- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6814

Undiscovered Gems With Promising Potential In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with major indices like the Nasdaq Composite reaching new heights while small-cap stocks, such as those in the Russell 2000 Index, face underperformance compared to their larger peers, investors are keenly observing economic indicators and central bank decisions that may impact future market dynamics. Amidst these conditions, identifying promising small-cap stocks requires careful consideration of factors such as growth potential and resilience in a cooling labor market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative (ENXTPA:CRAP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative offers a range of banking products and services in France, with a market capitalization of €587.75 million.

Operations: The company generates revenue primarily from its retail banking segment, amounting to €434.27 million.

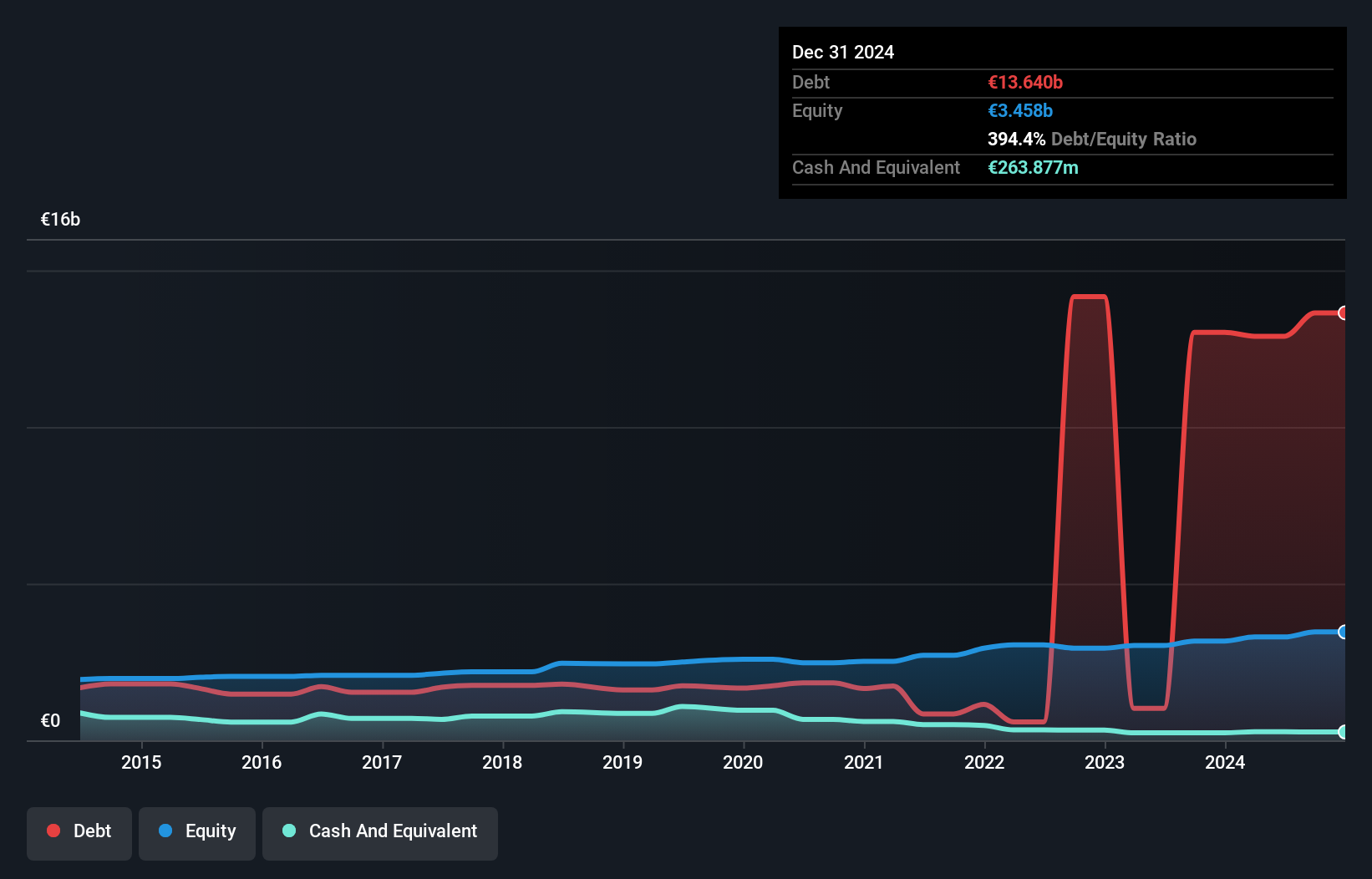

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence, a regional player with total assets of €26.2 billion and equity of €3.3 billion, showcases a solid financial base. Its allowance for bad loans stands at 109%, covering its 1.7% non-performing loan ratio effectively. Despite earnings growing at an impressive 17% annually over five years, recent growth of 5% aligns with the broader banking sector's pace. With total deposits of €9 billion against loans amounting to €18.8 billion, it trades significantly below its estimated fair value by about 64%, hinting at potential undervaluation in the market.

China Beststudy Education Group (SEHK:3978)

Simply Wall St Value Rating: ★★★★★★

Overview: China Beststudy Education Group offers after-school education services for K-12 students in China and has a market capitalization of HK$2.63 billion.

Operations: The primary revenue stream for China Beststudy Education Group is the provision of K-12 after-school education services, generating CN¥617.90 million.

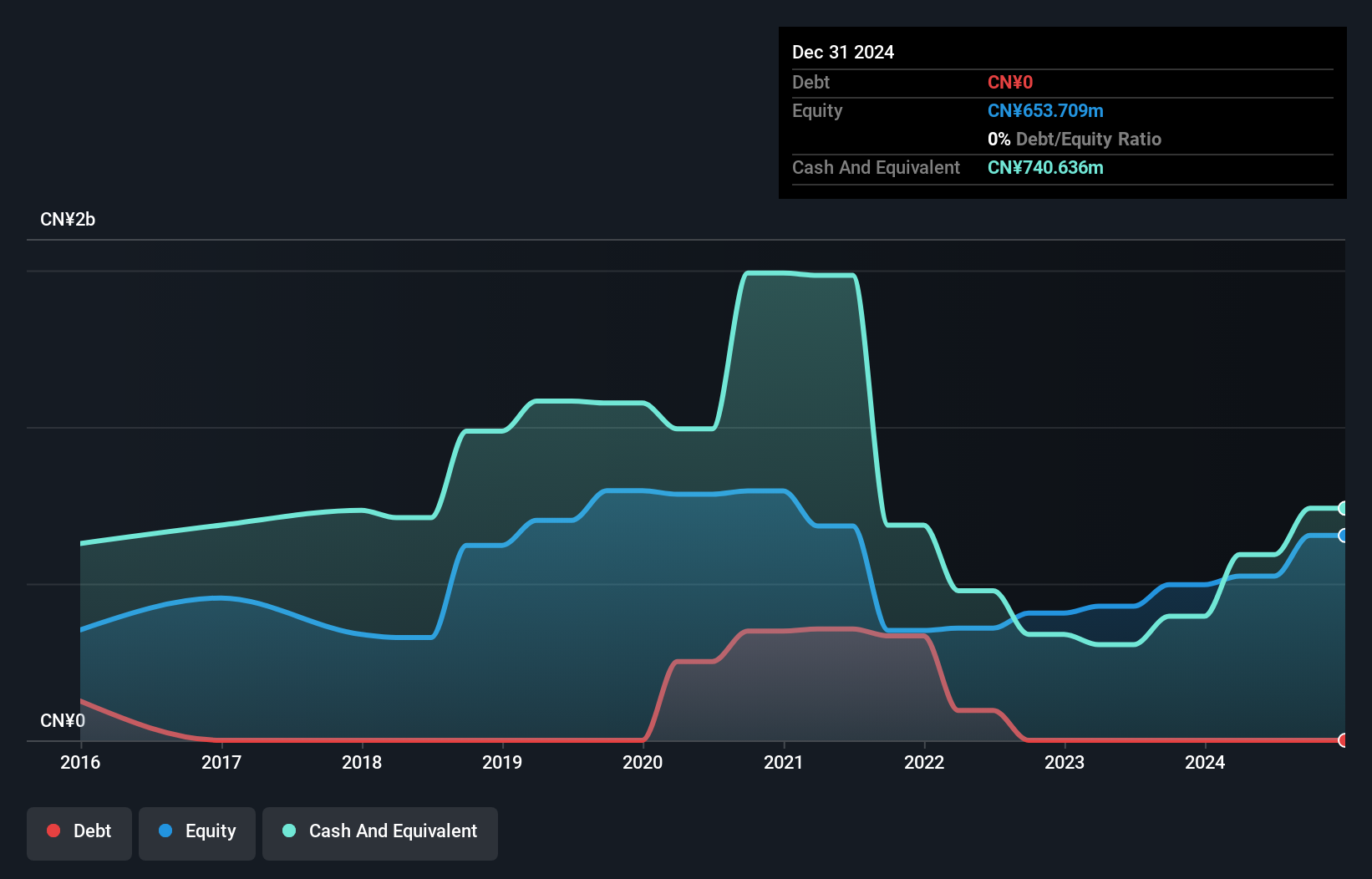

Beststudy Education Group is making waves with its impressive 73.5% earnings growth over the past year, outpacing the Consumer Services industry's 5.5%. The company is debt-free, eliminating concerns about interest coverage and enhancing financial flexibility. Trading at a significant discount of 96.8% below estimated fair value, it presents an intriguing opportunity for investors seeking undervalued assets. Recent board changes include Mr. Haipeng Shen's appointment as an independent director, bringing extensive educational experience to the table and potentially steering strategic initiatives forward. With forecasted earnings growth of 42.32% per year, Beststudy seems poised for continued expansion in its sector.

Furuno Electric (TSE:6814)

Simply Wall St Value Rating: ★★★★★★

Overview: Furuno Electric Co., Ltd. manufactures and sells marine and industrial electronics equipment, wireless LAN systems, and handy terminals across Japan, the Americas, Europe, Asia, and internationally with a market cap of ¥86.42 billion.

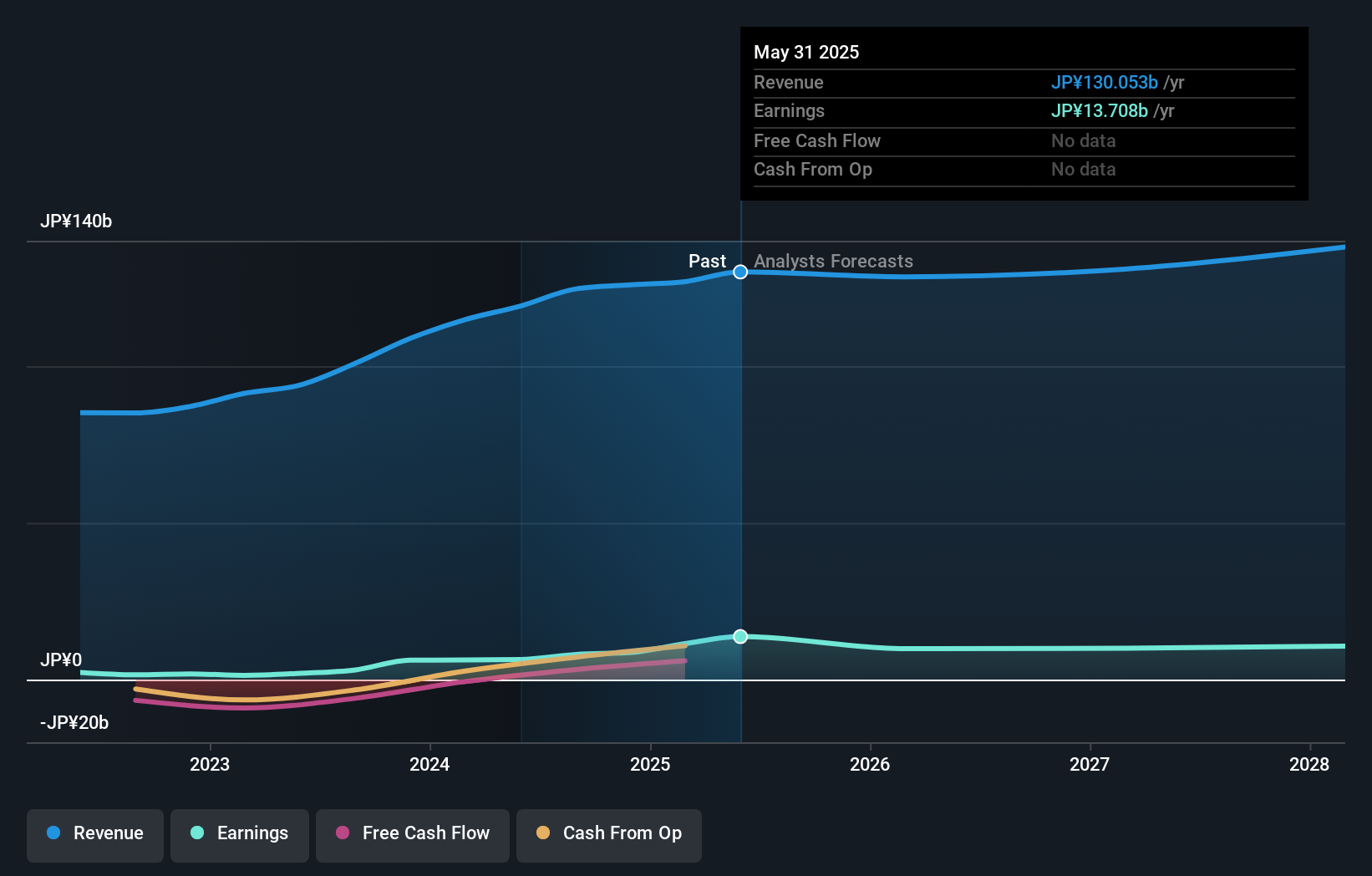

Operations: Furuno Electric generates revenue primarily from the sale of marine and industrial electronics, wireless LAN systems, and handy terminals. The company's net profit margin is 7.5%.

Furuno Electric, a small-cap player in the electronics sector, has seen significant earnings growth of 160% over the past year, outpacing its industry. This growth is backed by high-quality earnings and a satisfactory net debt to equity ratio of 4.5%, indicating prudent financial management. Despite trading at 64% below its estimated fair value, Furuno's share price has been quite volatile recently. The company's ability to cover interest payments comfortably suggests strong operational efficiency. However, looking ahead, earnings are projected to decrease by an average of 13% annually over the next three years, which may impact investor sentiment.

- Click here and access our complete health analysis report to understand the dynamics of Furuno Electric.

Evaluate Furuno Electric's historical performance by accessing our past performance report.

Make It Happen

- Get an in-depth perspective on all 4495 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6814

Furuno Electric

Engages in the manufacture and sale of marine and industrial electronics equipment, wireless LAN system, and handy terminals in Japan, the Americas, Europe, rest of Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.