- Thailand

- /

- Marine and Shipping

- /

- SET:RCL

Discover 3 Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks, driven by expectations of economic growth and tax reforms following a political shift, small-cap indices like the Russell 2000 have shown notable gains. This environment creates an intriguing backdrop for investors seeking opportunities among smaller companies that may benefit from potential regulatory changes and fiscal policies. Identifying promising stocks often involves looking for those with strong fundamentals, innovative business models, or unique market positions that could thrive in evolving economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Lion Capital | NA | 21.26% | 24.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Regional Container Lines (SET:RCL)

Simply Wall St Value Rating: ★★★★★★

Overview: Regional Container Lines Public Company Limited, along with its subsidiaries, operates feeder and vessel services in Thailand, Singapore, Hong Kong, and China with a market cap of THB22.58 billion.

Operations: Regional Container Lines generates revenue primarily through its feeder and vessel operations across Thailand, Singapore, Hong Kong, and China. The company focuses on cost management to optimize its financial performance.

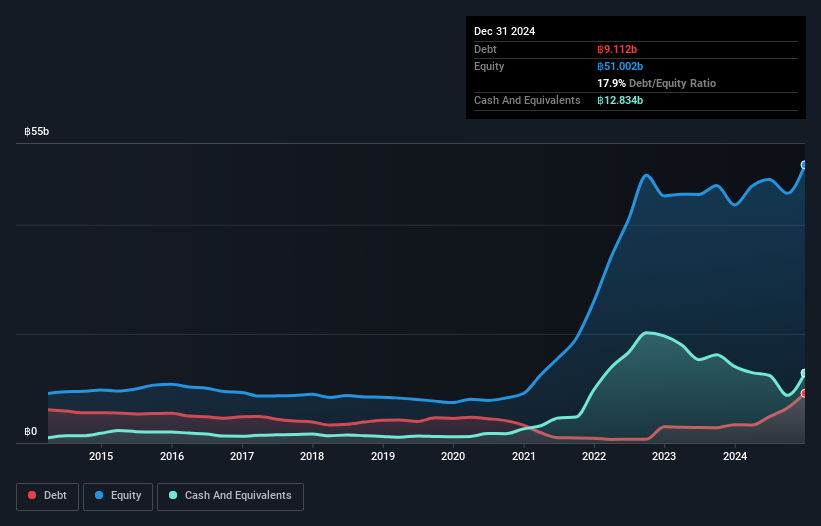

Regional Container Lines, a promising player in the shipping industry, has demonstrated significant financial improvement. Its debt to equity ratio impressively decreased from 60.3% to 14% over five years, indicating stronger financial health. The company's earnings growth of 12.6% outpaced the shipping industry's -6.4%, showcasing its robust performance amidst sector challenges. RCL's price-to-earnings ratio stands at an attractive 4.3x compared to the Thai market's average of 14.6x, suggesting potential undervaluation. Recent results highlight revenue of THB 11 billion and net income of THB 4 billion for Q3, reflecting substantial year-on-year growth and reinforcing its competitive edge in a volatile market environment.

Hochiki (TSE:6745)

Simply Wall St Value Rating: ★★★★★★

Overview: Hochiki Corporation is involved in the research, development, manufacturing, sale, consulting, engineering, design, and maintenance of fire alarm systems as well as information and communication technology, fire extinguishing solutions, and security systems both in Japan and globally with a market cap of approximately ¥59.96 billion.

Operations: Hochiki generates revenue primarily from the sale and maintenance of fire alarm, information and communication, fire extinguishing, and security systems. The company's net profit margin has shown notable fluctuations over recent periods.

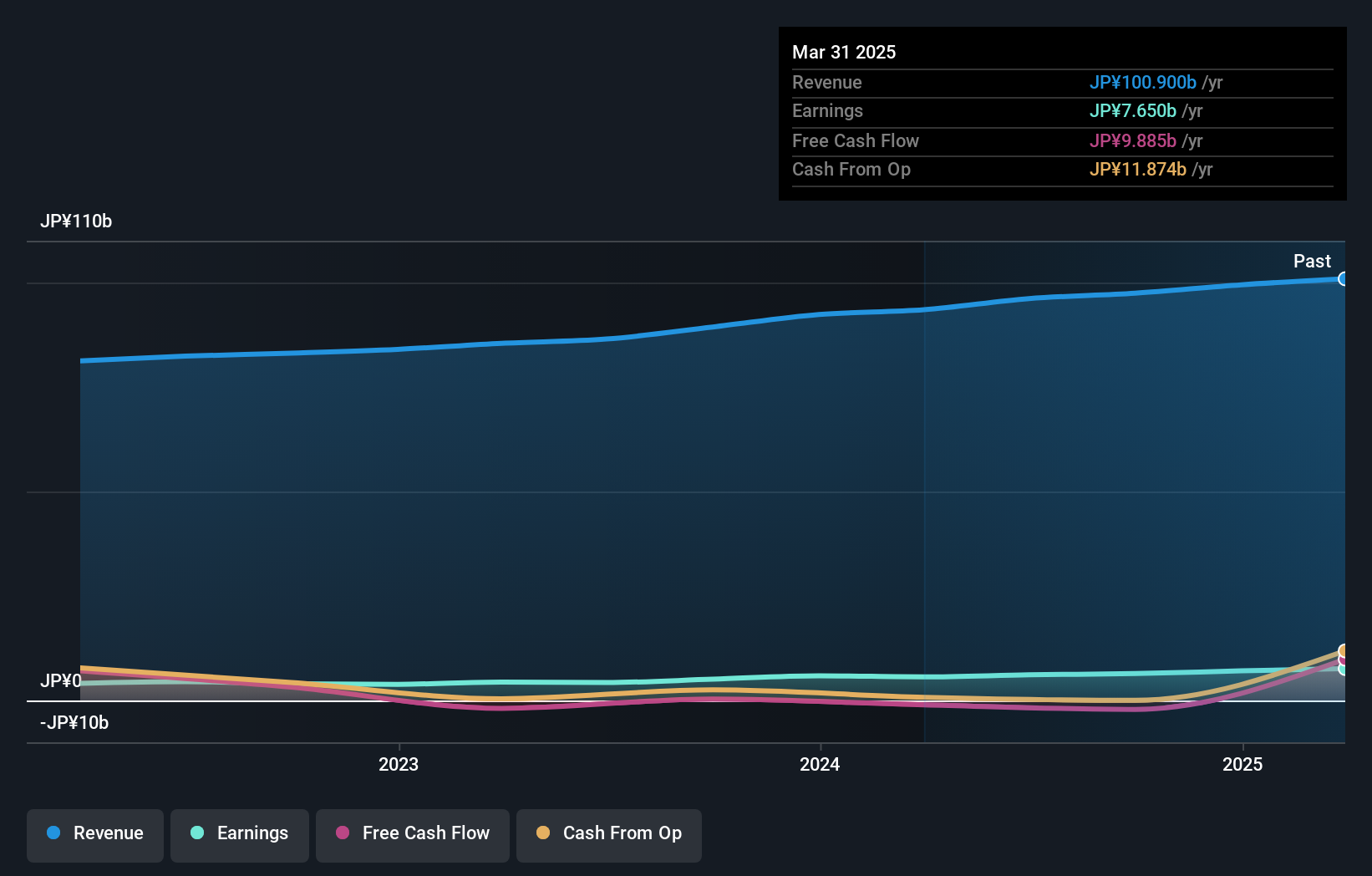

Hochiki's recent performance highlights its potential as a hidden treasure in the market. With no debt compared to five years ago when the debt-to-equity ratio was 2.2, it's clear that financial stability is a priority. The company boasts high-quality earnings and has outpaced the electronics industry with a notable 26% earnings growth over the past year, while maintaining a price-to-earnings ratio of 9x, below Japan's market average of 13x. Despite these positives, Hochiki faces some challenges ahead with projected earnings decline averaging 0.9% annually over three years and share price volatility in recent months potentially impacting investor sentiment.

- Click here and access our complete health analysis report to understand the dynamics of Hochiki.

Gain insights into Hochiki's past trends and performance with our Past report.

Nippon Avionics (TSE:6946)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nippon Avionics Co., Ltd. specializes in the manufacturing and sale of micro joining equipment in Japan, with a market capitalization of approximately ¥40.40 billion.

Operations: Nippon Avionics generates revenue primarily from its Information Systems segment, which accounts for ¥14.72 billion, and its Electronic Systems segment, including infrared rays and measurement equipment, contributing ¥3.77 billion.

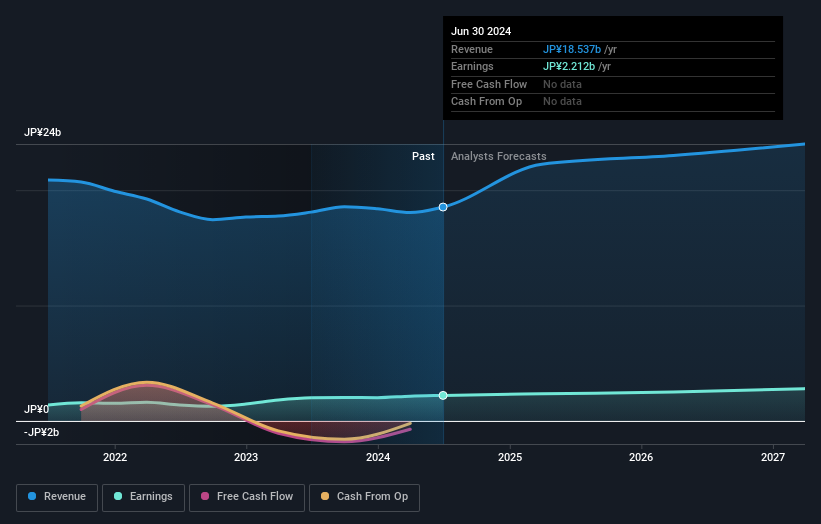

Nippon Avionics, a player in the electronics sector, has been making waves with its addition to the S&P Global BMI Index. The company boasts high-quality earnings and a satisfactory net debt to equity ratio of 28.8%, showcasing financial prudence. Over the past year, earnings rose by 5.3%, outpacing the industry average of -0.3%. Although free cash flow isn't positive, interest payments are well-covered with EBIT at 67 times interest expenses. Despite recent share price volatility, this small cap's forecasted annual earnings growth of nearly 14% paints an optimistic picture for future performance in its niche market segment.

Turning Ideas Into Actions

- Get an in-depth perspective on all 4676 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:RCL

Regional Container Lines

Engages in the feeder and vessel operations in Thailand, Singapore, Hong Kong, and the People’s Republic of China.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives