- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7762

Will Nikkei 225 Removal Change Citizen Watch's (TSE:7762) Narrative?

Reviewed by Sasha Jovanovic

- Citizen Watch Co., Ltd. was recently removed from the Nikkei 225 Index, one of Japan's most widely followed equity benchmarks.

- This change can impact how index funds and institutional investors manage their portfolios, as many replicate the index's holdings.

- We'll look at how index removal may shift Citizen Watch's investment narrative, particularly regarding institutional investor engagement and market visibility.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Citizen Watch's Investment Narrative?

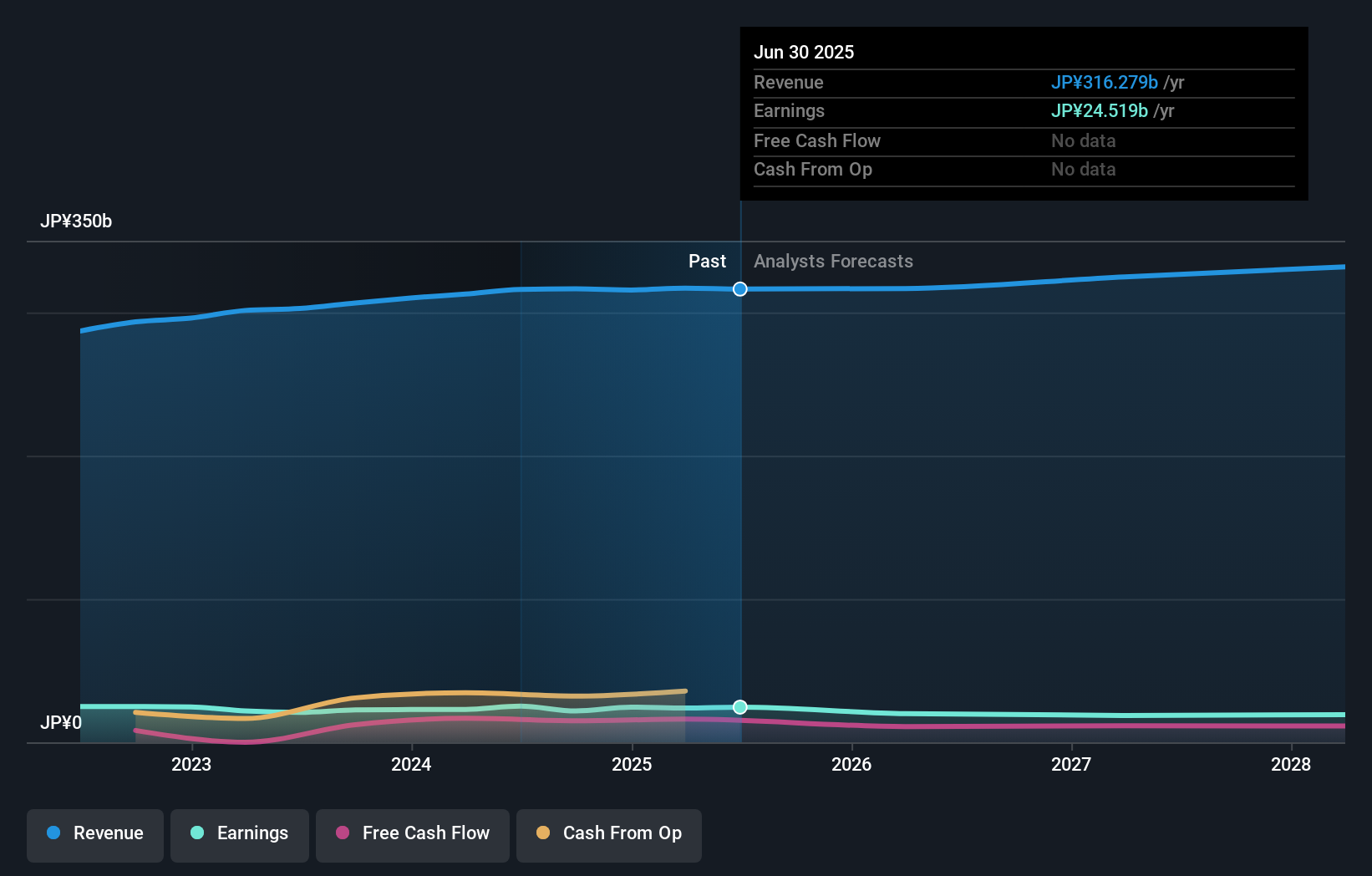

To be a shareholder in Citizen Watch, you’d likely need to believe in the company’s resilience as a traditional watchmaker adapting to a slow-growth environment. Until now, drivers for the stock included gradual revenue growth, a prudent capital return approach with increasing dividends, and sustained cost controls. However, with Citizen Watch recently dropped from the Nikkei 225, there’s potential for some institutional investor outflows and reduced short-term visibility, even if the core business outlook has not shifted overnight. Index exclusion rarely changes a company’s fundamentals, but it could amplify existing risks like declining earnings and slow revenue growth, especially if it reduces analyst and investor coverage. The company’s low price-to-earnings multiple had underlined its appeal, but with profit declines forecast and one-off gains distorting recent results, the investment case may hinge even more on operational improvements and restoring lasting profit growth. Yet, there’s no ignoring how index removal can shake up liquidity and sentiment, at least temporarily.

Citizen Watch's shares are on the way up, but they could be overextended by 33%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Citizen Watch - why the stock might be a potential multi-bagger!

Build Your Own Citizen Watch Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citizen Watch research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Citizen Watch research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citizen Watch's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7762

Citizen Watch

Manufactures and sells watches and related components worldwide.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives