- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6814

Furuno Electric (TSE:6814) Is Up 9.2% After Raising FY26 Q2 Forecasts on Strong Marine Sales – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

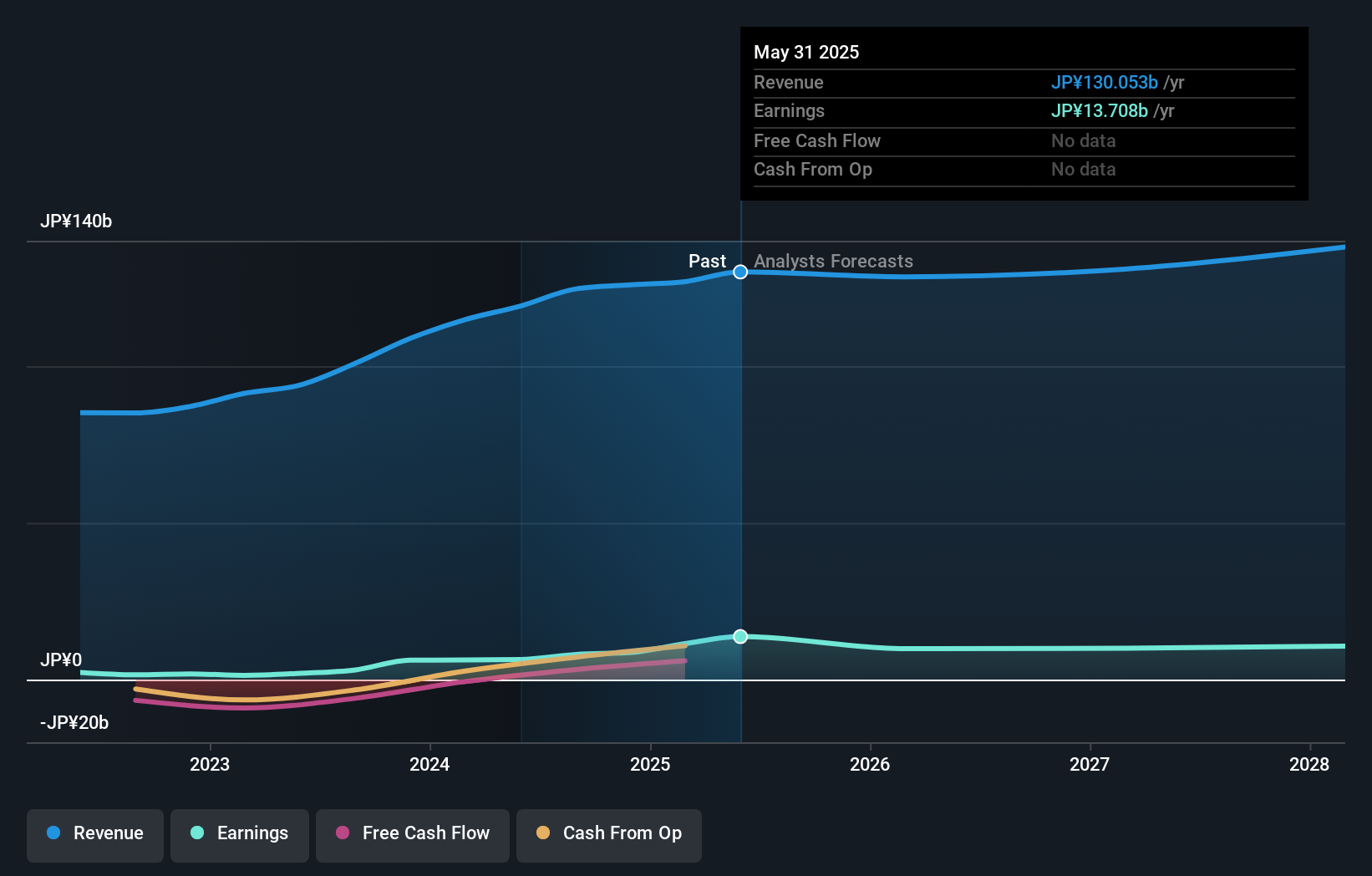

- Furuno Electric recently announced a substantial upward revision to its fiscal 2026 second quarter earnings and dividend forecasts, attributing the change to strong marine business sales, especially from higher merchant vessel deliveries and successful new products in the pleasure boat segment, alongside lower interim tax expenses.

- This adjustment follows positive momentum from both international market dynamics, such as increased demand influenced by U.S. tariff changes, and favorable tax policy impacts.

- We’ll consider how Furuno Electric’s marine business strength, especially from accelerated shipbuilder activity in China, reinforces its investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is Furuno Electric's Investment Narrative?

To be a Furuno Electric shareholder, you need to believe that recent momentum in the marine business, driven by surging merchant vessel orders from Chinese shipbuilders and robust uptake in pleasure boats, can provide a strong foundation for near-term performance and help offset longer-term concerns. The sharp upward earnings revision, together with the planned dividend increase, has likely altered the suite of short-term catalysts: instead of market caution around fading demand or earnings declines, attention will focus on sustained order strength in shipping and the company's capability to convert regulatory tailwinds, like U.S. tariff-driven demand and lower interim taxes, into tangible profit. However, the news does not erase all risks; concerns around the sustainability of this demand bulge, and analyst projections for earnings to decline in coming years, remain. As the share price has shown significant volatility and now trades well above past analyst targets, risk from profit normalization or margin pressures may take on greater importance after this upbeat news.

But even with results trending up, the sustainability of shipping orders remains crucial for investors to consider.

Exploring Other Perspectives

Explore another fair value estimate on Furuno Electric - why the stock might be worth over 3x more than the current price!

Build Your Own Furuno Electric Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Furuno Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Furuno Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Furuno Electric's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6814

Furuno Electric

Manufactures and sells marine and industrial electronics equipment, wireless LAN system, and handheld terminal in Japan, the Americas, Europe, rest of Asia, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)