- Canada

- /

- Healthtech

- /

- TSX:VHI

Exploring 3 High Growth Tech Stocks For Potential Portfolio Strength

Reviewed by Simply Wall St

Amidst a backdrop of global market fluctuations driven by tariff uncertainties and mixed economic indicators, the tech sector continues to capture investor interest with its potential for high growth. In this environment, identifying stocks with strong fundamentals and innovative capabilities can be crucial for enhancing portfolio resilience and capitalizing on emerging opportunities in the tech landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 1215 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

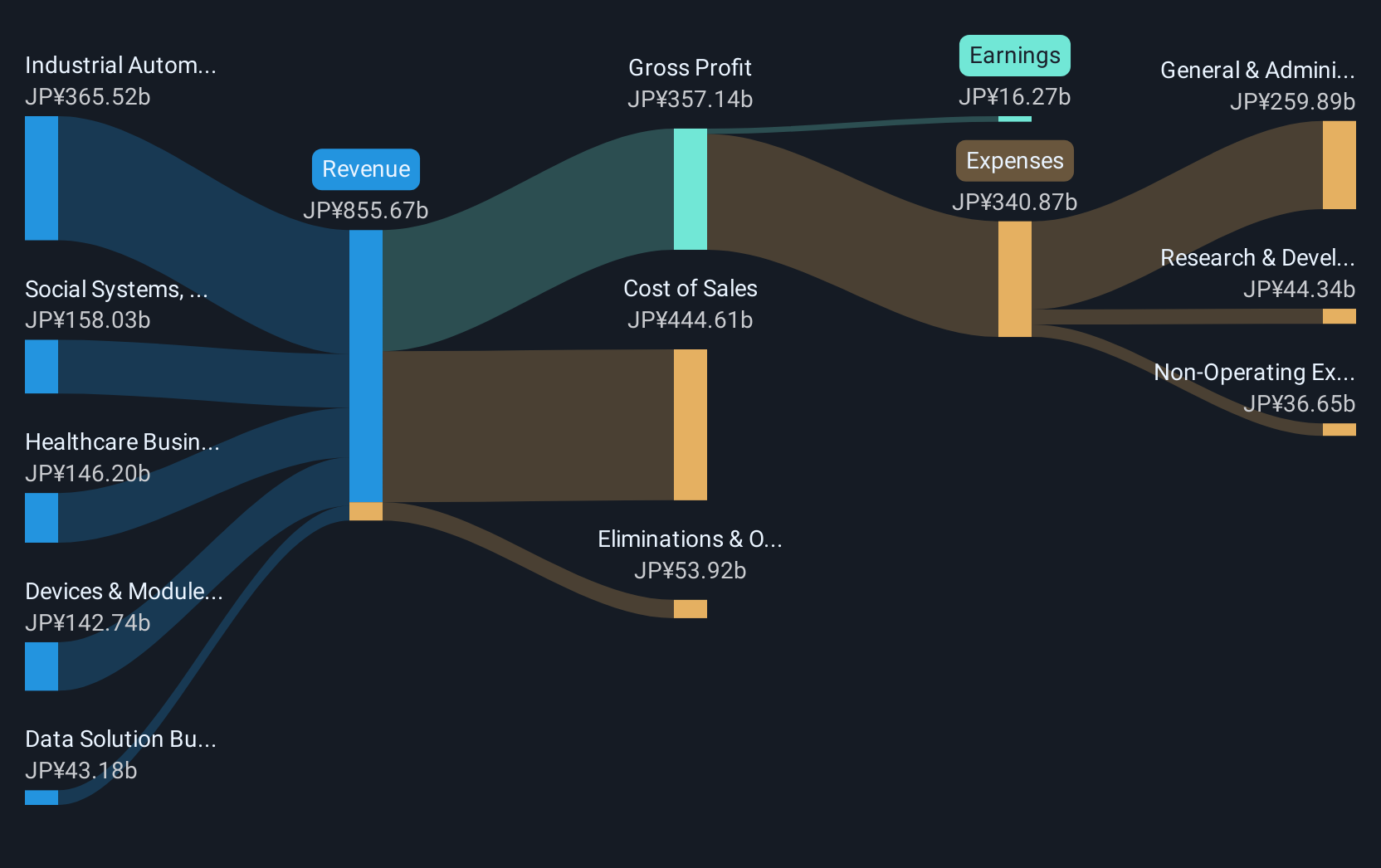

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors with a market capitalization of ¥958.88 billion.

Operations: OMRON Corporation generates revenue primarily from its Industrial Automation Business, which contributes ¥362.56 billion, followed by the Social Systems, Solutions and Service Business at ¥157.64 billion. The Healthcare Business and Devices & Module Solutions Business add ¥148.58 billion and ¥139.57 billion respectively to its revenue streams.

OMRON has recently revised its earnings guidance upwards, reflecting a robust operational stance with expected net income rising to JPY 12,500 million from an earlier forecast of JPY 11,000 million. This adjustment underscores a promising trajectory in profitability amid competitive tech landscapes. Notably, the company's commitment to innovation is evident from its R&D spending trends which are crucial for sustaining growth in the dynamic electronics sector. Despite challenges in achieving high revenue growth rates compared to some industry peers, OMRON's strategic financial maneuvers like the recent fixed-income offerings totaling JPY 40 billion suggest a proactive approach to financing its future expansions and potentially boosting shareholder returns. The company's focus on enhancing operational efficiencies and expanding market reach could position it favorably within the tech industry’s evolving framework.

- Delve into the full analysis health report here for a deeper understanding of OMRON.

Evaluate OMRON's historical performance by accessing our past performance report.

Wacom (TSE:6727)

Simply Wall St Growth Rating: ★★★★☆☆

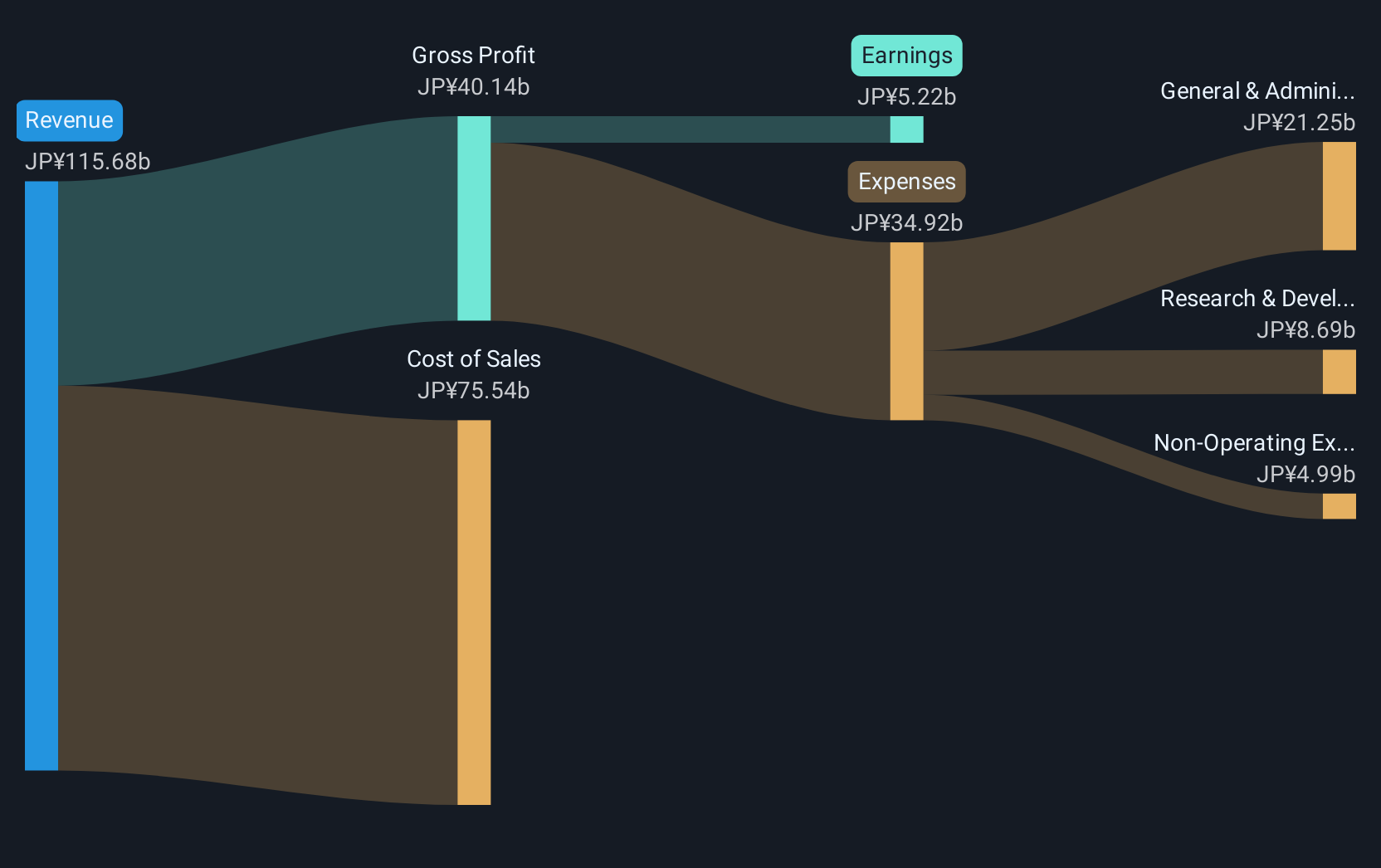

Overview: Wacom Co., Ltd. is a global developer, manufacturer, and seller of pen tablets and related software, with a market capitalization of ¥89.71 billion.

Operations: The company's revenue streams are primarily divided into the Branded Products Business, generating ¥29.83 billion, and the Technology Solution Business, contributing ¥87.33 billion.

Wacom, amidst a competitive tech landscape, has committed to enhancing shareholder value through a strategic share repurchase program, buying back 5 million shares for ¥2.5 billion. This initiative aligns with their mid-term management plan aiming to prioritize returns to shareholders. Despite modest annual revenue growth at 2.6%, Wacom's earnings have surged by an impressive 67.8% over the past year, significantly outpacing the industry average of 1.9%. The company's focus on R&D is evident as they continue to innovate within the digital art and design sectors, ensuring their technology remains at the forefront of creative industries' evolving demands.

- Get an in-depth perspective on Wacom's performance by reading our health report here.

Review our historical performance report to gain insights into Wacom's's past performance.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

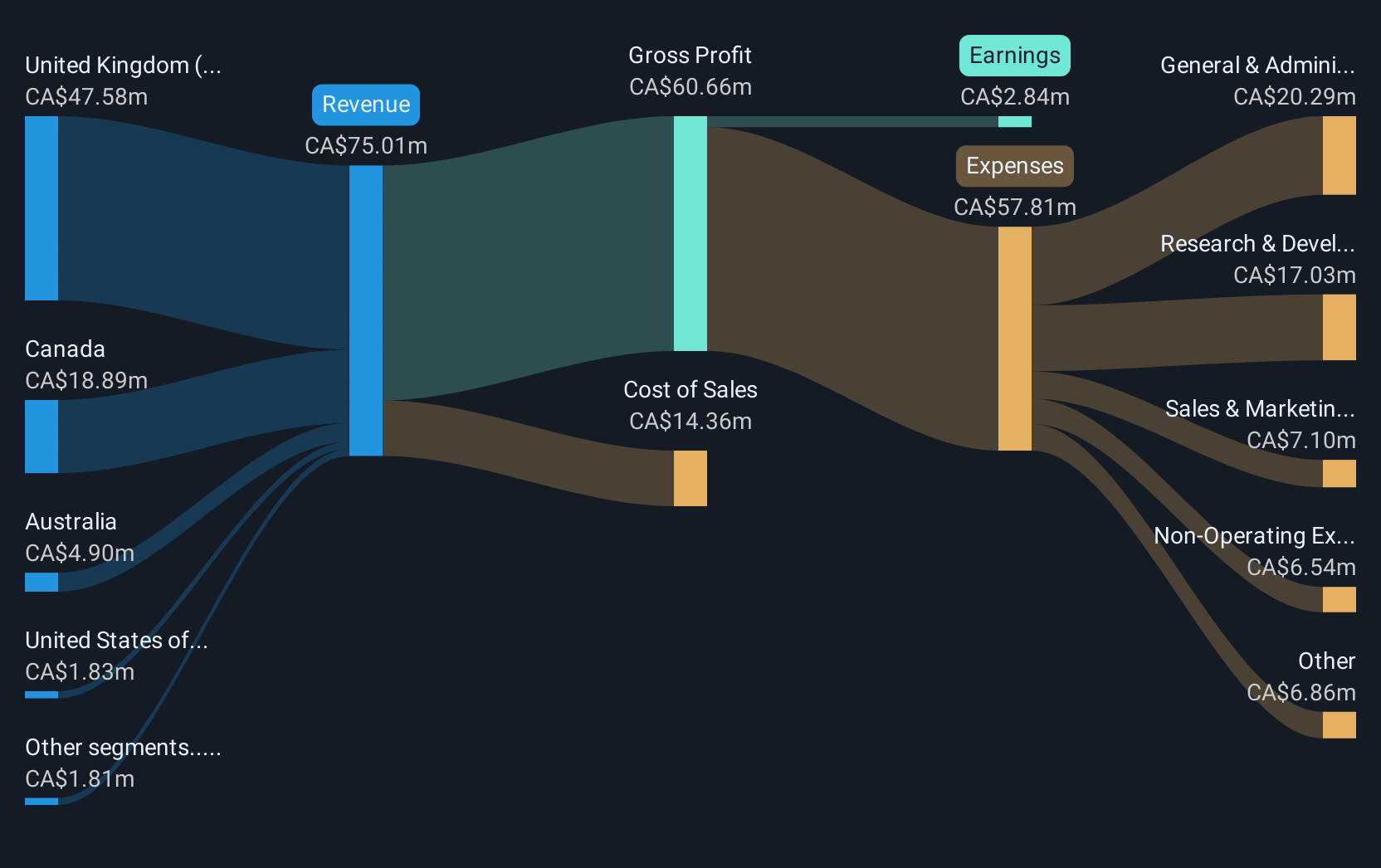

Overview: Vitalhub Corp., along with its subsidiaries, offers technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market capitalization of CA$602.97 million.

Operations: Vitalhub generates revenue primarily through its healthcare software segment, which contributed CA$61.61 million. The company's operations span multiple international markets, focusing on providing technology solutions for health and human service sectors.

Vitalhub, demonstrating robust growth dynamics, recently expanded its financial flexibility through amended credit facilities totaling $65 million, enhancing its strategic positioning. With a recent follow-on equity offering raising CAD 30 million, the company is poised to fuel further innovation and market expansion. Notably, Vitalhub's SHREWD platform has been pivotal in advancing patient flow solutions across significant health networks like the Winnipeg Regional Health Authority and NHS England. This aligns with an industry trend where tech solutions are increasingly integrated into healthcare systems for real-time data utilization and operational efficiency. Despite a dip in net income from CAD 2.83 million to CAD 1.23 million in the latest quarter, Vitalhub's annual revenue growth forecast at 19% outpaces the Canadian market projection of 5.9%, underscoring its potential in a competitive sector.

- Navigate through the intricacies of Vitalhub with our comprehensive health report here.

Understand Vitalhub's track record by examining our Past report.

Key Takeaways

- Delve into our full catalog of 1215 High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VHI

Vitalhub

Provides technology and software solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)