- Japan

- /

- Trade Distributors

- /

- TSE:8002

Discovering 3 Leading Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape of interest rate cuts and mixed economic signals, investors are keenly observing the performance of major indices, with the Nasdaq Composite reaching new heights while others face declines. Amidst this backdrop, dividend stocks continue to attract attention as potential havens for steady income and long-term value. In such an environment, selecting dividend stocks that demonstrate resilience and consistent payouts can be a prudent strategy for those looking to balance growth with stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.12% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.58% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.00% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.96% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.42% | ★★★★★★ |

Click here to see the full list of 1829 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

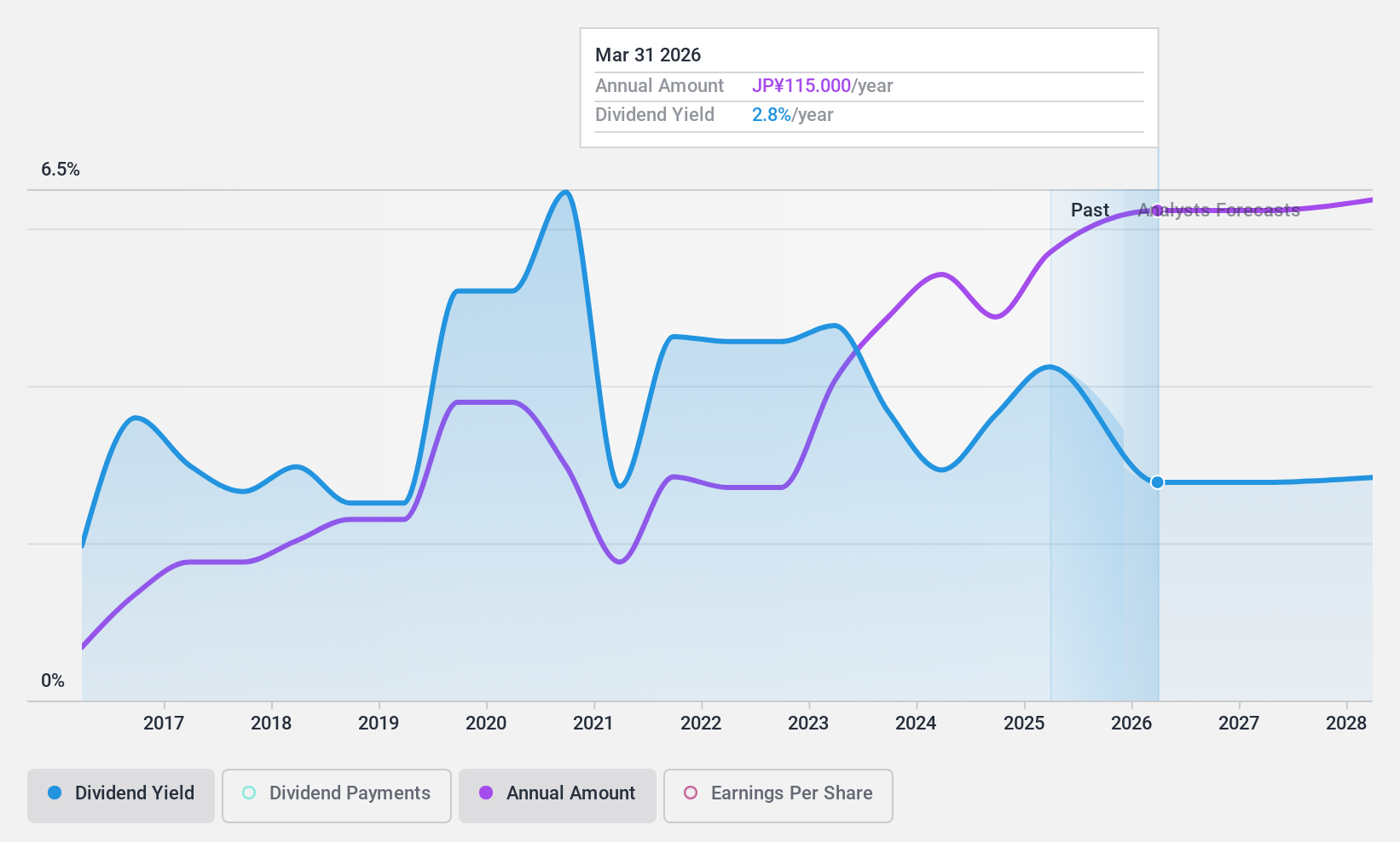

Krosaki Harima (TSE:5352)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Krosaki Harima Corporation, along with its subsidiaries, is engaged in the manufacturing and sale of refractory and ceramic products both in Japan and internationally, with a market capitalization of ¥81.33 billion.

Operations: I'm sorry, but the Business operations text you provided does not contain any revenue segment data for Krosaki Harima Corporation. If you have the specific revenue segment information, please share it so I can help summarize it for you.

Dividend Yield: 4.3%

Krosaki Harima's dividend payments are well-covered by earnings with a payout ratio of 33.8% and by cash flows at 64.8%, indicating sustainability despite an unstable track record over the past decade. The company's dividend yield of 4.35% is among the top in Japan, although its history has been marked by volatility with periods of significant annual drops. Trading at a good value relative to peers, it presents potential for income-focused investors.

- Delve into the full analysis dividend report here for a deeper understanding of Krosaki Harima.

- Our expertly prepared valuation report Krosaki Harima implies its share price may be lower than expected.

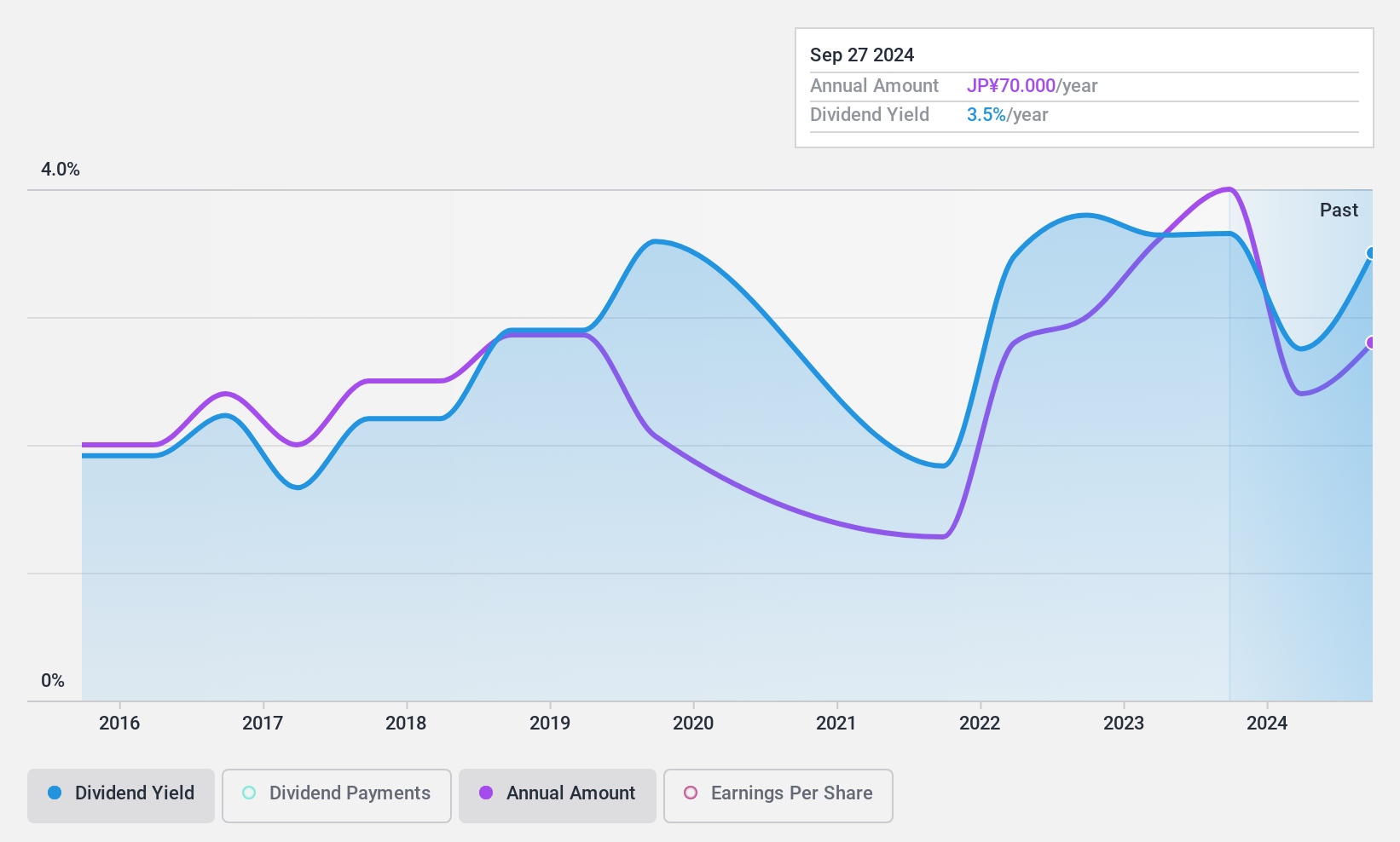

Sanyo Special Steel (TSE:5481)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanyo Special Steel Co., Ltd. and its subsidiaries manufacture and sell special steel products both in Japan and internationally, with a market cap of ¥98.67 billion.

Operations: Sanyo Special Steel Co., Ltd. generates revenue through its segments, with Steel Products contributing ¥321.51 billion, Formed and Fabricated Materials accounting for ¥18.30 billion, and Metal Powders adding ¥5.40 billion.

Dividend Yield: 3.9%

Sanyo Special Steel's dividend payments are covered by earnings with a payout ratio of 50.9% and cash flows at 24.1%, reflecting sustainability despite a history of volatility over the past decade. The recent reduction in dividends from ¥35 to ¥20 per share highlights ongoing instability. Although trading below estimated fair value, its profit margins have decreased compared to last year, raising concerns about long-term reliability for income-focused investors.

- Click here to discover the nuances of Sanyo Special Steel with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Sanyo Special Steel's current price could be quite moderate.

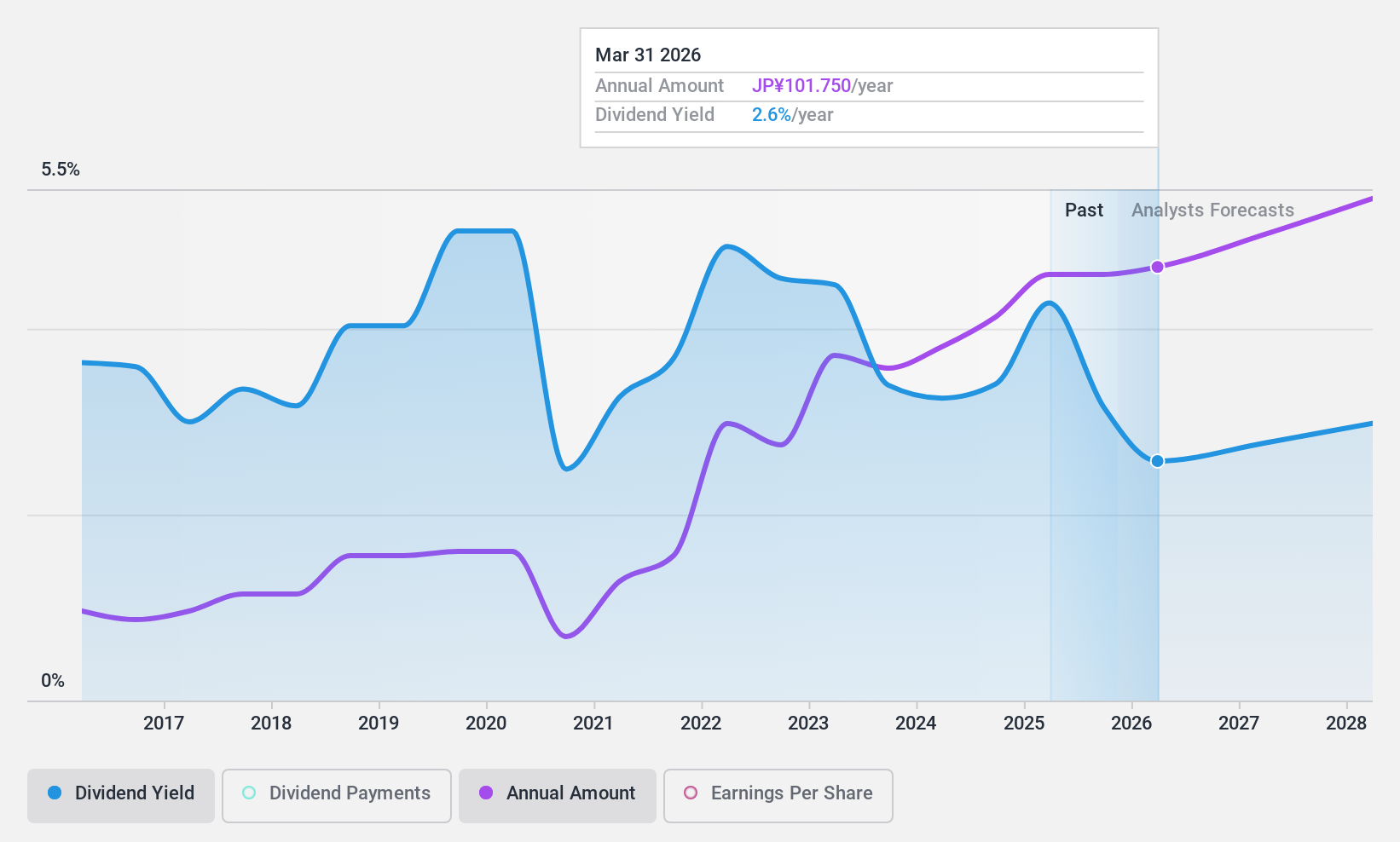

Marubeni (TSE:8002)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marubeni Corporation engages in the purchasing, distribution, and marketing of industrial and consumer goods, with a market cap of ¥3.73 trillion.

Operations: Marubeni Corporation's revenue segments include Power (¥396.59 million), Energy (¥801.89 million), Food I (¥907.11 million), Food II (¥1.05 billion), Chemicals (¥584.45 million), Lifestyle (¥203.32 million), IT Solutions (¥390.92 million), Agri Business (¥1.42 billion), Forest Products (¥247.25 million), Aerospace & Ship (¥138.06 million), Infrastructure Project (¥34.50 million), Metals & Mineral Resources (¥579.06 million), Finance, Leasing & Real Estate Business (¥53.35 million) and Construction, Industrial Machinery & Mobility which generates ¥556.14 million in revenue, while next Generation Business Development contributes ¥22.95 million to its financials.

Dividend Yield: 4%

Marubeni's dividend yield is among the top 25% in Japan, supported by a low payout ratio of 32.3% and cash coverage at 48.5%, indicating sustainability despite historical volatility. Recent leadership changes, including Masayuki Omoto's upcoming CEO appointment, may influence strategic direction but do not directly impact dividends. The stock trades slightly below fair value with expectations for earnings growth; however, past dividend unreliability remains a concern for income investors seeking stability.

- Take a closer look at Marubeni's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Marubeni is trading behind its estimated value.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1829 Top Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8002

Marubeni

Marubeni Corporation purchases, distributes, and markets industrial and consumer goods.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives