- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6964

We Think That There Are More Issues For Sanko (TSE:6964) Than Just Sluggish Earnings

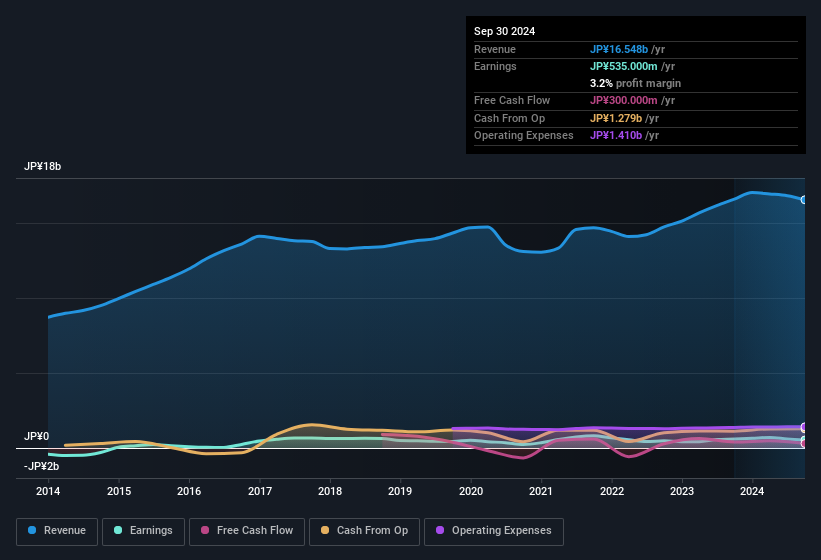

The subdued market reaction suggests that Sanko Co., Ltd.'s (TSE:6964) recent earnings didn't contain any surprises. However, we believe that investors should be aware of some underlying factors which may be of concern.

View our latest analysis for Sanko

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Sanko's profit received a boost of JP¥229m in unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. Sanko had a rather significant contribution from unusual items relative to its profit to September 2024. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Sanko.

Our Take On Sanko's Profit Performance

As we discussed above, we think the significant positive unusual item makes Sanko's earnings a poor guide to its underlying profitability. For this reason, we think that Sanko's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. Sadly, its EPS was down over the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've discovered 3 warning signs that you should run your eye over to get a better picture of Sanko.

Today we've zoomed in on a single data point to better understand the nature of Sanko's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6964

Sanko

Manufactures and sells pressed products, mechatronic parts, and plastic products used in automobiles, business machines, and digital home appliances in Japan.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)