Is NEC’s Rally Justified After Government Contract Wins and 123% Price Surge in 2025?

Reviewed by Bailey Pemberton

- Curious about whether NEC is truly worth its current share price, or if there is still untapped value for investors? Let’s take a closer look before you make any big moves.

- NEC's stock has experienced an impressive rally recently, climbing 18.0% over the last month and notching a staggering 123.0% gain year-to-date. These are signals of both renewed growth optimism and shifting perceptions of risk.

- The buzz around NEC has been amplified by industry partnerships and an expanded focus on digital transformation, with the company landing notable government contracts as reported in tech sector news. These developments are fueling market enthusiasm and drawing more attention from institutional investors.

- When we tally up the numbers, NEC only scores a 1 out of 6 on our valuation checklist so far. We will break down the different approaches to valuing a company like NEC next. Stick around, because at the end, we will highlight a little-known way to spot true value that many investors overlook.

NEC scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NEC Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental valuation approach that estimates the value of a company by projecting its future cash flows and then discounting them back to their present value. This method aims to capture a business’s intrinsic worth based on its ability to generate free cash flow over time.

For NEC, recent numbers show the company delivered ¥356,797 Million in free cash flow over the last twelve months. Analysts project steady growth in future free cash flows, with estimates increasing to ¥417,800 Million by the year ending March 2030. It is important to note that these projections combine both five years of analyst estimates and further extrapolations made by Simply Wall St, which reflect the expectation of ongoing business growth, although at a moderating pace beyond 2028.

After discounting these cash flows back to present value, the DCF analysis yields an estimated intrinsic value of ¥4,561.63 per share. However, when compared to NEC's prevailing share price, this model finds the stock trading at a 31.8% premium to its calculated value. In other words, the market price is significantly above what the company’s future cash generation might justify on a fundamental basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NEC may be overvalued by 31.8%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

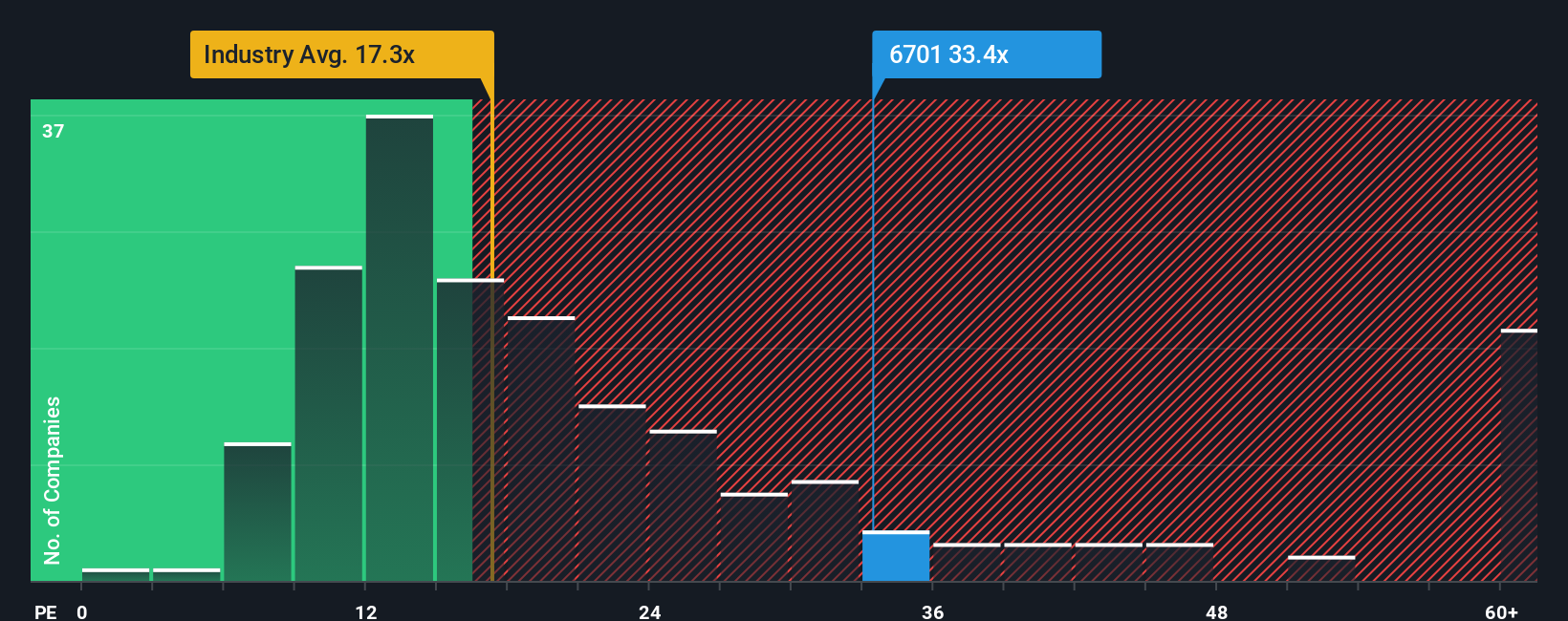

Approach 2: NEC Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is one of the most common metrics for valuing profitable companies like NEC because it quickly shows how much investors are paying for each yen of current earnings. A higher PE typically reflects higher growth expectations, while a lower PE may signal investor caution or structural risks. However, what constitutes a “fair” PE depends on broader dynamics like the company's future growth prospects, stability of earnings, and prevailing market sentiment.

Currently, NEC trades at a PE ratio of 34.2x, which is higher than the average for the IT industry at 17.3x and also above the peer group average of 30.8x. This premium suggests that investors are pricing in strong growth or greater confidence in NEC’s long-term prospects. But headline PE numbers rarely tell the whole story, as different companies face different risks, growth rates, and profitability profiles.

Simply Wall St’s proprietary "Fair Ratio" provides additional insight. This metric sets a tailored PE expectation for NEC by factoring in its forecasted earnings growth, industry trends, profit margins, company size, and specific risk exposures. Instead of using only broad averages, the Fair Ratio offers a more precise benchmark that is uniquely calibrated for NEC’s business reality.

NEC’s calculated Fair Ratio is 35.8x, which is almost identical to its current PE. This suggests the market price accurately reflects all of NEC’s measurable qualities and prospects at this time.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

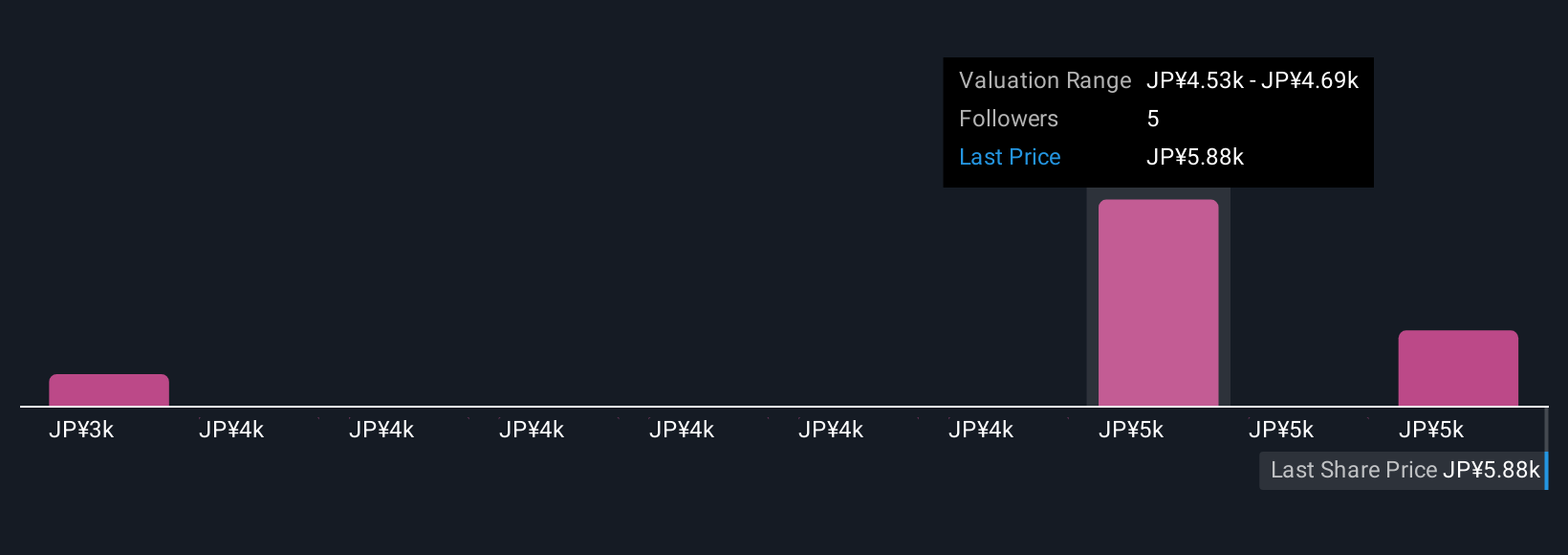

Upgrade Your Decision Making: Choose your NEC Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects your personal perspective on a company’s story, such as its business strengths, industry outlook, and innovation potential, to a financial forecast and an estimate of fair value. Unlike traditional ratios, Narratives make it easy to express your view on what really drives a company’s future by letting you set your assumptions for NEC’s future revenue growth, profit margins, and risk profile, all within an accessible tool available to millions of investors on Simply Wall St’s Community page.

By linking a company’s evolving story to its projected numbers, Narratives allow you to see whether NEC is undervalued or overvalued based on your own analysis, not just market consensus or analyst opinions. Narratives are updated automatically when new news or results come out, helping you decide when to buy, hold, or sell in response to the latest data.

For example, some users believe NEC should be worth as much as ¥5,450 per share due to robust digital growth and margin improvements, while others see more risk and value it as low as ¥3,500 per share. This demonstrates how personal conviction and real-time insights combine to shape practical investment decisions.

Do you think there's more to the story for NEC? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6701

NEC

Provides information technology services and social infrastructure in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026