Did Fujitsu’s £80 Million Post Office Payout Reshape Its (TSE:6702) Investment Narrative?

Reviewed by Sasha Jovanovic

- In October 2025, Fujitsu injected £80 million into its UK operations as it addressed compensation obligations stemming from the Post Office Horizon scandal, signaling an increased commitment to government engagement on remediation and compensation efforts.

- This substantial financial move not only highlights the company's resolve to address reputational risks but also introduces uncertainty around future cash flows due to its evolving involvement with compensation schemes in the UK.

- We will examine how Fujitsu’s significant financial response to the Horizon scandal impacts its investment narrative and long-term outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Fujitsu Investment Narrative Recap

To be a Fujitsu shareholder right now means believing in its ability to capture long-term growth in digital transformation and modernization, especially in Japan, while transitioning away from legacy hardware. The recent £80 million injection into its UK business in response to compensation obligations tied to the Post Office Horizon scandal brings short-term uncertainty to cash flows, but does not materially alter core catalysts centered on AI-driven expansion and modernization momentum.

Among recent developments, the expanded partnership with NVIDIA to build a full-stack AI infrastructure stands out as most relevant to ongoing catalysts. This collaboration is positioned to accelerate sector-specific AI adoption for industries like healthcare and manufacturing, supporting Fujitsu’s shift toward high-margin, recurring services and potentially helping to offset near-term headline risks.

Yet, in contrast, investors should also be aware that ongoing international revenue instability and exposure to currency swings remain material risks if...

Read the full narrative on Fujitsu (it's free!)

Fujitsu's narrative projects ¥3,829.0 billion in revenue and ¥339.8 billion in earnings by 2028. This requires 2.6% yearly revenue growth and a ¥129.4 billion earnings increase from ¥210.4 billion currently.

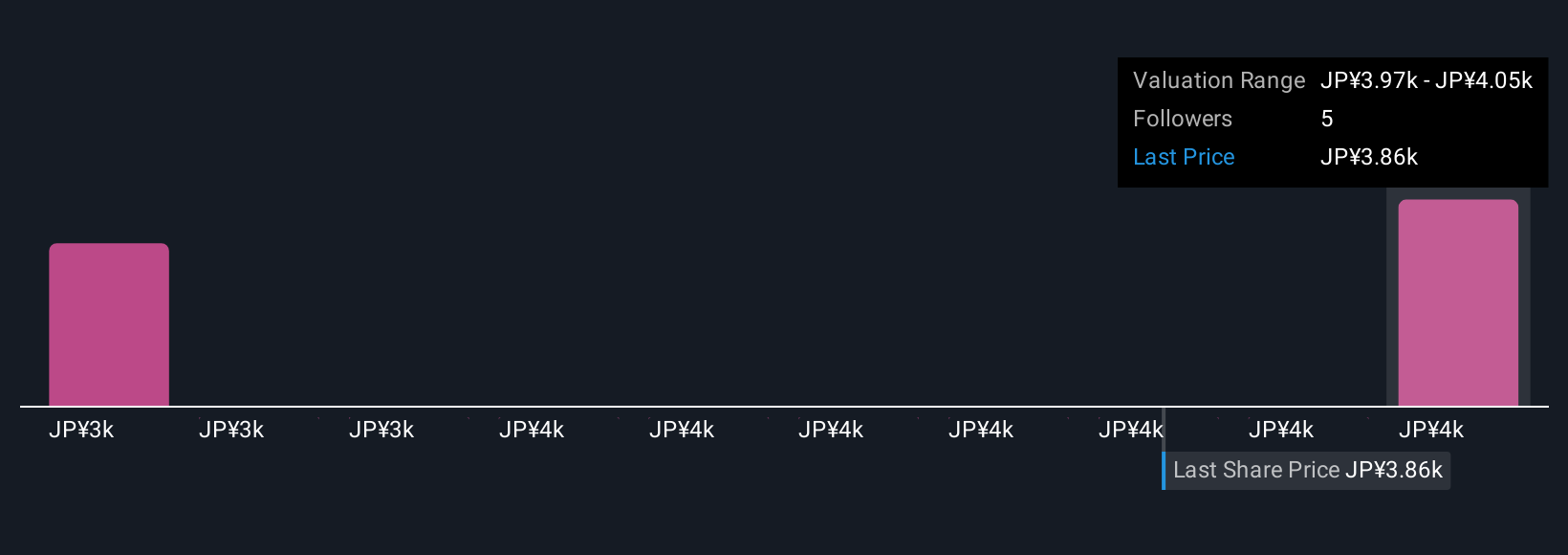

Uncover how Fujitsu's forecasts yield a ¥4047 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Fair value estimates for Fujitsu from two Simply Wall St Community members range from ¥3,280 to ¥4,047 per share. While optimism surrounds AI-driven business transformation, differing forecasts highlight how future international revenue swings may affect Fujitsu’s broader growth story.

Explore 2 other fair value estimates on Fujitsu - why the stock might be worth 12% less than the current price!

Build Your Own Fujitsu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fujitsu research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Fujitsu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fujitsu's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6702

Fujitsu

Engages in providing digital services in Japan, Europe, Americas, Asia Pacific, East Asia, and internationally.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives