- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6640

PeptiDream Leads Trio Of Value Stocks On Japanese Exchange For Investor Consideration

Reviewed by Simply Wall St

Amid a backdrop of a weakening yen and expectations of monetary policy adjustments, Japan's stock markets have shown resilience with notable gains in major indices. This environment may present opportunities for investors to consider undervalued stocks that could benefit from current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Link and Motivation (TSE:2170) | ¥478.00 | ¥929.27 | 48.6% |

| Mimaki Engineering (TSE:6638) | ¥1934.00 | ¥3864.32 | 50% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥1815.00 | ¥3714.13 | 51.1% |

| Hibino (TSE:2469) | ¥2638.00 | ¥5106.44 | 48.3% |

| Hamee (TSE:3134) | ¥1128.00 | ¥2154.46 | 47.6% |

| Cyber Security Cloud (TSE:4493) | ¥2259.00 | ¥4353.46 | 48.1% |

| Medley (TSE:4480) | ¥3560.00 | ¥7128.63 | 50.1% |

| Macromill (TSE:3978) | ¥874.00 | ¥1678.09 | 47.9% |

| S-Pool (TSE:2471) | ¥325.00 | ¥625.50 | 48% |

| LibertaLtd (TSE:4935) | ¥548.00 | ¥1009.26 | 45.7% |

Let's review some notable picks from our screened stocks

PeptiDream (TSE:4587)

Overview: PeptiDream Inc. is a biopharmaceutical company focused on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market capitalization of approximately ¥323.24 billion.

Operations: The company generates revenue primarily through its biopharmaceutical activities, focusing on the development of unique therapeutic peptides and small molecule drugs.

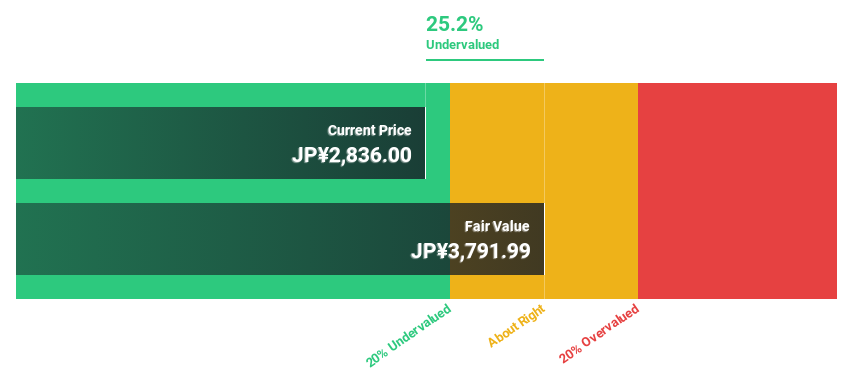

Estimated Discount To Fair Value: 20.5%

PeptiDream, trading at ¥2453, is perceived as undervalued with its price 21.7% below the estimated fair value of ¥3132.67 based on discounted cash flows. Despite a significant expected earnings growth of 22.3% annually over the next three years and revenue projected to outpace the Japanese market at 10.5% per year, concerns arise from its high share price volatility recently and a drop in profit margins from 25.9% to 8.7%. Recent strategic expansions with Novartis and positive clinical trial advancements underscore its potential despite financial inconsistencies.

- Our earnings growth report unveils the potential for significant increases in PeptiDream's future results.

- Click here to discover the nuances of PeptiDream with our detailed financial health report.

I-PEX (TSE:6640)

Overview: I-PEX Inc. is a Japanese company that specializes in developing, manufacturing, and selling connectors, electronic components, automotive electronics components, and semiconductor manufacturing equipment across Japan, China, and other parts of Asia with a market capitalization of ¥40.66 billion.

Operations: The company operates primarily in the development, manufacture, and sale of connectors, electronic and automotive electronics components, as well as semiconductor manufacturing equipment across Japan, China, and other Asian regions.

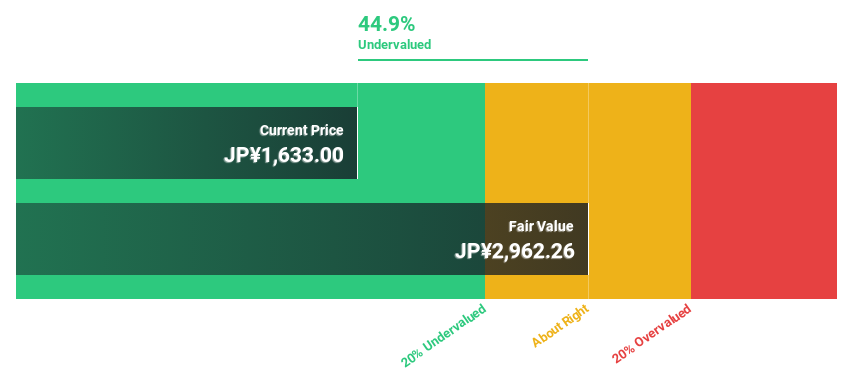

Estimated Discount To Fair Value: 16.9%

I-PEX Inc., priced at ¥2192, is trading 16.7% below its fair value of ¥2630.11, indicating potential undervaluation based on cash flows. While earnings are expected to surge by 46.36% annually over the next three years, outpacing the Japanese market's growth, revenue growth projections remain modest at 4.7% per year. The company's dividend coverage is weak due to significant one-off items affecting earnings quality and a low forecasted Return on Equity of 3%.

- Upon reviewing our latest growth report, I-PEX's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of I-PEX.

Forum Engineering (TSE:7088)

Overview: Forum Engineering Inc. specializes in providing personnel management services for mechanical and electrical engineers across Japan, with a market capitalization of ¥49.06 billion.

Operations: The firm specializes in offering staffing solutions for mechanical and electrical engineering sectors across Japan.

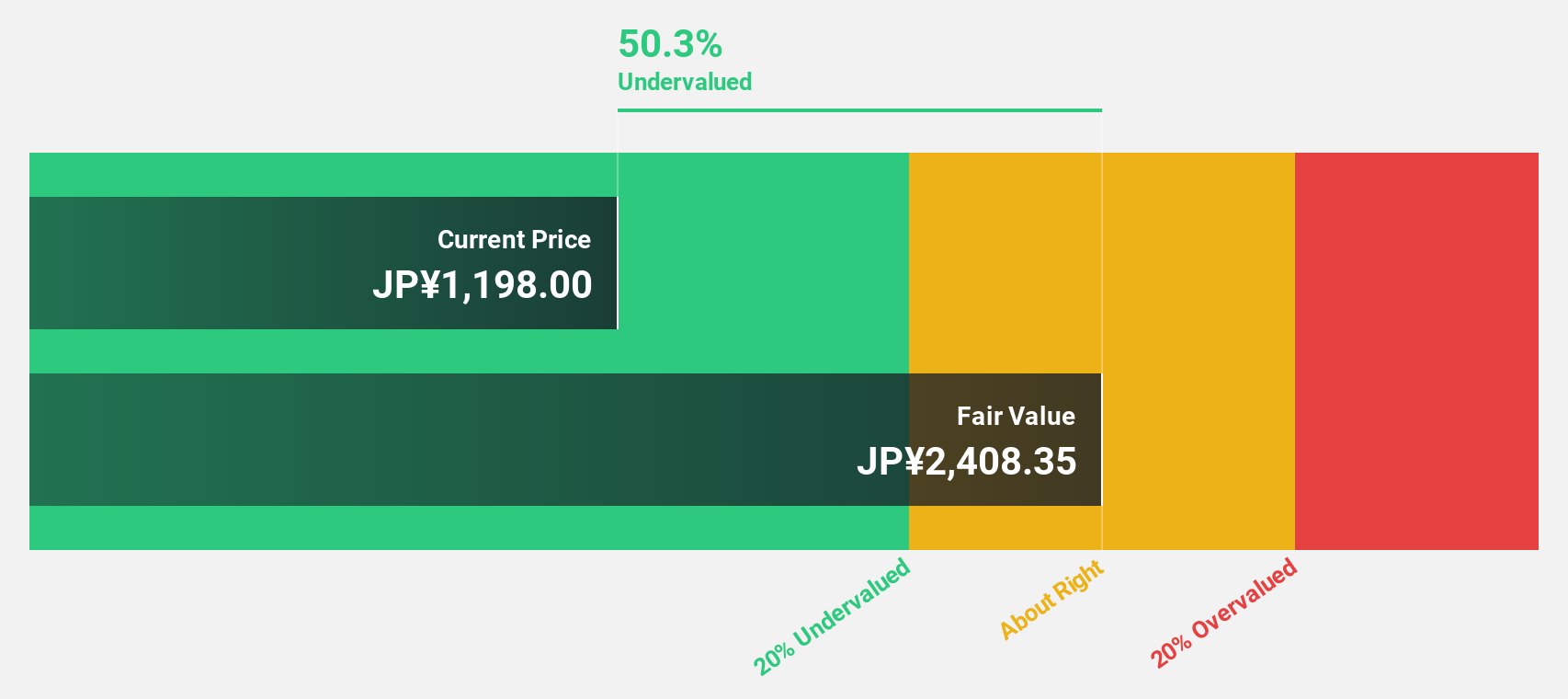

Estimated Discount To Fair Value: 35.8%

Forum Engineering, priced at ¥934, is significantly undervalued with its market price 35.7% below the estimated fair value of ¥1451.7. Despite a less stable dividend history and shareholder dilution last year, the company's earnings are expected to grow by 13.2% annually, surpassing Japan's market average. Additionally, its revenue growth forecast at 9.2% per year also outstrips the broader Japanese market expectation of 4.2%. However, financial data for less than three years raises some concerns about long-term projections.

- Our comprehensive growth report raises the possibility that Forum Engineering is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Forum Engineering.

Key Takeaways

- Click this link to deep-dive into the 93 companies within our Undervalued Japanese Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade I-PEX, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6640

I-PEX

Develops, manufactures, and sells connectors and electronics components, automotive electronics components, and semiconductor manufacturing equipment in Japan.

Flawless balance sheet very low.