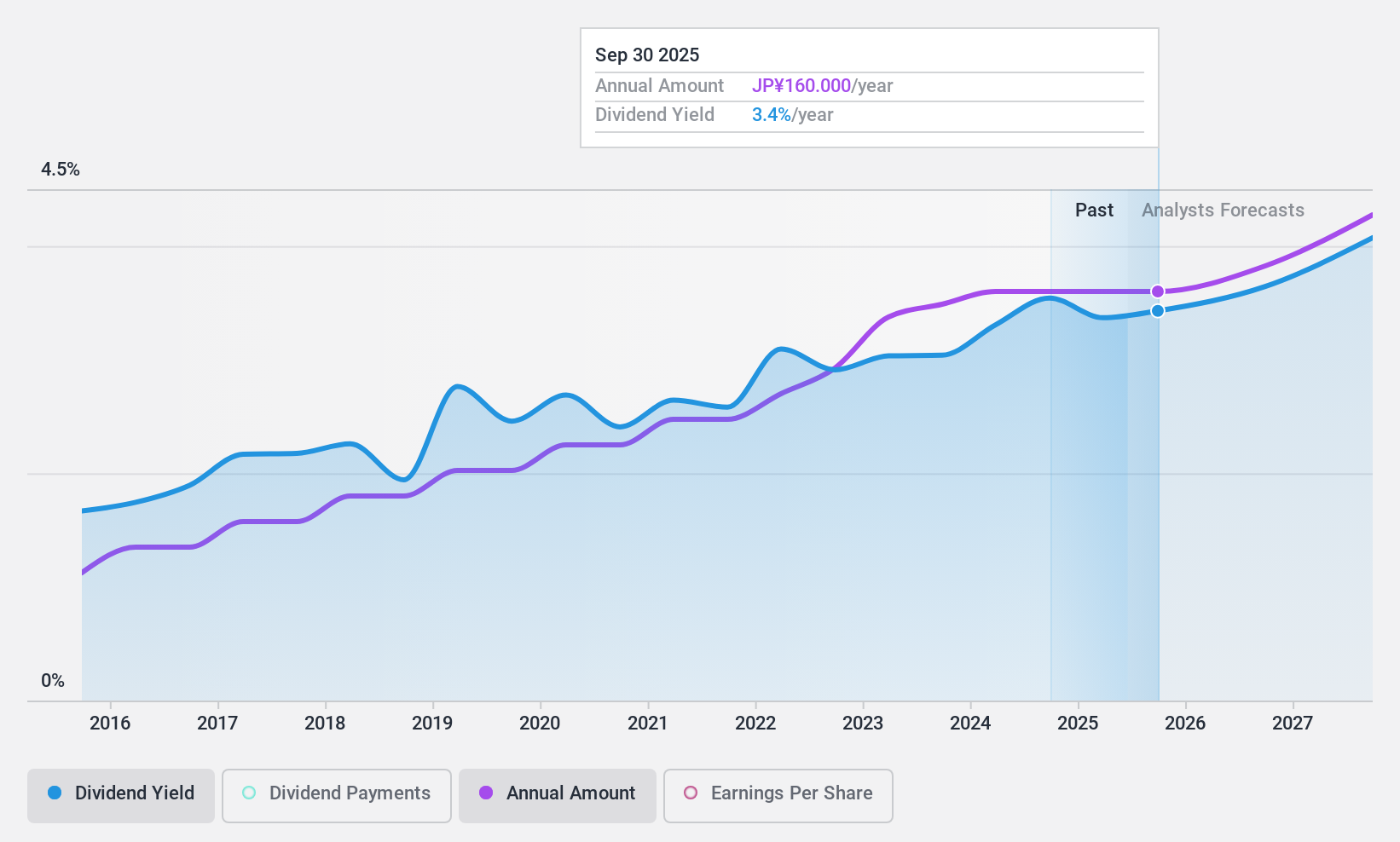

Dividend Yield: 3.5%

Mitsubishi Research Institute's dividend payments have been stable and growing over the past decade, supported by a sustainable payout ratio of 50.6% and a cash payout ratio of 26.8%. Although its 3.53% yield is below the top quartile in Japan, it remains reliable. The stock trades at a significant discount to estimated fair value, suggesting potential for appreciation. Recent strategic alliances in AI could bolster future growth and enhance its dividend appeal further.

- Unlock comprehensive insights into our analysis of Mitsubishi Research Institute stock in this dividend report.

- Upon reviewing our latest valuation report, Mitsubishi Research Institute's share price might be too pessimistic.

Next Steps

- Access the full spectrum of 1944 Top Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3636

Mitsubishi Research Institute

Provides research, consulting, and ICT solution to public and private sectors in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives