- Japan

- /

- Electronic Equipment and Components

- /

- TSE:268A

Rigaku Holdings (TSE:268A): Exploring Valuation After Recent Share Buyback Completion

Reviewed by Kshitija Bhandaru

Rigaku Holdings (TSE:268A) just wrapped up a share buyback, repurchasing 1,721,200 shares, or 0.76% of its outstanding stock, for roughly ¥1,468.83 million. This move often draws interest from investors keeping an eye on valuation and capital allocation decisions.

See our latest analysis for Rigaku Holdings.

Following the completion of its buyback, Rigaku Holdings has shown meaningful upward momentum, posting a 25% share price return over the past 90 days and a modest gain year-to-date. Short-term volatility aside, the recent capital return may signal renewed confidence in longer-term prospects.

If you’re weighing next steps after Rigaku’s buyback, it could be helpful to broaden your search and discover fast growing stocks with high insider ownership

With Rigaku Holdings demonstrating solid buyback activity and healthy recent gains, the big question for investors now is whether its shares are still undervalued or if the market has already accounted for future growth potential.

Price-to-Earnings of 19.4x: Is it justified?

Rigaku Holdings is trading with a price-to-earnings (P/E) ratio of 19.4x, which puts its valuation above that of its industry peers and the overall sector average. At the last close of ¥927, shares appear expensive compared to both specific peers and broader Japanese electronics companies.

The price-to-earnings ratio measures how much investors are willing to pay for each ¥1 of the company’s earnings. It acts as a gauge of market expectations for earnings growth and profitability, with higher ratios often signaling optimism for future results or reflecting strong historical performance.

In this case, Rigaku Holdings’ P/E ratio of 19.4x is higher than the Japanese electronic industry average of 14.6x and the peer group average of 17.6x. This premium could suggest the market expects Rigaku Holdings to deliver superior earnings growth or maintain a leading position. Notably, its current P/E ratio is nearly identical to its estimated fair P/E ratio of 19.5x. This indicates the stock might be more in line with its intrinsic value than the market average suggests.

Explore the SWS fair ratio for Rigaku Holdings

Result: Price-to-Earnings of 19.4x (ABOUT RIGHT)

However, downside risks remain if revenue or net income growth disappoints investor expectations. This could potentially lead to a shift in sentiment around Rigaku Holdings’ valuation.

Find out about the key risks to this Rigaku Holdings narrative.

Another View: DCF Suggests a Different Story

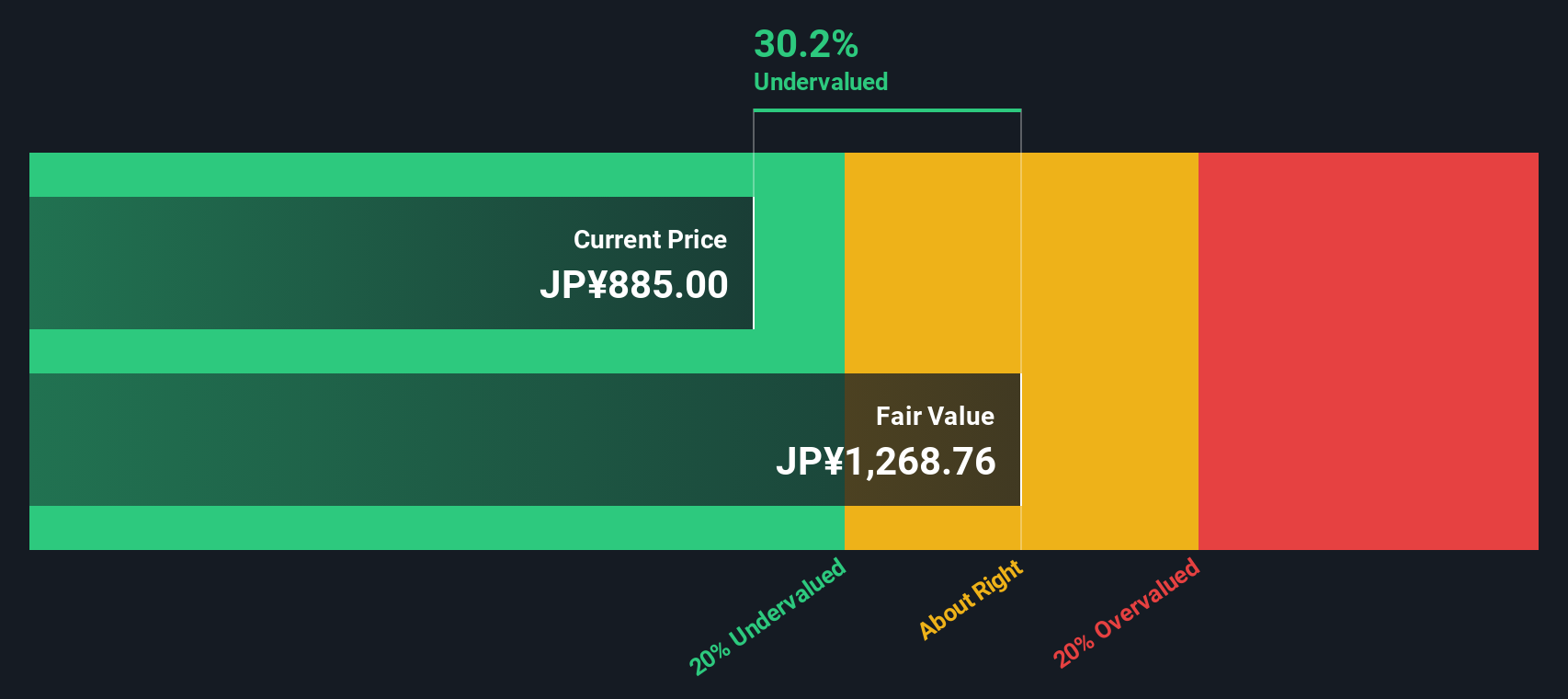

While the price-to-earnings ratio puts Rigaku Holdings at a premium, our DCF model tells a more optimistic tale. The SWS DCF model estimates fair value at ¥1,279 per share, which is about 27.5% above the current price. Does this point to a hidden undervaluation, or is the market more cautious for a reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rigaku Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rigaku Holdings Narrative

If you’d rather work through the numbers yourself or want to draw your own conclusions from the available data, you can easily build your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Rigaku Holdings.

Looking for more investment ideas?

Staying ahead means spotting fresh opportunities before others do. This is your chance to access ground-floor ideas and rethink what's possible for your portfolio.

- Tap into future profitability with these 892 undervalued stocks based on cash flows, which stand out for their strong cash flows and compelling valuations.

- Ride the momentum of innovation by following these 24 AI penny stocks as they power rapid advances in artificial intelligence and real-world solutions.

- Secure growth and resilience from these 19 dividend stocks with yields > 3%, delivering reliable income and market-beating yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:268A

Rigaku Holdings

Manufactures and sells scientific instruments focuses on x-ray technologies in Japan, Asia, the United States, Europe, the Middle East, and Africa.

Excellent balance sheet and good value.

Market Insights

Community Narratives