A Look at Fujitsu (TSE:6702) Valuation After Expanded AI Partnership with NVIDIA

Reviewed by Kshitija Bhandaru

Fujitsu (TSE:6702) has drawn investor interest this week after announcing an expanded strategic partnership with NVIDIA. The collaboration focuses on building full-stack AI infrastructure and tailored AI agent platforms for key industries in Japan.

See our latest analysis for Fujitsu.

Fujitsu’s share price saw noticeable momentum after unveiling its expanded AI partnership with NVIDIA, climbing 3% on the day of the news. This enthusiasm comes on the back of steady long-term growth, with a 1-year total shareholder return of 18.5% and an impressive 163% gain over five years. This highlights durable investor confidence in the company’s evolving strategy and sector leadership.

If this surge in Japanese tech piques your interest, consider what else is unfolding and check out the See the full list for free..

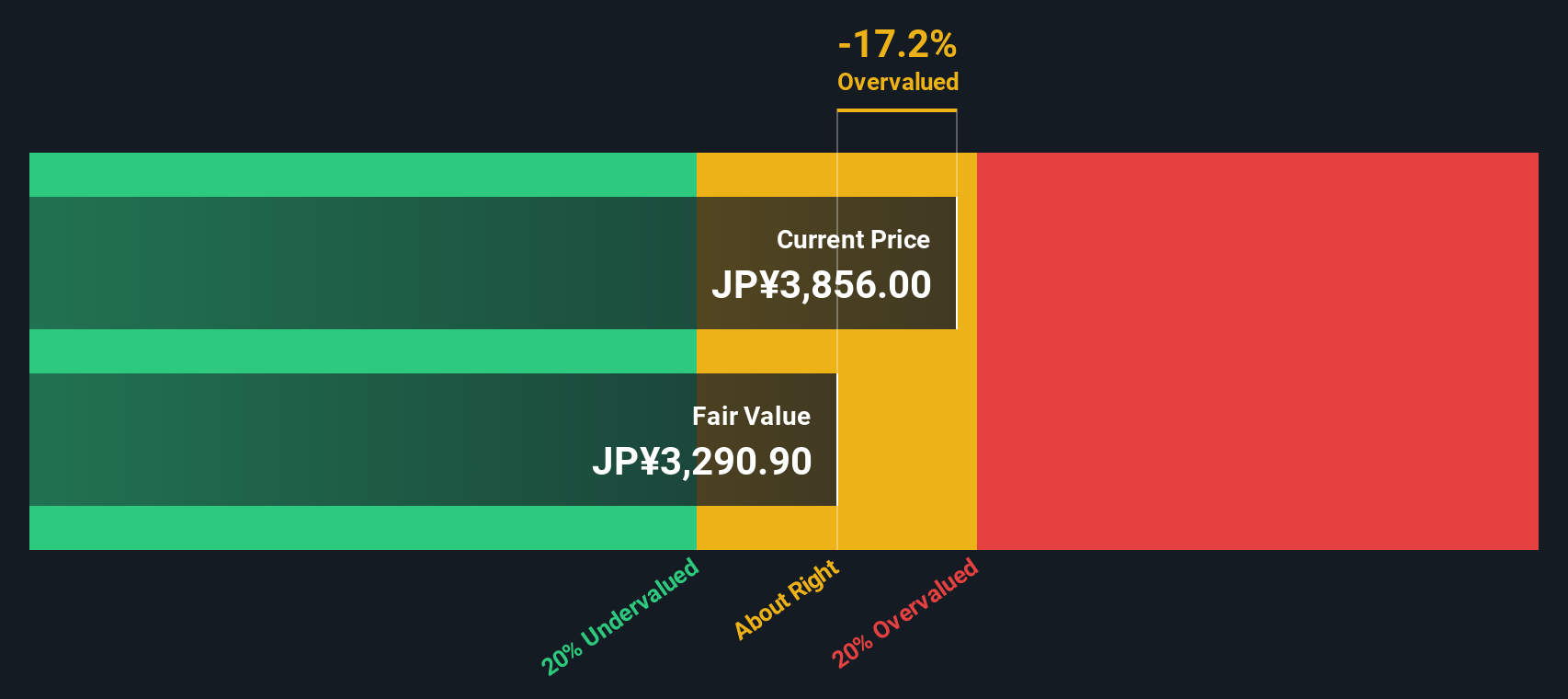

With momentum strong after this AI deal, investors are now weighing whether Fujitsu’s shares still offer upside or if the current price already reflects expectations for growth in artificial intelligence and beyond.

Most Popular Narrative: 13% Undervalued

Based on the most popular view, Fujitsu is priced notably below what the narrative considers fair value, with a projected upside compared to the latest close. This valuation is rooted in expectations for margin expansion and a transformation towards higher-value digital services.

Substantial growth in modernization and Uvance businesses (modernization revenue up 44% YoY, Uvance revenue up 52% YoY, Uvance now 29% of segment sales) reflects a successful transition away from legacy hardware towards high-margin, recurring cloud, consulting, and advanced IT services. This shift is expected to structurally lift net margins.

Want to know the growth blueprint behind this high valuation? The narrative is banking on increased profitability and bolder revenue shifts than what most expect. What assumptions are driving this aggressive fair value? Possibilities include steady margin expansion, faster recurring revenue, or a shakeup in segment sales. Find out which one tips the scale in favor of Fujitsu’s future prospects.

Result: Fair Value of ¥4,047 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sustained decline in overseas revenue or delayed adoption of key AI capabilities could present challenges to Fujitsu’s bullish growth outlook and could weigh on future returns.

Find out about the key risks to this Fujitsu narrative.

Another View: Value from a Different Angle

While the popular narrative points to notable upside, our DCF model tells a more cautious story. According to this approach, Fujitsu’s fair value stands closer to ¥3,305. This suggests that current prices may be a bit high rather than cheap. Which scenario do you believe gives a truer picture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fujitsu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fujitsu Narrative

If these perspectives don’t fully match your own or you’d rather dig into the numbers yourself, you can craft and refine your own Fujitsu view faster than you might think, often in under three minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Fujitsu.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Take the next step by searching handpicked stock ideas across fast-growing sectors and untapped markets using the Simply Wall Street Screener.

- Unlock potential gains with these 899 undervalued stocks based on cash flows filled with businesses trading below what their cash flows suggest they’re truly worth.

- Seize the edge in healthcare innovation by checking out these 31 healthcare AI stocks and see which companies are using artificial intelligence to transform patient care and diagnostics.

- Capture high yields for your portfolio by browsing these 19 dividend stocks with yields > 3% that deliver consistently strong dividends above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6702

Fujitsu

Engages in providing digital services in Japan, Europe, Americas, Asia Pacific, East Asia, and internationally.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives