In December 2024, global markets are navigating a complex landscape with the Nasdaq Composite reaching new heights, while small-cap stocks face challenges as evidenced by the Russell 2000's underperformance against larger indices. Amidst expectations of an imminent Federal Reserve rate cut and a cooling labor market, investors are keenly observing high-growth tech stocks that demonstrate resilience and potential in this dynamic environment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1249 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Bioneer (KOSDAQ:A064550)

Simply Wall St Growth Rating: ★★★★★★

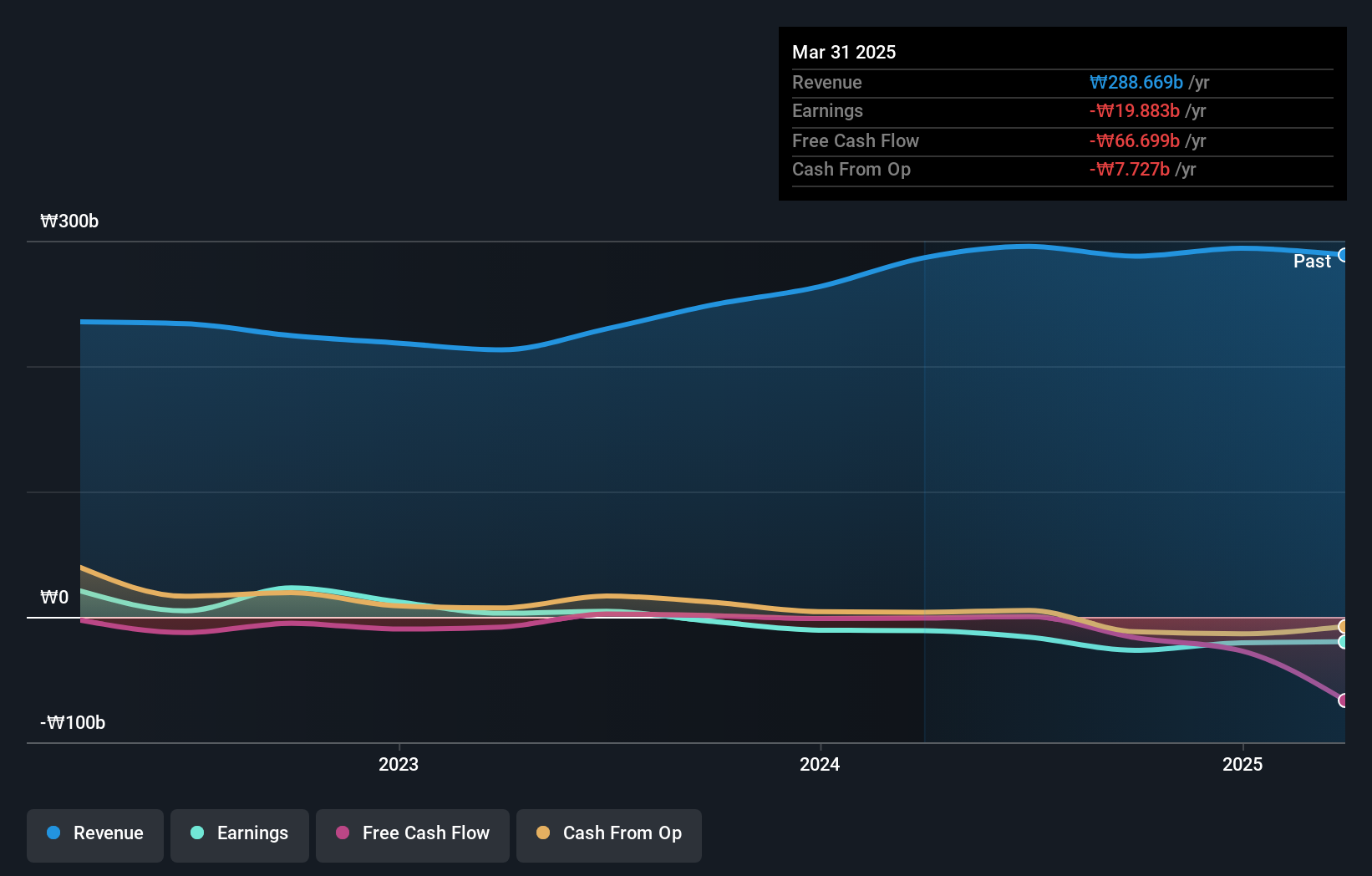

Overview: Bioneer Corporation is a biotechnology company with operations in South Korea and internationally, holding a market cap of ₩518.79 billion.

Operations: Bioneer Corporation generates revenue through its biotechnology operations across various regions, including South Korea, the Americas, Europe, Asia, and Africa.

Bioneer, despite recent setbacks with a net loss reported in the third quarter of 2024, shows promise with an expected revenue growth of 26.1% per year, outpacing the South Korean market average of 9%. This growth is complemented by an anticipated shift to profitability within three years, showcasing potential resilience and adaptability in its operational strategy. The company's commitment to enhancing corporate value was evident from special calls held in December 2024 aimed at deepening stakeholder understanding of its business model. With R&D expenses not specified but integral to its recovery and future profitability, Bioneer appears poised for a turnaround bolstered by strategic planning and market foresight.

- Click here and access our complete health analysis report to understand the dynamics of Bioneer.

Evaluate Bioneer's historical performance by accessing our past performance report.

EuBiologics (KOSDAQ:A206650)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EuBiologics Co., Ltd. is a biopharmaceutical company that develops vaccines for epidemics in South Korea and has a market cap of approximately ₩465.08 billion.

Operations: EuBiologics generates revenue primarily from its pharmaceuticals segment, which amounts to approximately ₩69.37 billion.

EuBiologics, a contender in the biotech sector, is navigating a landscape marked by rapid expansion and innovation. With an impressive annual revenue growth rate of 21.9%, the company outstrips the South Korean market's average of 9%. This growth trajectory is bolstered by an anticipated earnings surge of 66.3% per year, positioning EuBiologics well above many peers in terms of profitability forecasts. Significantly, its commitment to research and development (R&D) underscores its potential for sustained innovation and market competitiveness; however, specific R&D expenditure figures are not detailed in this summary. Looking ahead, EuBiologics is expected to pivot to profitability within three years—a testament to its strategic initiatives and robust operational framework amidst volatile market conditions.

Plus Alpha ConsultingLtd (TSE:4071)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plus Alpha Consulting Co., Ltd. is a company that offers marketing solutions and has a market capitalization of ¥81.67 billion.

Operations: The company generates revenue primarily from HR Solutions and Marketing Solutions, with HR Solutions contributing ¥10.13 billion and Marketing Solutions adding ¥3.78 billion.

Plus Alpha ConsultingLtd. has demonstrated a robust financial performance with an 18.1% earnings growth over the past year, surpassing the software industry's average of 13.5%. This growth is supported by strategic share repurchases totaling ¥3,000 million to enhance shareholder value and capital efficiency, reflecting a proactive management approach in adapting to market dynamics. The company also forecasts a revenue increase to JPY 17,730 million and an operating profit of JPY 5,600 million for FY2025, underlining its potential for sustained profitability and market presence amidst evolving tech landscapes.

- Delve into the full analysis health report here for a deeper understanding of Plus Alpha ConsultingLtd.

Assess Plus Alpha ConsultingLtd's past performance with our detailed historical performance reports.

Make It Happen

- Click through to start exploring the rest of the 1246 High Growth Tech and AI Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4071

Flawless balance sheet and good value.