- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6976

Exploring 3 High Growth Tech Stocks with Promising Potential

Reviewed by Simply Wall St

In a week marked by cautious earnings reports and economic data, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 reach record highs before retreating, while small-cap stocks demonstrated resilience amidst broader market volatility. As investors navigate these dynamic conditions, identifying high growth tech stocks with strong fundamentals and innovative potential becomes crucial for those looking to capitalize on emerging opportunities in the technology sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

B-SOFTLtd (SZSE:300451)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: B-SOFT Co., Ltd. is a company engaged in the medical and health industry in China, with a market capitalization of CN¥8.31 billion.

Operations: B-SOFT Ltd. focuses on the medical and health sector in China, leveraging its expertise to generate revenue primarily through healthcare software solutions and related services. The company strategically allocates resources to enhance its product offerings, aiming to address the evolving needs of the healthcare industry.

B-SOFTLtd, navigating through a challenging fiscal period, reported modest revenue growth from CNY 1.16 billion last year to CNY 1.17 billion in the recent nine-month period ending September 2024, despite a significant drop in net income from CNY 91.38 million to CNY 52.75 million year-over-year. The company's commitment to innovation is evident in its R&D spending trends, maintaining a robust investment despite financial headwinds—critical as it competes in the rapidly evolving tech landscape where continuous innovation is key to sustainability and growth. This strategy aligns with industry shifts towards more R&D-intensive operations as companies strive to stay ahead of technological advancements and market demands. Despite these efforts, B-SOFTLtd faces challenges reflected by its earnings forecast predicting an aggressive annual growth rate of 66.93% which appears optimistic given current performance metrics. However, with revenue expected to outpace the Chinese market's growth at an annual rate of 18.1%, there's potential for recovery and profitability if it can effectively capitalize on its R&D investments and navigate market volatilities efficiently.

- Delve into the full analysis health report here for a deeper understanding of B-SOFTLtd.

Examine B-SOFTLtd's past performance report to understand how it has performed in the past.

Taiyo Yuden (TSE:6976)

Simply Wall St Growth Rating: ★★★★☆☆

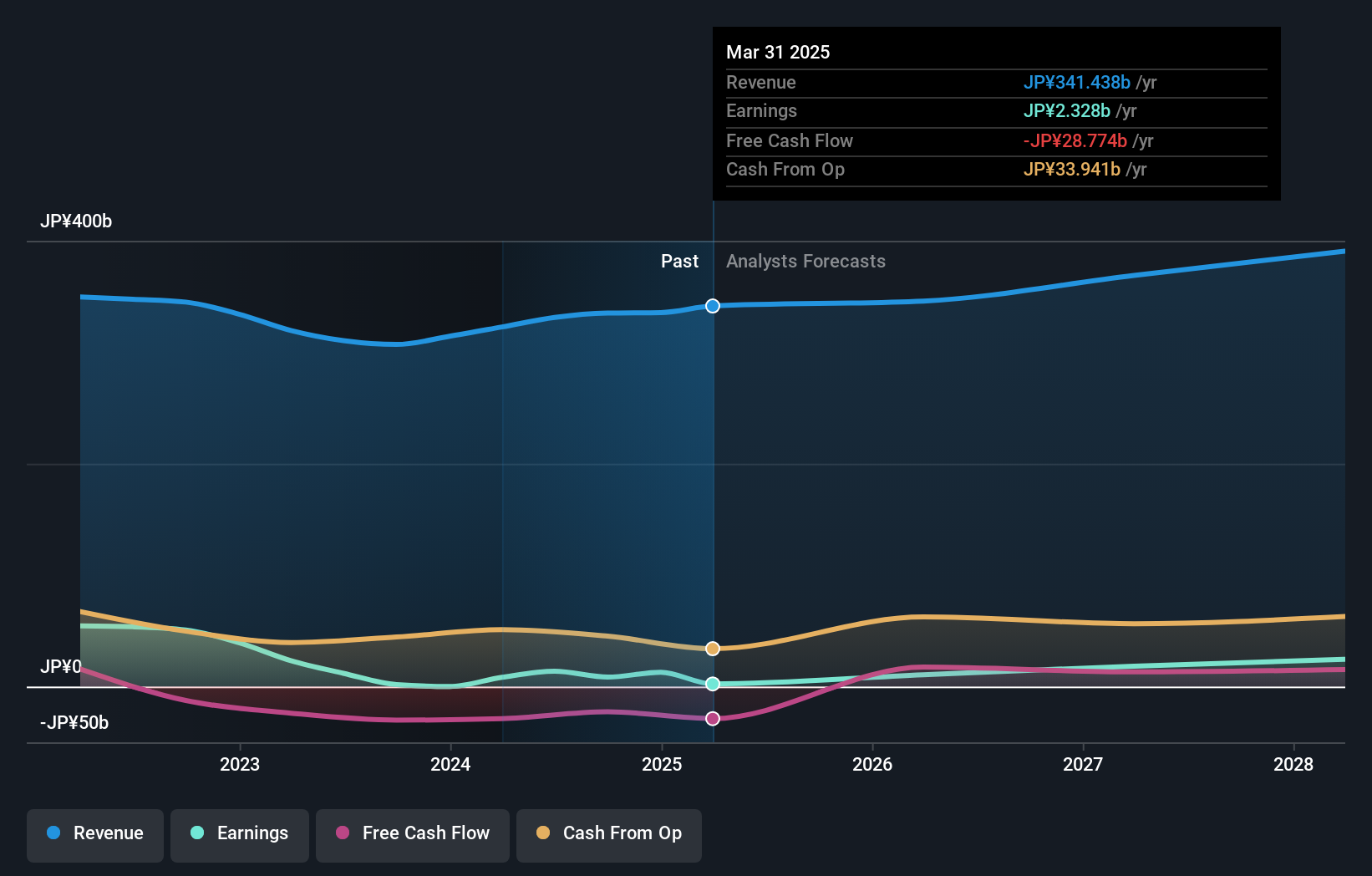

Overview: Taiyo Yuden Co., Ltd. is engaged in the development, manufacturing, and sale of electronic components with operations spanning Japan, China, Hong Kong, and international markets; it has a market capitalization of approximately ¥341.42 billion.

Operations: The company generates revenue primarily from its Electronic Components Business, amounting to ¥331.17 billion. Its operations are geographically diverse, covering Japan, China, Hong Kong, and international markets.

Taiyo Yuden, amidst a volatile market, showcases resilience with its earnings growth outpacing the electronic industry's average by 12.2% over the past year. The company's strategic commitment to R&D is evident as it channels substantial resources into innovation, spending {rd_expense_string} on research and development activities. This investment fuels a forecasted annual earnings growth of 25.3%, significantly above Japan's market average of 8.9%. Despite challenges in maintaining free cash flow positivity, Taiyo Yuden’s revenue growth projections remain robust at 6.6% annually, outperforming the broader Japanese market forecast of 4.2%. This blend of aggressive financial strategy and dedicated R&D expenditure positions Taiyo Yuden uniquely within its sector for potential future gains.

- Take a closer look at Taiyo Yuden's potential here in our health report.

Review our historical performance report to gain insights into Taiyo Yuden's's past performance.

Topcon (TSE:7732)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Topcon Corporation, along with its subsidiaries, engages in the development, manufacturing, and sale of positioning systems, eye care solutions, and smart infrastructure products across Japan and global markets; it has a market capitalization of ¥167.08 billion.

Operations: Topcon's business operations focus on three primary segments: positioning systems, eye care solutions, and smart infrastructure products. These segments cater to both domestic and international markets.

Topcon, amidst a challenging market, has demonstrated a strategic focus on growth and innovation. The company's recent collaboration with BeeKeeperAI to enhance healthcare imaging analytics underscores its commitment to integrating advanced AI technologies, which could significantly shorten the time-to-market for new healthcare solutions in the U.S. This move aligns with Topcon's robust R&D spending aimed at fostering innovation across its segments. Financially, Topcon is poised for substantial growth with earnings expected to surge by 29.9% annually and revenue forecasts indicating a 6% yearly increase, outpacing the broader Japanese market projections of 4.2%. These figures reflect not only Topcon’s resilience but also its potential to capitalize on emerging technological trends within the healthcare sector.

- Get an in-depth perspective on Topcon's performance by reading our health report here.

Gain insights into Topcon's past trends and performance with our Past report.

Taking Advantage

- Click this link to deep-dive into the 1282 companies within our High Growth Tech and AI Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiyo Yuden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6976

Taiyo Yuden

Develops, manufactures, and sells electronic components in Japan, China, Hong Kong, and internationally.

Excellent balance sheet with reasonable growth potential.