- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6814

How Investors Are Reacting To Furuno Electric (TSE:6814) Upward Forecasts on Marine Segment Momentum

Reviewed by Sasha Jovanovic

- Earlier this month, Furuno Electric Co., Ltd. revised its financial forecasts upward, attributing the change to robust sales in the merchant vessel market and strong demand for new products in the pleasure boat segment.

- A notable contributor to the revised outlook was a reduction in tax expenses, which further signaled improved momentum in the company's core marine business.

- We'll explore how Furuno Electric's marine business growth, especially in merchant vessels and pleasure boats, shapes its investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

What Is Furuno Electric's Investment Narrative?

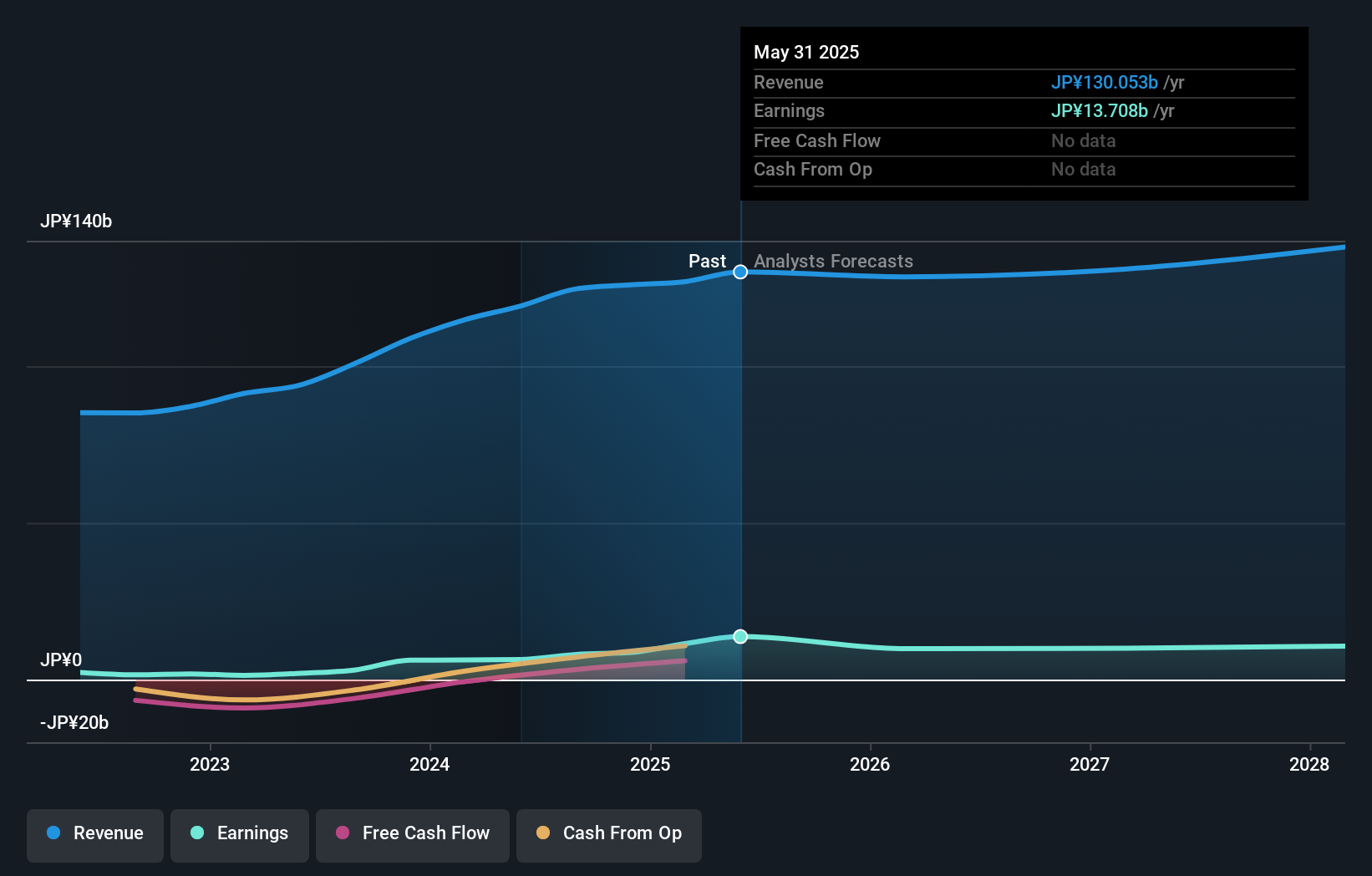

If you’re considering Furuno Electric, the big picture hinges on sustained momentum in its marine segment, particularly via merchant vessel and pleasure boat markets. The recent upward revision to financial forecasts puts fresh attention on short-term catalysts such as stronger demand and improved margins, supported by reduced tax expenses. This update could temporarily offset earlier analyst concerns about slow revenue growth and shrinking earnings over the next three years. While the business now appears to have firmer footing than previous analysis suggested, keep in mind profit growth is not expected to keep pace with industry peers long term, and the share price still trades above some fair value estimates. The revised outlook may dampen caution from earlier risk assessments, but dividend sustainability and earnings visibility remain front of mind for investors trying to balance recent wins with persistent uncertainty. In contrast, the company’s dividend consistency still poses a concern that investors should be aware of.

Furuno Electric's share price has been on the slide but might be up to 40% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore another fair value estimate on Furuno Electric - why the stock might be worth 29% less than the current price!

Build Your Own Furuno Electric Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Furuno Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Furuno Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Furuno Electric's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6814

Furuno Electric

Manufactures and sells marine and industrial electronics equipment, wireless LAN system, and handheld terminal in Japan, the Americas, Europe, rest of Asia, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives