- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6996

Home Product Center And 2 Other Reliable Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a resurgence, driven by cooling inflation and robust bank earnings in the U.S., investors are increasingly seeking stable opportunities to capitalize on these positive trends. Amidst this backdrop, dividend stocks present an attractive option for those looking to enhance their portfolios with reliable income streams, particularly as core inflation shows signs of easing and economic optimism grows.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.50% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.02% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

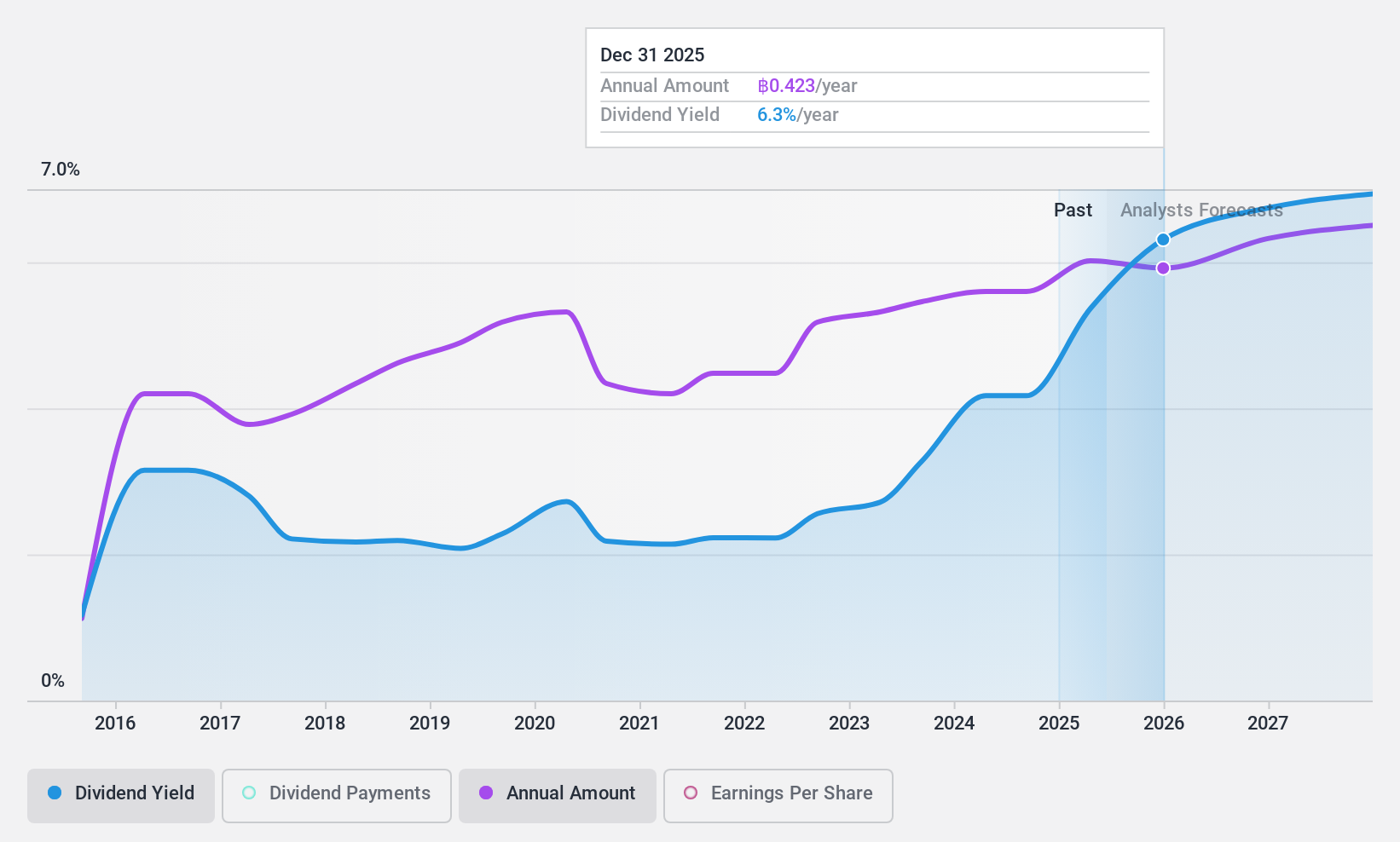

Home Product Center (SET:HMPRO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Home Product Center Public Company Limited is a home improvement retailer operating in Thailand, Malaysia, and Vietnam with a market cap of THB119.02 billion.

Operations: The company's revenue segment consists of Retail - Building Products, generating THB72.47 billion.

Dividend Yield: 4.4%

Home Product Center's dividend sustainability is supported by an earnings payout ratio of 81.7% and a cash payout ratio of 85.9%, indicating coverage by both earnings and cash flows. However, its dividend track record has been volatile over the past decade, with instances of significant annual drops. The recent financial performance showed a slight decline in sales and net income for Q3 2024 compared to the previous year, reflecting some challenges in revenue growth.

- Unlock comprehensive insights into our analysis of Home Product Center stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Home Product Center is priced lower than what may be justified by its financials.

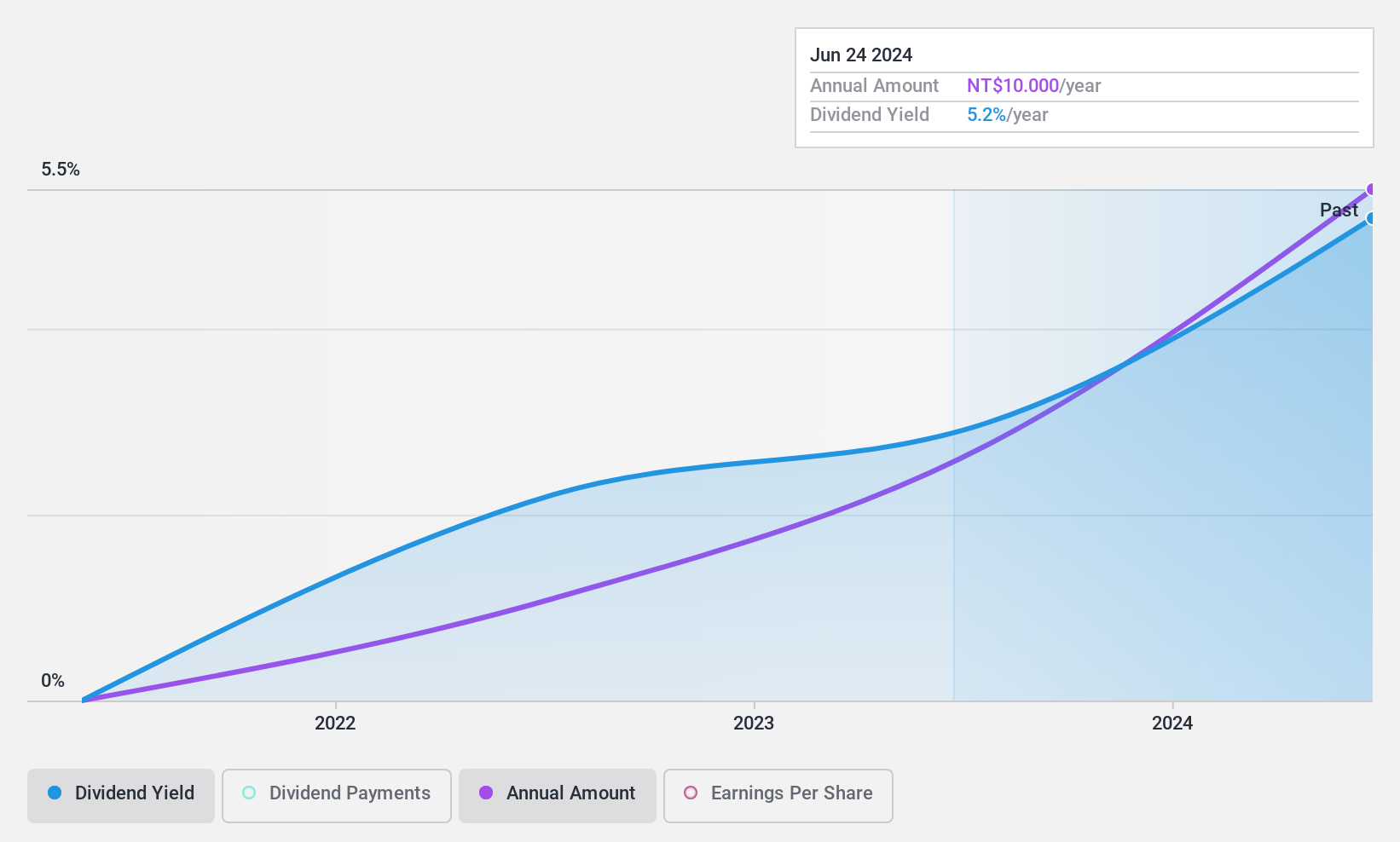

Taiwan Puritic (TPEX:6826)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Puritic Corp. operates in Taiwan, focusing on the sale and maintenance of integrated circuit semiconductors, electronics, and computer equipment products, with a market cap of NT$11.28 billion.

Operations: Taiwan Puritic Corp. generates revenue primarily from the installation of gas equipment, amounting to NT$15.99 billion.

Dividend Yield: 5.4%

Taiwan Puritic's dividend payments have been stable and reliable, with coverage from both earnings (44.1% payout ratio) and cash flows (69.2% cash payout ratio). Although dividends have only been paid for four years, they are growing, supported by strong earnings growth of 44.6% annually over the past five years. The dividend yield is competitive at 5.39%, placing it in the top quartile of Taiwan's market, while a low price-to-earnings ratio of 8.2x suggests potential value.

- Click to explore a detailed breakdown of our findings in Taiwan Puritic's dividend report.

- In light of our recent valuation report, it seems possible that Taiwan Puritic is trading beyond its estimated value.

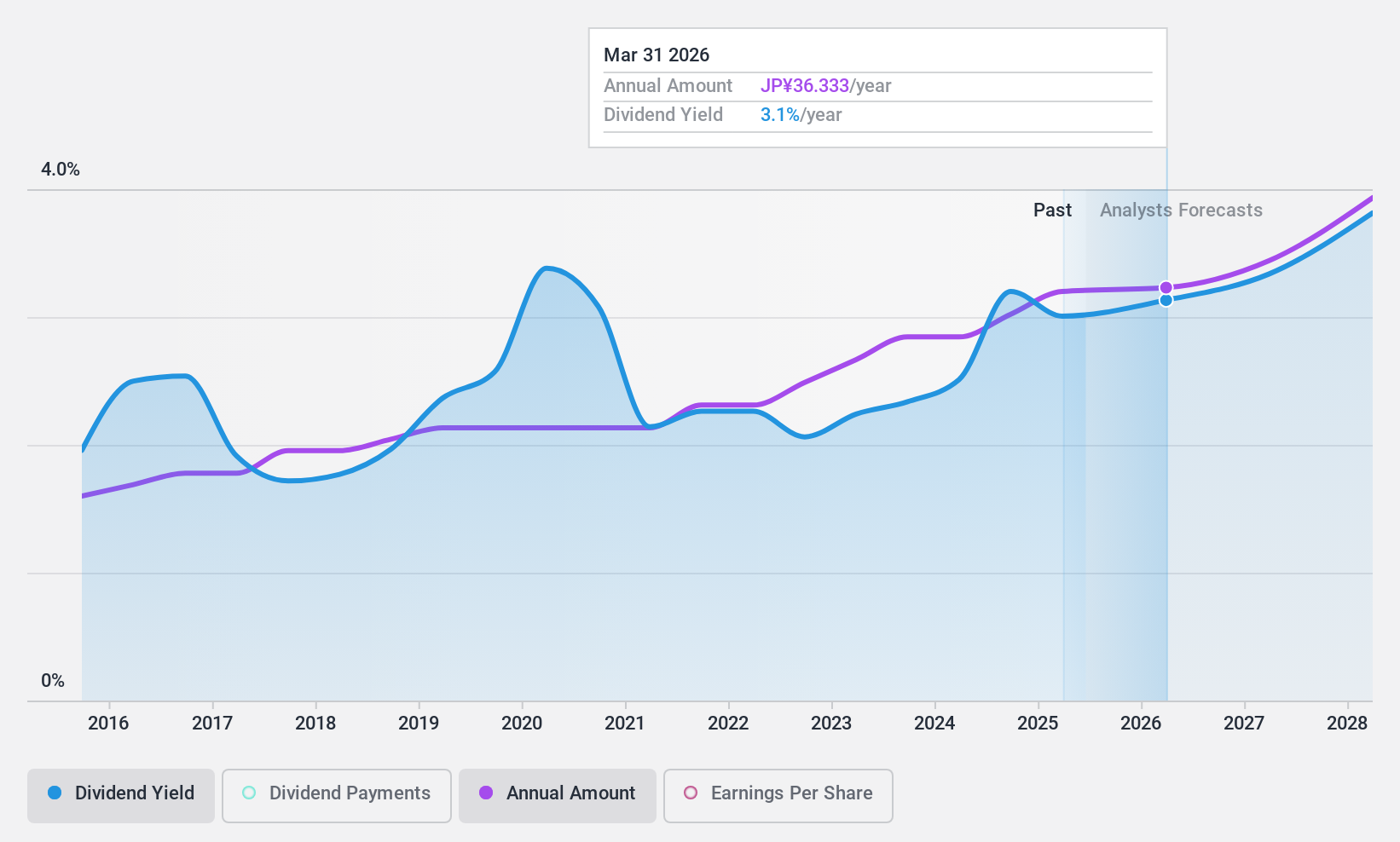

Nichicon (TSE:6996)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nichicon Corporation, with a market cap of ¥77.45 billion, manufactures and sells capacitors and circuit products for electric and electronic products across Japan, the United States, Europe, Asia, and internationally.

Operations: Nichicon Corporation's revenue is primarily derived from its Capacitor Business, generating ¥101.25 billion, and the NECST Business, contributing ¥73.15 billion.

Dividend Yield: 3%

Nichicon's dividend payments have been stable and growing over the past decade, yet its 3% yield is below Japan's top quartile. Despite trading at a good value, with a payout ratio of 37.1%, dividends are not covered by cash flows due to a high cash payout ratio of 353%. Profit margins have decreased from last year, impacting sustainability. Earnings are forecasted to grow annually by 10.23%, which may support future dividend stability.

- Navigate through the intricacies of Nichicon with our comprehensive dividend report here.

- According our valuation report, there's an indication that Nichicon's share price might be on the cheaper side.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 1983 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nichicon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6996

Nichicon

Manufactures and sells capacitors and circuit products for electric and electronic products in Japan, the United States, Europe, Asia, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives