- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6666

Should You Use River Eletec's (TYO:6666) Statutory Earnings To Analyse It?

As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether River Eletec's (TYO:6666) statutory profits are a good guide to its underlying earnings.

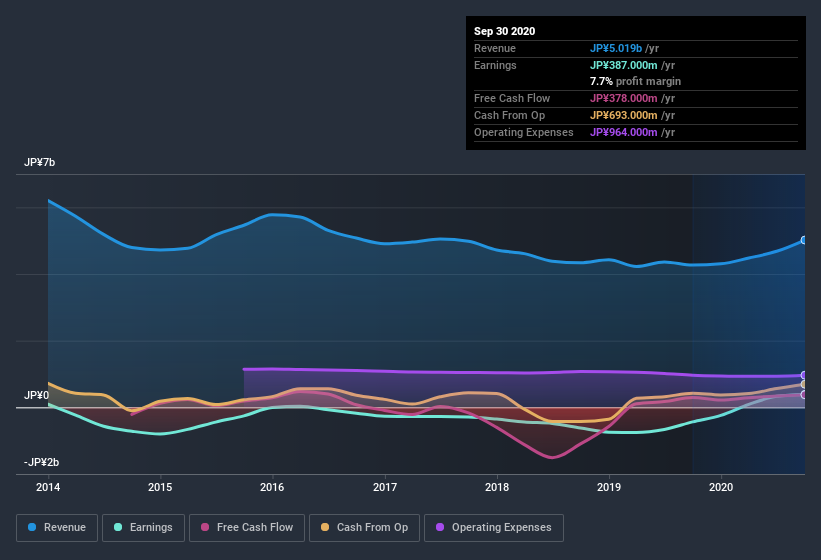

We like the fact that River Eletec made a profit of JP¥387.0m on its revenue of JP¥5.02b, in the last year. Even though revenue has remained steady over the last three years, you can see in the chart below that the company has moved from loss-making to profitable.

See our latest analysis for River Eletec

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. Therefore, we think it makes sense to note and understand the impact that a tax benefit has had on River Eletec's statutory profit in the last twelve months. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of River Eletec.

An Unusual Tax Situation

We can see that River Eletec received a tax benefit of JP¥97m. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! Of course, prima facie it's great to receive a tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On River Eletec's Profit Performance

River Eletec reported that it received a tax benefit, rather than paid tax, in its last report. As a result we don't think its profit result, which includes that tax-boost, is a good guide to its sustainable profit levels. Therefore, it seems possible to us that River Eletec's true underlying earnings power is actually less than its statutory profit. The good news is that it earned a profit in the last twelve months, despite its previous loss. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing River Eletec at this point in time. When we did our research, we found 2 warning signs for River Eletec (1 is a bit concerning!) that we believe deserve your full attention.

This note has only looked at a single factor that sheds light on the nature of River Eletec's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade River Eletec, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSE:6666

River Eletec

Develops, produces, and sells quartz crystal units, crystal oscillators, resistors, and other components.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)