- Japan

- /

- Tech Hardware

- /

- TSE:6638

Discovering February 2025's Undiscovered Gems on None

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and fluctuating economic indicators, investors are keenly observing how these factors impact small-cap stocks, particularly those in indices like the S&P 600. With U.S. job growth below expectations and manufacturing showing signs of recovery amidst potential threats, identifying promising opportunities in this environment requires a focus on companies with robust fundamentals and resilience to external pressures.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Nestlé Pakistan | 40.95% | 14.04% | 17.18% | ★★★★★☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Sumitomo Seika Chemicals Company (TSE:4008)

Simply Wall St Value Rating: ★★★★★★

Overview: Sumitomo Seika Chemicals Company, Limited operates in the chemical industry with a market cap of approximately ¥65.66 billion.

Operations: The company generates revenue primarily from its chemical products. The net profit margin has shown fluctuations, indicating variability in profitability over different periods.

Sumitomo Seika, a notable player in the chemicals sector, recently revised its earnings guidance upward for fiscal 2025, projecting net sales of ¥149 billion and an operating profit of ¥11 billion. The company's debt to equity ratio has improved over five years from 25.6% to 19.2%, reflecting prudent financial management. Despite not being free cash flow positive, it trades at nearly 34% below estimated fair value and has more cash than total debt. Additionally, Sumitomo Seika's earnings growth of 93% outpaced the industry average of 18%, highlighting its robust performance in a competitive market.

Mimaki Engineering (TSE:6638)

Simply Wall St Value Rating: ★★★★★★

Overview: Mimaki Engineering Co., Ltd. develops, manufactures, and sells computer devices and software in Japan and internationally with a market cap of ¥40.94 billion.

Operations: Mimaki Engineering generates revenue primarily through the sale of computer devices and software. The company has a market capitalization of ¥40.94 billion.

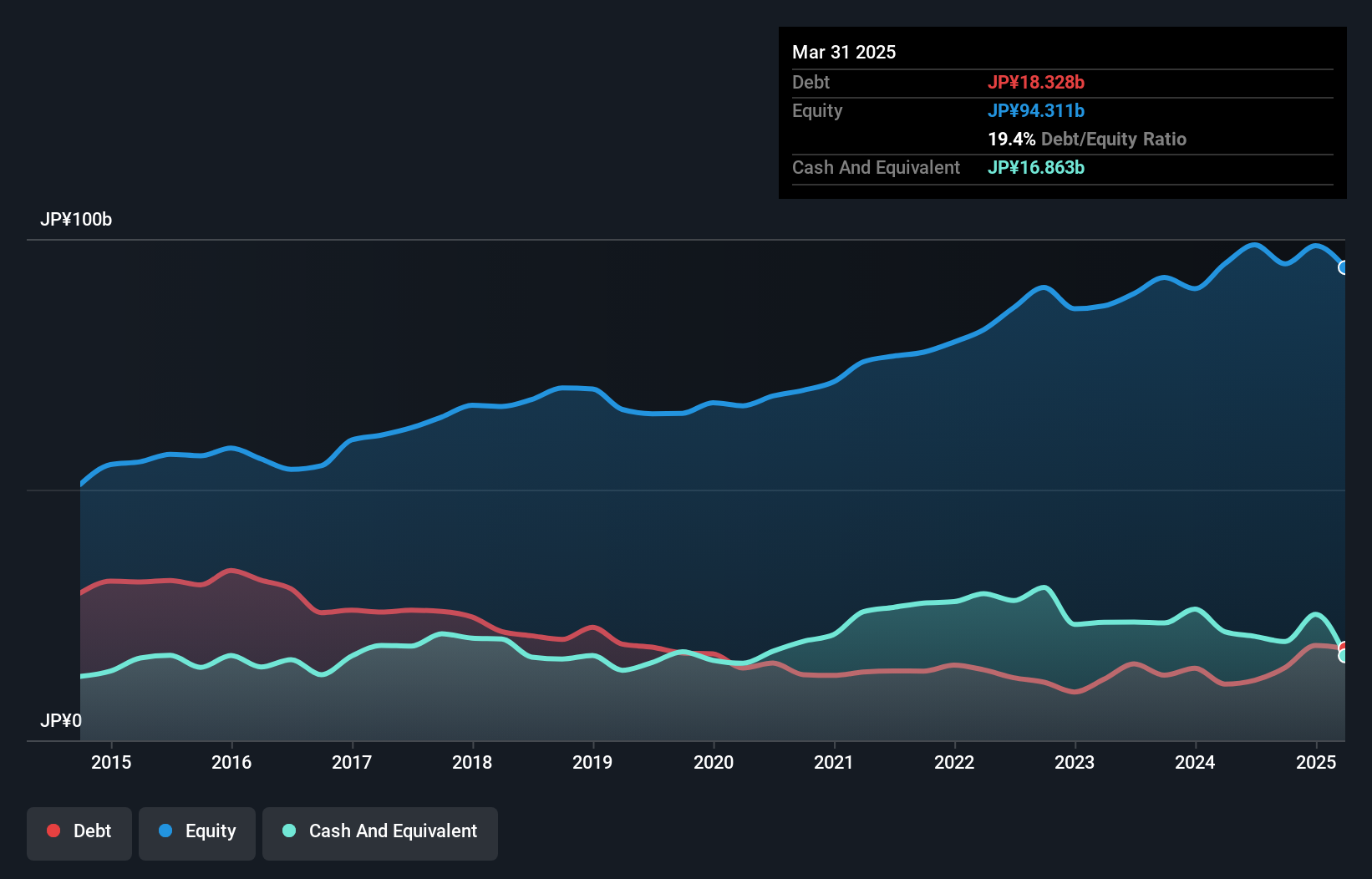

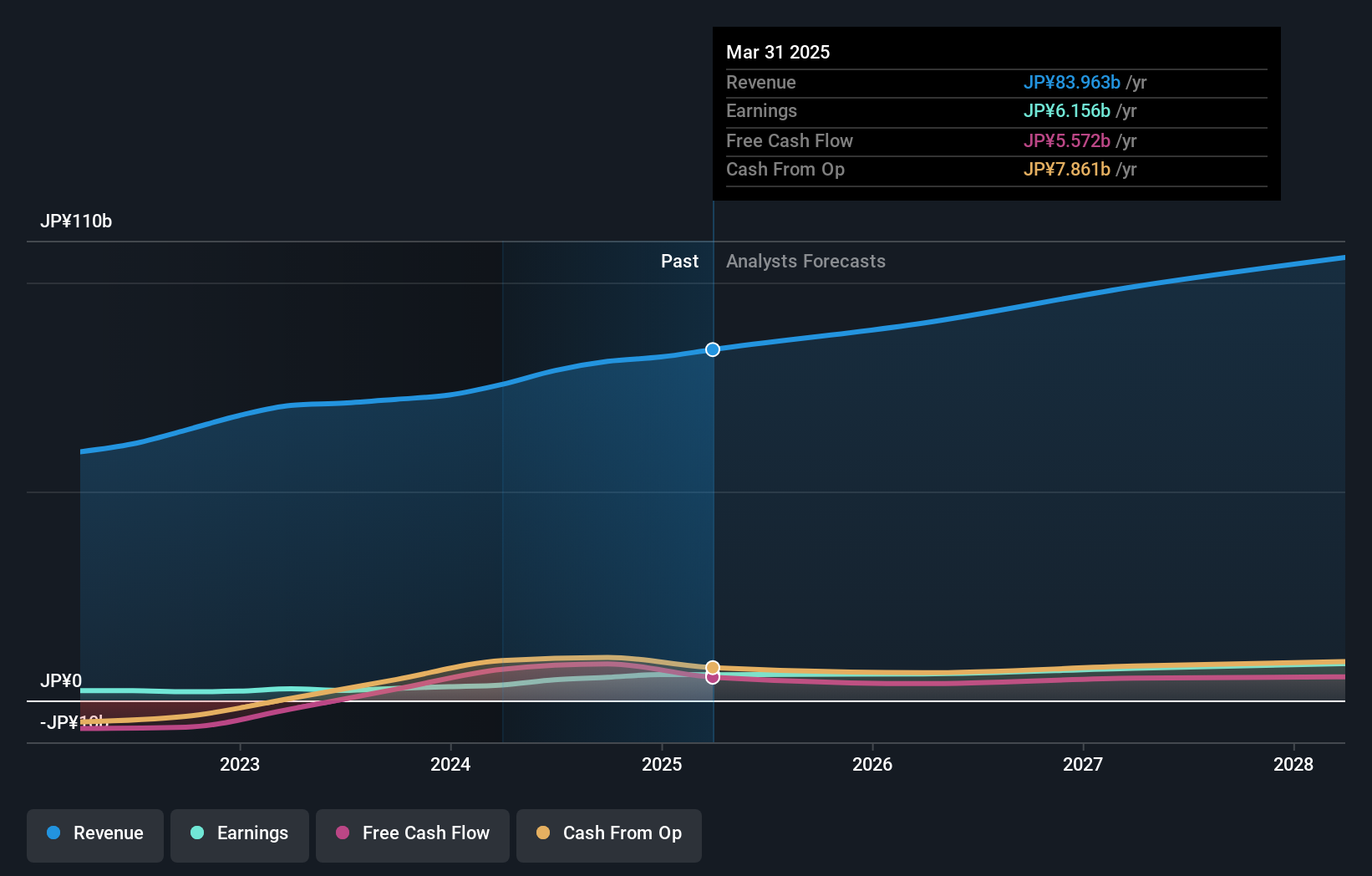

Mimaki Engineering, a noteworthy player in the tech space, has shown impressive financial health with earnings growth of 89.7% over the past year, outpacing the industry average of 1.9%. The company is trading at a significant discount, around 62.8% below its estimated fair value, suggesting potential upside for investors. With a net debt to equity ratio of 22%, Mimaki's debt levels are considered satisfactory and have improved from 120.8% to 69.5% over five years. Additionally, its interest payments are well covered by EBIT at a multiple of 22x, further indicating robust financial management and stability.

- Get an in-depth perspective on Mimaki Engineering's performance by reading our health report here.

Examine Mimaki Engineering's past performance report to understand how it has performed in the past.

Oki Electric Industry (TSE:6703)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Oki Electric Industry Co., Ltd. is engaged in the manufacturing and sale of products, technologies, software, and solutions for telecommunication and information systems both in Japan and internationally, with a market capitalization of ¥79.69 billion.

Operations: Oki Electric generates revenue through the sale of products, technologies, software, and solutions for telecommunication and information systems. The company's market capitalization stands at ¥79.69 billion.

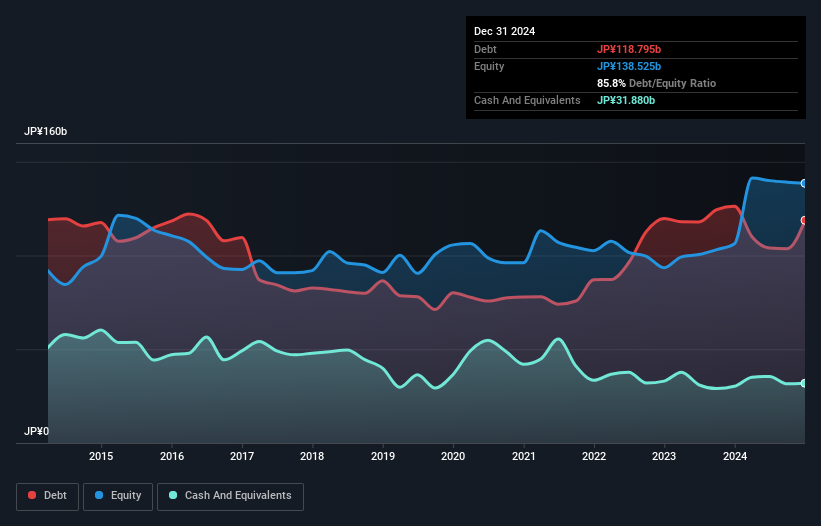

Oki Electric Industry has been making waves with its innovative strides, notably developing a ship classification AI system achieving over 90% accuracy using minimal data. This aligns with their strategic partnership with FPT Corporation, enhancing software capabilities and global reach. Financially, Oki's earnings surged by 138% last year, outpacing the electronics industry’s growth of 6%. However, they face challenges like a high net debt-to-equity ratio of 62.7%. Despite this, Oki trades at a favorable P/E ratio of 3.4x compared to Japan's market average of 13.3x, suggesting potential value for investors.

Turning Ideas Into Actions

- Click here to access our complete index of 4710 Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6638

Mimaki Engineering

Develops, manufactures, and sells computer devices and software in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)