- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6663

Taiyo TechnolexLtd (TSE:6663) Is Due To Pay A Dividend Of ¥3.00

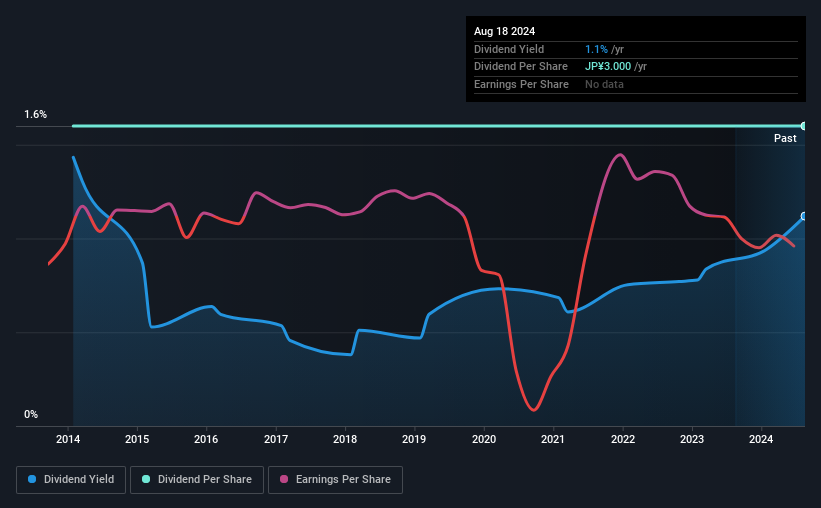

Taiyo Technolex Co.,Ltd. (TSE:6663) has announced that it will pay a dividend of ¥3.00 per share on the 18th of March. This means the annual payment will be 1.1% of the current stock price, which is lower than the industry average.

See our latest analysis for Taiyo TechnolexLtd

Taiyo TechnolexLtd's Distributions May Be Difficult To Sustain

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. While Taiyo TechnolexLtd is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Over the next year, EPS could expand by 29.8% if recent trends continue. We like to see the company moving towards profitability, but this probably won't be enough for it to post positive net income this year. The healthy cash flows are definitely as good sign, though so we wouldn't panic just yet, especially with the earnings growing.

Taiyo TechnolexLtd Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The most recent annual payment of ¥3.00 is about the same as the annual payment 10 years ago. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

The Company Could Face Some Challenges Growing The Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Taiyo TechnolexLtd has seen EPS rising for the last five years, at 30% per annum. While the company hasn't yet recorded a profit, the growth rates are healthy. If profitability can be achieved soon and growth continues apace, this stock could certainly turn into a solid dividend payer.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Taiyo TechnolexLtd's payments, as there could be some issues with sustaining them into the future. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for Taiyo TechnolexLtd that you should be aware of before investing. Is Taiyo TechnolexLtd not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Taiyo TechnolexLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6663

Taiyo TechnolexLtd

Engages in the manufacture and sale of flexible printed circuit in Japan, China, Thailand, rest of Asia, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)